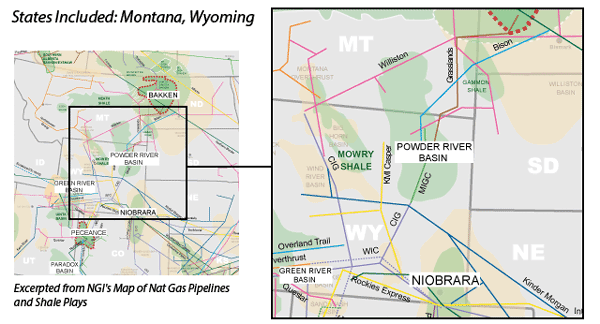

View more information about the North American Pipeline Map

Background Information about the Powder River Basin

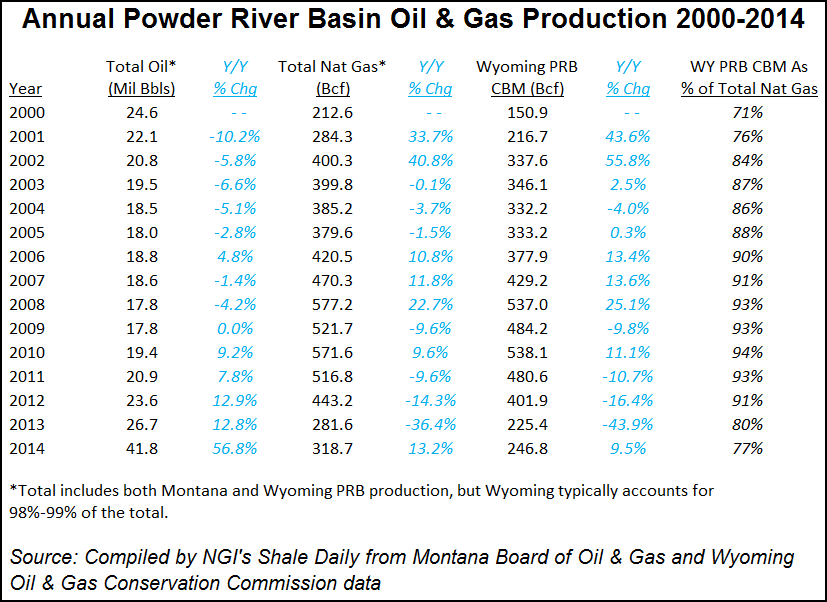

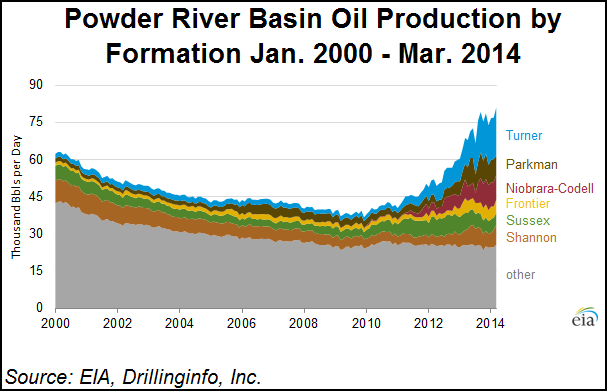

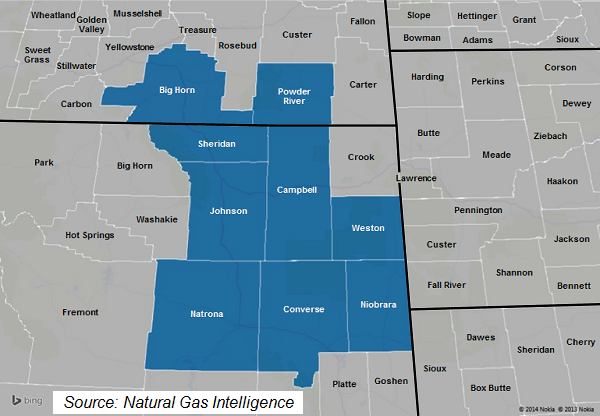

The Powder River Basin (PRB) in Northeast Wyoming and Southeast Montana, which is traditionally more known for its coal production, was one of the fastest growing oil producing regions in North America through the first half of 2014. However, the oil and gas oversupply situation forced national natural gas prices steeply lower during 2H14, followed by a similar crash in crude markets.

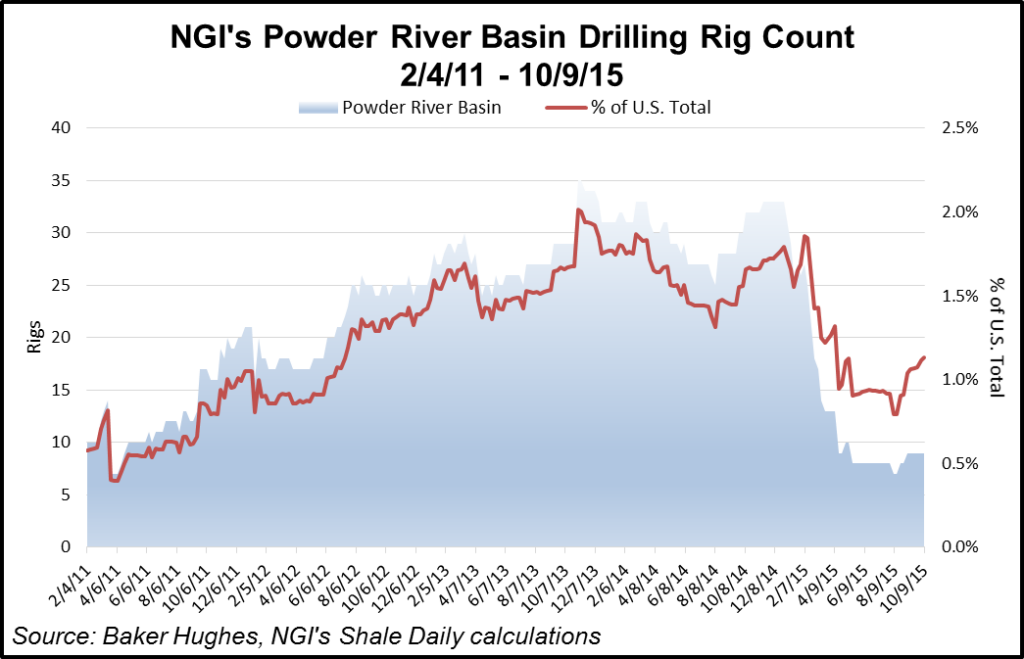

As a result, development of the Powder River Basin has slowed significantly as producers tighten their belts, laying down rigs nationally and using their reduced E&P assets and budgets on more developed plays with more certain returns. From the first week of December 2014 to the second week of October 2015, producers have reduced drilling activity in the Powder River Basin by 73%, from 33 active rigs to just nine. Over the same period, the country’s most active plays such as the Marcellus Shale, the Williston Basin and the Eagle Ford Shale have declined by 44%, 66% and 61%, respectively, to 46 rigs, 65 rigs and 80 rigs.

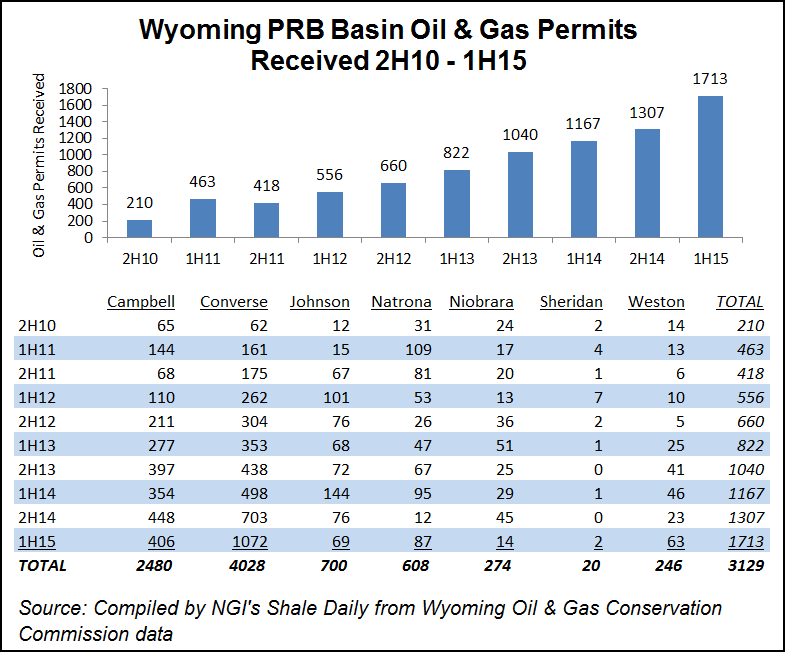

Of the nine rigs working the PRB in early October 2015, all of which were in Wyoming, 4 were in Campbell County, another 4 in Converse County, and the final rig in Weston County.

The PRB technically stretches into Montana, but the Wyoming portion of the basin typically accounts for 98%-99% of its annual production. Back in 2014 Chesapeake Energy stated on its 2Q14 conference call that difficulty obtaining permits and a lack of gas processing plants in the PRB (historically, most natural gas production in the PRB has been coalbed methane, which is about as dry a gas as you can get, and therefore usually does not need processing) had slowed the pace of growth in the basin somewhat. However, Denver-based Meritage Midstream Service II LLC completed and brought online its new natural gas processing plant, 50 Buttes, in Campbell County, WY, in October 2014. This plant is large enough to accommodate up to 300 MMcf/d.

Takeaway capacity continues to expand on the oil side as well. The new Black Thunder oil rail terminal, which was developed jointly by Denver-based Meritage Midstream Services II LLC and Arch Coal, saw its first shipment of crude oil from the PRB in Wyoming go out in June 2014. A 99-car train operated by Union Pacific Railway carried 70,000 bbl of Wyoming crude to a refinery on the East Coast for the terminal’s anchor shipper, Black Thunder Marketing LLC, a spokesperson for Meritage said. Meritage is touting the rail facility as providing “rail-to-market optionality” for PRB crude oil production. The new terminal is served by BNSF Railway, as well as Union Pacific, and it is strategically located in Wyoming’s energy rich Campbell County.

Other options for crude takeaway are also in the works. Genesis Energy LP in November 2015 was holding an open season for a crude oil pipeline extension that would serve the Powder River Basin in Wyoming with service as early as the first quarter of 2016 (see Shale Daily, Nov. 12, 2015). The pipeline would be 135 miles long and capable of receiving crude oil from multiple receipt points in Wyoming’s Campbell and Converse counties. Deliveries would be to the company’s Pronghorn unit train loading facility north of Douglas, WY, and to its new terminal in Guernsey, WY (see Shale Daily, June 25, 2015). The latter offers a direct connection to the Pony Express Pipeline, as well as infrastructure that feeds regional refineries. The Phase 2 extension would also provide shippers direct rail access to a majority of the nation’s crude oil unloading facilities, via two Class 1 railroads: BNSF and Union Pacific.

The Powder River Basin was the subject of many 3Q15 earnings calls by E&P companies. On Oct. 28, executives with SM Energy Inc. said they would transition one drilling rig out of the Powder River Basin in early 2016 (see Shale Daily, Oct 29, 2015). One week later, Chesapeake Energy Corp. CEO Robert Lawler said its asset in the basin “has progressed dramatically in the past year,” adding that its estimate of recoverable resources there continues to grow (see Shale Daily, Nov. 4, 2015). And in a separate statement on the same day, ONEOK Inc. also reported increased production volumes from the basin.

While EOG Resources Inc. is the largest oil producer and acreage holder in the Eagle Ford Shale. David Trice, executive vice president for E&P, said on Nov. 6 that the Powder River Basin “remains a core position for EOG,” despite reduced capital spending there in 2015 (see Shale Daily, Nov. 9, 2015).

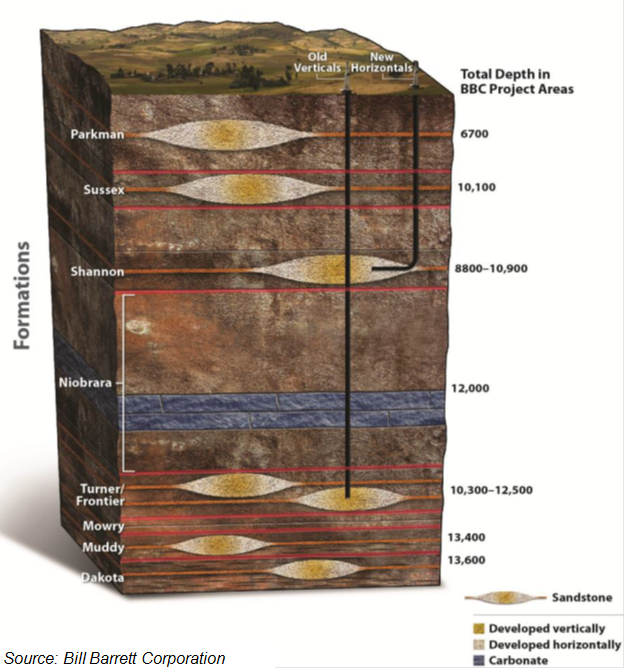

With a goal of more precise E&P in the Powder River Basin, University of Wyoming researchers and industry in August 2015 moved into the second phase of cooperative research on the basin’s geology (see Shale Daily, Aug. 12, 2015). The focus is on the Frontier formation, where hydraulic fracturing (fracking) has revitalized E&P activity (see Shale Daily, Sept. 15, 2014). New Orleans-based service company Helis Oil & Gas Co. and Oklahoma City-based Devon Energy Corp. are working with researchers at UW’s Department of Geology and Geophysics and the School of Energy Resources. The Cretaceous Tight Oil Consortium is seeking the best ways to tap unconventional oil reservoirs. PRB, one of the busiest oilfields, helped spark the first phase of the research in 2012.

Initial UW research focused on the stratigraphy of tight sandstone of the Frontier. Graduate student Rebekah Rhodes used core and outcrop analysis to provide “a clearer picture of the subsurface,” according to UW. The analysis is expected to help E&Ps “better model and more efficiently extract oil from deep reservoirs.” In the second phase, researchers plan to analyze the interaction of fracking fluids with the minerals of the formation. “We’re looking at how the fluids react with the Frontier,” said UW’s associate professor John Kaszuba. “‘This should provide companies with information about what treatments to use downhole to maximize production.” Using core samples from the Frontier and the fracking chemicals used, researchers during the next two years plan to duplicate underground temperature and pressure levels in the laboratory to analyze the geochemical reactions to gain insights into which chemicals to use or avoid in frack jobs.

The combination of the earlier stratigraphic data with the geochemical research “could substantially improve well completions in the Frontier and other similar reservoirs,” said assistant professor and co-leader of the research Brandon McElroy.

Even among difficult economics, some producers are doubling down in the Powder River Basin. In early December 2015 Devon Energy Corp. paid $2.5 billion to tack on 80,000 net surface areas in Oklahoma’s emerging stacked reservoirs and double its position in the Powder River Basin, two onshore areas that CEO Dave Hager said were among the best in North America (see Shale Daily, Dec. 7, 2015).

The acquired PRB acreage, south of Devon’s legacy position in Wyoming, includes production of 7,000 boe/d, 85% weighted to oil. The leasehold “is most prospective for the Parkman, Turner and Teapot formations,” Vaughn noted.

The contiguous acreage in the PRB allows for extended-reach horizontal drilling, and Devon has conservatively identified 500 development-ready locations with potential for as many as 2,700 unrisked locations as appraisal drilling further de-risks multiple formations.

“This opportunistic transaction adds scale and scope to our Powder River Basin operations, creating the largest and highest quality acreage position in the industry,” said Vaughn. “Our Powder River programs are delivering some of the best returns at Devon, and we will apply our unique basin knowledge to efficiently develop and derisk this premium acreage position.”

After deducting the value of current production at $30,000/flowing barrel and $100 million of midstream infrastructure, Devon secured the undeveloped leasehold at roughly $1,100/acre. Devon’s PRB leasehold would double to more than 470,000 net acres once the deal is completed, with Rockies business unit’s production increasing to more than 30,000 boe/d.

The play has also seen some new players entering. In September 2015 Moriah Group LLC, based in Midland, TX, is becoming one of the biggest operators in Powder River Basin after securing a bundle of CBM gas wells from WPX Energy Inc. and Anadarko Petroleum Corp., as well as a big natural gas gathering system.

Over the past couple of months, Moriah and its partners have agreed to acquire WPX’s entire PRB portfolio, including its stakes in Fort Union Gas Gathering LLC, with system capacity of 1.2 Bcf/d. Fort Union is being sold to affiliate Moriah Powder River LLC for $80 million, according to WPX.

Carbon Creek Energy LLC, formed by Moriah and with private equity funding, separately is buying an estimated 7,500 gas wells in the PRB through dual transactions with WPX and Anadarko. About 2,000 wells are being purchased from WPX with 5,500 from Anadarko. About 4,500 of the wells in September produced an estimated 400 MMcf/d of natural gas. Another 800 wells are expected to ramp up.

WPX had an agreement last year to sell its CBM wells to an undisclosed buyer for $155 million (see Shale Daily, Aug. 20, 2014). However, that sale is said to have fallen through.

Counties

Montana: Big Horn, Powder River

Wyoming: Campbell, Converse, Johnson, Natrona, Niobrara, Sheridan, Weston

Local Major Pipelines

Natural Gas: Bison Pipeline, CIG, Grasslands, KMI-Casper, MIGC, Tallgrass, WBI Energy Transmission, WIC

Crude Oil: Express System (Spectra), Frontier, Platte, Pony Express, Rocky Mountains (Plains)

NGLs: Bakken NGL, Kinder Morgan CIG Powder River Lateral (Proposed), Powder River (ConocoPhillips)

Shale Daily

Shale Daily