E&P | NGI All News Access | NGI The Weekly Gas Market Report

Precision Drilling Rehires 2,000-Plus as Canada, Lower 48 Activity Builds

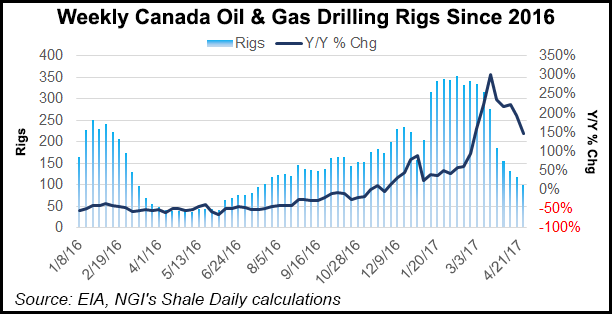

The comeback continues in North America’s onshore, with Precision Drilling Corp. now running 59 rigs in the United States and 36 in Canada, combined activity that is almost three times higher than last year’s record lows.

The high-specification Calgary-based driller had an average of 76 rigs working in Canada during the first three months of the year, its highest mark since late 2014. Utilization days in Canada increased 71% year/year and 46% sequentially. In the Lower 48, Precision had an average of 47 rigs working during 1Q2017 versus 39 in 4Q2016, with utilization days increasing 17% sequentially to 4,190.

“The rebound which began in mid-2016 has continued unabated through the first quarter of 2017,” CEO Kevin Neveu said during a conference call Monday. “During the quarter, we activated 17 rigs in the U.S., growing from 39 to 56 operating rigs by the end of the quarter. In Canada, we experienced a seasonal peak of 91 active rigs, almost 50% higher than the same quarter of 2016 with our total drilling days up 71% over last year.

“With three consecutive quarters of increased activity, all signs point to a strengthening recovery and Precision has responded as promised, rehiring more than 2,000 field personnel and activating over 100 rigs from 2016 trough activity.”

The global operator works in two segments, contract drilling services, which includes the drilling rig, directional drilling, oilfield supply and manufacturing divisions, and in completion/production services, which includes the service rig, snubbing, rental, camp and catering and wastewater treatment divisions.

”Sentiment Fragile’

“There’s no question that the customer sentiment is substantially more constructive than at any point in last 30 months, yet I believe the sentiment remains fragile and is sensitive to the seemingly daily volatility and commodity prices,” Neveu said. “From an activity and demand perspective, we believe our customers are carefully managing their spending by hedging production to walk-in cash flows with commodity price permits, and this gives us some confidence that the current demand and activity we see today will be sustained through 2017 and into 2018.”

Throughout North America, demand for Precision’s elite “Super Triple” drilling rigs remains strong as many customers are opting for high-pressure, high-volume mud systems that are capable of drilling long laterals.

Still stacked are 42 U.S. rigs, including 20 Super Triples, 10 that are silicone-rectifiers. Another 11 “Super Singles,” are available, seven that are alternating-current powered, with 11 rigs configured for turnkey and natural gas storage well applications. But Precision has no plans to upgrade any rigs without customer contracts in hand, the CEO said.

“We expect to have customer contracts ensuring payback before we proceed in these projects,” Neveu said. “In addition to the upgrades, most of these rigs have not been active for two years and more and may require some time-based recertifications. And since these recertifications are time based, and the clock starts to run when the recertification is complete, we will not perform this work until the rig has a firm customer activation date scheduled.” The reactivations/recertifications per rig likely will cost C$300,000-500,000.

“But I want to point out that Precision’s idle 42 rigs have not been cannibalized. All of these rigs are fully intact and other than time-based certifications, the rigs are ready to go back to work on a near immediate basis…Precision has activated over 100 rigs from 2016 levels” and has reactivated more than 2,000 field personnel. “I believe we’ve demonstrated our preparation and ability to rebalance to meet customer needs on this rapidly raising market.”

Pricing Trending Up

Thirty-one of the U.S. rigs are on term contracts with fixed take-or-pay pricing. The balance of U.S. activity is essentially on well-to-well contracts, “and we would expect pricing to trend upwards over the coming quarters, providing commodity prices remain in the current range,” Neveu said. Eight of the U.S. rigs that are contracted “are still enjoying pre-downturn pricing, and we expect three of those will renew and re-price over the next eight months…We expect the renewals rates to be at or near leading-edge market pricing as most of these rigs are essentially leading-edge technology equipped.”

Canadian activity was “substantially stronger than expected” during the first quarter. However, day rates lagged because customer pricing negotiations were conducted last fall, he noted. “Also surprisingly, the industry rig mix included substantially more shallow rigs than expected,” and “the price competition remains intense for the shallower rigs.”

Precision is deploying new technology to automate many manual processes on its rigs and to further integrate and automate directional drilling.

Because of improved commodity prices and increasing activity, Precision has been able to increase prices on spot market rigs across most of its fleet.

“Should commodity prices continue to improve, we expect sequential improvements in pricing in the U.S. and the Deep Basin in Canada,” Neveu said. “We expect pricing improvements in the shallower parts of the Canadian market; however, the increases are not expected to be of the same magnitude as other North American markets in which we operate.”

Precision expects its top-of-the-line Tier 1 rigs to remain the preferred modus operandi.

“The economic value created by the significant drilling and mobility efficiencies delivered by the most advanced XY pad walking rigs have been highlighted and widely accepted by our customers,” the CEO said. “The trend to longer-reach horizontal completions and the importance of the rig delivering these complex wells consistently and efficiently has been well established by the industry.

“We expect that demand for leading edge high efficiency Tier 1 rigs will continue to strengthen as the drilling rig capability has been a key economic facilitator of horizontal/unconventional resource exploitation. Development and field application of drilling equipment process automation, coupled with closed loop drilling controls and demanning of the rigs, will continue this technical evolution…”

Precision, which reports in Canadian dollars, reported a net loss of $22.6 million (minus 8 cents/share) in 1Q2017, versus a year-ago net loss of $19.9 million (minus 7 cents). Revenue jumped almost 15% to $346 million.

Average revenue/utilization day for contract drilling rigs decreased to $18,524 from $23,880 in Canada and fell in the United States to US$19,972 from US$31,830. The decrease in Canada resulted from lower spot market rates and a higher proportion of revenue from shallower drilling activity relative to 1Q2016. The decrease in the U.S. revenue rate came as fewer rigs were working under long-term contracts and from a lower daily revenue impact from idle but contracted rigs.

Average rig operating costs/utilization in Canada fell year/year to $9,947 from $10,899, while U.S. operating costs on a per-day basis decreased to US$14,682 from US$16,656.

Capital expenditures this year are expected to be about $119 million, including $13 million for expansion capital, $52 million for sustaining and infrastructure expenditures, and $54 million to upgrade existing rigs. The split would be $113 million in the contract drilling services segment and $6 million in the completion/production services segment.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |