E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Pioneer’s Optimization Campaign Paying Off in Spraberry/Wolfcamp

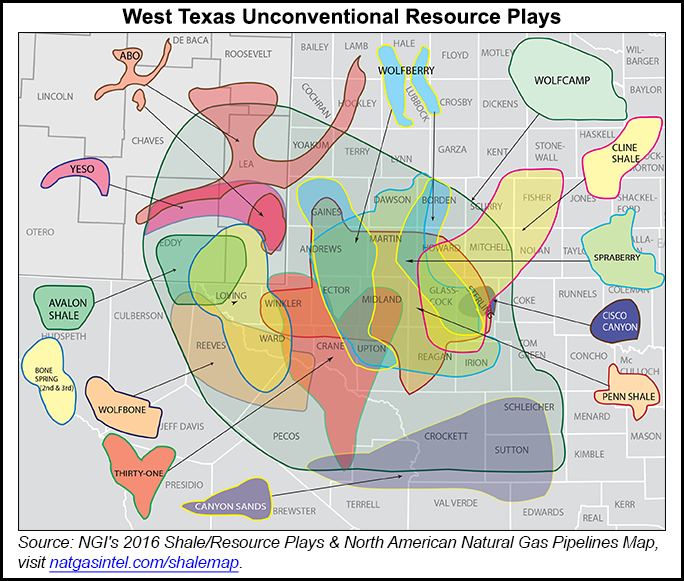

The Spraberry/Wolfcamp play in the Permian Basin continued to be an oasis of strong economics and robust production for Pioneer Natural Resources Co. during the first quarter.

Pioneer raised its forecasted 2016 growth rate for the Spraberry/Wolfcamp from 30%+ to 33%+ as a result of improving well productivity.

“The performance from our Spraberry/Wolfcamp horizontal drilling program continues to be outstanding. Our strong balance sheet, derivatives position and improving capital efficiency are allowing us to continue to grow and bring forward the inherent net asset value associated with this world class asset during a period of low commodity prices,” said CEO Scott Sheffield.

“We have the financial flexibility to prudently manage through the current commodity price downturn and quickly ramp up drilling activity when prices improve. We expect to add five to 10 horizontal rigs when the price of oil recovers to approximately $50/bbl and when our outlook for oil supply-demand fundamentals is positive.”

Pioneer is the largest acreage holder in the Spraberry/Wolfcamp, with about 600,000 gross acres in the northern portion of the play and about 200,000 gross acres in the company’s southern Wolfcamp joint venture area.

The company placed 55 horizontal wells on production in the Spraberry/Wolfcamp during the first quarter, of which 42 were in the northern portion and 13 were in the southern Wolfcamp joint venture area. Of the 55 wells, 37 wells were in the Wolfcamp B interval, nine wells were in the Wolfcamp A interval, eight wells were in the Lower Spraberry Shale interval and one well was in the Middle Spraberry Shale interval.

The Wolfcamp A, Lower Spraberry Shale and Middle Spraberry Shale wells were all in the north, while 24 of the Wolfcamp B interval wells were in the north and the remaining 13 Wolfcamp B interval wells were in the southern Wolfcamp joint venture area.

Because of efficiency gains, Pioneer was able to bring on about 10 more wells during the quarter than initially planned, COO Timothy Dove said during an earnings conference call Tuesday.

“Most of those [additional wells] were near the very end of the quarter, as you might expect as the timing works, so they don’t have much of an effect on the first quarter results as they will have more of an effect in the second quarter. But as to the bigger picture, I think we’re going to see continuous optimization gains across the board. It has to do with…the completion optimization campaign on the one hand and also mixing in longer laterals,” Dove said. “We’re going to have 10-20 long lateral wells in the mix here for 2016 as well.

“I think you’re going to see continuous gains, and I think you’ll see us, hopefully, continue to outperform.”

All of the wells placed on production in the first quarter benefited from the company’s completion optimization program, management said.

In the northern Spraberry/Wolfcamp, 97 wells have been completed under the optimization program since the middle of last year. These wells (68 wells in the Wolfcamp B interval, 13 wells in the Wolfcamp A interval and 16 wells in the Lower Spraberry Shale interval), are delivering productivity improvements based on early production rates ranging from 10% to 35% above a 1 million boe estimated ultimate recovery (EUR) type curve, Pioneer said Monday.

The 1 million boe EUR type curve reflects the average performance of the horizontal Wolfcamp A and Wolfcamp B interval wells drilled by Pioneer across its northern acreage before the completion optimization program was initiated.

Horizontal wells in the southern Wolfcamp joint venture area are also benefiting from the program, with 22 wells having been completed under the program. Of these, 21 wells were in the Wolfcamp B interval and are delivering a productivity improvement based on early production rates averaging 25% above a 1 million boe EUR type curve. Early production from the remaining Wolfcamp A interval well is delivering an average productivity improvement of 25% compared to an 800,000 boe EUR type curve.

Pioneer’s completion optimization program uses longer laterals with optimized stage lengths, clusters per stage, fluid volumes and proppant concentrations. “The objective of the program is to improve well productivity by allowing more rock to be contacted closer to the wellbore,” it said.

The company said it continues to expect to place about 230 horizontal wells on production in the Spraberry/Wolfcamp area during 2016. Of these, about 190 will be in the northern area and 40 would be in the southern Wolfcamp joint venture area. About 60% of the wells would be drilled in the Wolfcamp B interval, 25% in the Wolfcamp A interval and 15% in the Lower Spraberry interval.

The current cost to drill and complete a horizontal well is about $7.5-8.0 million, assuming average perforated lateral lengths of about 9,000 feet and utilization of the 2015 optimized completion design as the standard design for 2016.

Production costs for Pioneer’s horizontal Spraberry/Wolfcamp wells range from $5.00-7.00/boe per well (including lease operating expenses ranging from $3.00 to $5.00/boe and production and ad valorem taxes of $2.00/boe).

“Despite the weak commodity price environment, the 2016 drilling program in the northern Spraberry/Wolfcamp area is expected to continue to deliver favorable internal rates of return, with returns of approximately 30% expected at current strip commodity prices,” Pioneer said. “These returns, which include tank battery and saltwater disposal facility costs, are benefiting from ongoing cost reduction efforts, drilling and completion efficiency gains and well productivity improvements.”

During the second quarter Pioneer expects to place about 60 horizontal wells on production. It also plans to begin choke management in selected areas to optimize water disposal infrastructure. Second quarter production is forecasted to average 224,000-229,000 boe/d.

The capital budget for 2016 remains $2 billion, including $1.85 billion for drilling, completions and related activities, and $150 million for vertical integration, systems upgrades and field facilities.

The Northern Spraberry/Wolfcamp will get $1.71 billion; the Southern Wolfcamp joint venture area (net of carry) will receive $60 million; the Eagle Ford Shale will get $60 million; and “other” assets will get $20 million.

The 2016 capital budget is expected to be funded from forecasted operating cash flow of $1.4 billion (an increase of $0.1 billion over the previous estimate and based on assumed average 2016 estimated prices of $40/bbl for oil and $2.20/Mcf for gas), cash on hand and the remaining $500 million of proceeds from the sale of the company’s Eagle Ford Shale midstream business, which will be received in July 2016.

Pioneer said it expects production growth of 12%+ in 2016 compared to 2015. This growth reflects Spraberry/Wolfcamp area production growing by 33%+, partially offset by declines of approximately 25% in the Eagle Ford Shale and 10% across other assets. During the conference call, Sheffield said the company would look at restarting Eagle Ford activity once West Texas Intermediate increases to $50/bbl.

Pioneer reported a first quarter net loss of $267 million (minus $1.65/share) compared with a net loss of $78 million (minus 52 cents) in the year-ago quarter. Excluding derivative losses and other special items, first quarter adjusted results were a net loss of $104 million after tax (minus 64 cents/share).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |