Shale Daily | E&P | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Precision Drilling CEO Calls Deal to Acquire Trinidad a ‘Perfect Fit’

Precision Drilling Corp., Canada’s largest oilfield services operator and third largest U.S. driller, has clinched an agreement to buy Calgary rival Trinidad Drilling Ltd. in a transaction valued at C$1.028 billion ($800,000).

The deal announced on Friday trumps a hostile bid for Trinidad that was launched in August by Calgary-based Ensign Energy Services Inc. valued at C$947 million ($720 million). Ensign owns about 10% of Trinidad.

The Precision transaction, scheduled for completion by year’s end, includes acquiring all of Trinidad’s shares and assuming about C$477 million ($369 million) in net debt. Trinidad would own about 29% of the combined company.

“This transaction creates exceptional value for both Trinidad and Precision shareholders,” Precision CEO Kevin Neveu said. “The combination provides a truly unique opportunity to combine two highly focused drilling contractors that are pursuing similar growth initiatives and competitive strategies and importantly, operating similar Tier 1 assets.

“From a strategic perspective, Trinidad is a perfect fit with Precision. We can realize immediate synergies, estimated to be over C$30 million, through fixed cost reductions, operational efficiencies and reduced public company costs.”

In the long term, he said, the additional scale should strengthen Precision’s operating leverage and position the global company to service the “continued transition” by exploration and production companies to high-tech drilling services, including alternating current (AC) rigs, aka, walking rigs.

“The incremental free cash flow generated through this combination will ensure Precision meets or exceeds our long-term debt reduction targets and improves our financial flexibility to pursue growth opportunities in the United States and in international markets,” Neveu said.

Trinidad’s fleet includes 141 drilling rigs, including 61 AC rigs “that fit 90% within Precision’s standardization protocols and are equipped with major components that are well aligned for fleet integration.”

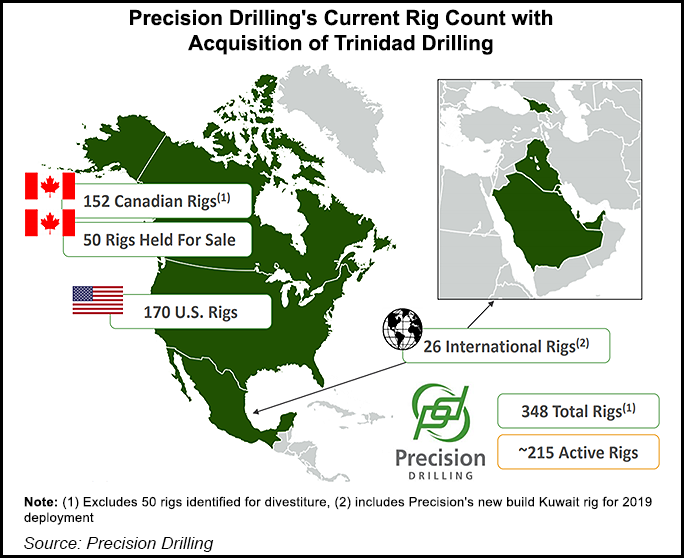

Once the transaction is completed, Precision’s North American fleet would include 200-plus active rigs and 322 total rigs. Precision expects to hold “strong positions” in all of the key North American onshore basins as industry activity improves. The company also would have an expanded platform for technology deployment and an increased inventory of “economically upgradeable rigs.”

Trinidad’s customer mix and rig fleet is complementary to Precision’s and would position the larger fleet for Western Canada’s Deep Basin development, which it said is poised to grow via more drilling linked to the newly announced liquefied natural gas (LNG) export terminal, LNG Canada, underway on the British Columbia coast.

Precision said it already has identified 50 rigs in the combined fleet that it could sell. Beginning in 2019, the operator also expects to begin to realize more than C$30 million in annual synergies through corporate efficiencies and facility consolidations. It plans to leverage its increased scale and realize long-term incremental operating efficiencies through a recently upgraded information technology infrastructure and from technical support centers in Nisku, Alberta and in Houston.

According to Precision, a key benefit of the merger would be its ability to deploy the combined fleet’s 26 international rigs into long-term contracts, with operating experience, infrastructure and scale in Saudi Arabia and Kuwait.

The Precision and Trinidad boards unanimously approved the merger, which is subject to regulatory and shareholder approvals.

Under terms of the agreement, Trinidad may not solicit or initiate discussions regarding any other business combination or asset sale. Precision also has the right to match any “superior proposals” within a five-day period. If the transaction is not completed, Trinidad could be on the hook for a noncompletion fee of C$20 million.

One of Trinidad’s directors is to be appointed to the Precision board, and another Trinidad director will be nominated for election to the board.

For Precision, RBC Capital Markets is acting as financial adviser and Torys LLP is legal adviser.

Trinidad’s financial adviser is TD Securities Inc. and its legal adviser is Blake, Cassels & Graydon LLP.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |