NGI Archives | NGI All News Access

Poland Readies Draft Shale Gas Regulations

The government of Poland plans to issue draft rules covering shale gas extraction within a week, the next step to help the country take advantage of what may be vast quantities of natural gas, authorities said Tuesday.

According to reports, Polish Prime Minister Donald Tusk said the draft legislation would include regulations defining how natural gas and other hydrocarbons may be extracted from shale. Severance taxes also are said to be part of the regulatory scheme. In addition, the draft rules would provide legal protection for oil and gas companies interested in developing the country’s shale reserves.

“Assumptions are ready. At the government’s sitting in one week we will approve this project,” Tusk said at a press conference. He later added that the legislation would provide terms that would not “discourage investors from this important costly venture,” but maintained that the Polish government would retain control over the regulatory process and distribute any assets gained from shale gas development.

Poland’s parliament, the National Assembly, would ultimately need to pass the draft regulations.

Poland Deputy environment minister Piotr Wozniak was responsible for creating the legislation, according to Reuters. Earlier this month Wozniak reportedly said he wanted most of the shale regulations to go into effect in 2013, with the severance tax delayed until at least 2016.

According to Poland’s Ministry of the Environment, the country has issued 111 licenses for shale gas exploration since 2007 — most of them in 2009 and 2010 — and it has 28 applications pending. About 29% of the country, about 90,000 square kilometers, has been opened to shale gas leasing. Poland’s most prospective shale gas areas are said to be in the Pomerania, Podlasie and Lubin regions.

Twenty-three test wells have been drilled in Poland so far, with another six in the process of being drilled, and the country anticipates having 41 test wells drilled by the end of this year, officials said. In March Poland cut its projections for the estimated amount of technically recoverable shale gas resources to 346-768 billion cubic meters (Bcm), or 12.2-27.1 Tcf (see Shale Daily, March 26). That’s a fraction — between 6.5% and 14.5% — of the 5.3 trillion cubic meters, or 187 Tcf, that the U.S. Energy Information Administration (EIA) had estimated for Poland in April 2011 (see Shale Daily, April 7, 2011).

Chevron Corp., Talisman Energy Corp. and ConocoPhillips are among the U.S. producers with operations in Poland (see Shale Daily, March 14; Nov. 7, 2011; Oct. 27, 2011). ExxonMobil Corp., however, pulled up stakes there in June after disappointing results from two test wells (see Shale Daily, June 19). Polish operators PGNiG and PKN Orlen, are also actively exploring the country’s shale deposits.

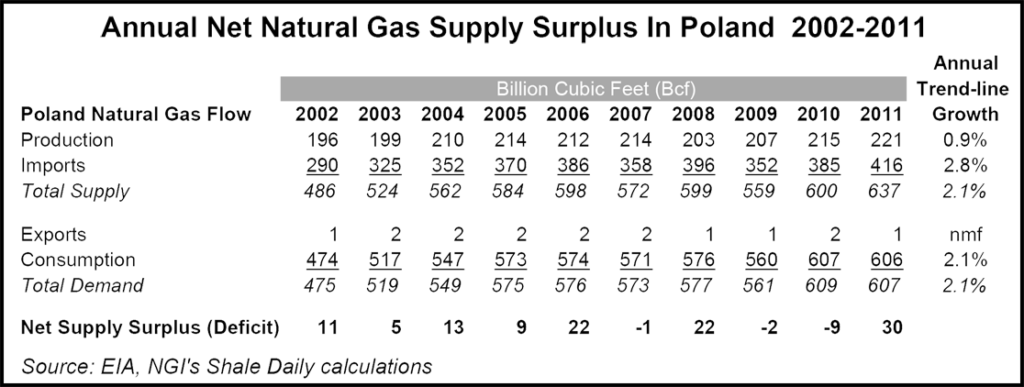

According to EIA, Poland imported 416 Bcf of natural gas in 2011. A large amount of Europe’s natural gas imports come from Russia.

Any dramatic increase in Polish natural gas production from its shale plays would likely go a long way toward reducing the country’s dependence on imports. Since 2002, total available supply in Poland has just kept up with the 2.1% annual trend-line growth rate in Polish demand. However, most of the growing demand has been met with imports, which have increased at a 2.8% annual clip over the last 10 years. Production in Poland has risen just 0.9% per year since 2002.

Growing shale production in Poland would certainly position it to be a greater supplier to the rest of Europe, which would be a dramatic departure from the country’s recent history. Poland has exported no more than 2 Bcf of natural gas in any year since 2002, according to EIA data.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |