E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Pioneer Triples Rigs in Permian’s Spraberry/Wolfcamp, Boosts Production

Pioneer Natural Resources Co. more than tripled the number of rigs it has deployed in the Permian Basin’s Spraberry and Wolfcamp formations during the first quarter of 2014, a move that helped the company beat its production guidance and grow its oil production.

Dallas-based Pioneer said Tuesday production for the quarter was 172,000 boe/d, beating its production guidance of 166,000-171,000 boe/d. The production figure excludes discontinued operations in Alaska and the Barnett Shale (see Shale Daily, Oct. 25, 2013;

Pioneer attributed the growth in production to successful drilling programs in the Permian sub-basin, the Midland, specifically horizontal drilling targeting the Spraberry and Wolfcamp formations, as well as the Eagle Ford Shale in South Texas, and to a full recovery from weather-related production curtailments during 4Q2013.

“The company delivered another great quarter, with strong earnings, production exceeding expectations and continued impressive horizontal well performance in the Spraberry/Wolfcamp and the Eagle Ford Shale areas,” said CEO Scott Sheffield. “Importantly, oil production grew 9% in the first quarter of 2014 as compared to the fourth quarter of 2013.”

According to Pioneer, oil production was 78,589 bbl during the first quarter, a 14.6% increase from 1Q2013. Natural gas liquids (NGL) production also rose during the same time frame, from 29,951 bbl to 35,763 bbl, an increase of 19.4%. Meanwhile, natural gas production fell year/year, from 359.7 MMcf to 345.5 MMcf, a decline of 3.9%.

Pioneer is the largest acreage holder in the Spraberry/Wolfcamp, with close to 600,000 gross acres in the northern part of the play and 200,000 gross acres in the southern part, a joint venture area with Sinochem Petroleum USA LLC, a U.S. subsidiary of China’s Sinochem Group (see Shale Daily, Jan. 31, 2013).

Pioneer said it plans to increase production 14-19% this year from 2013, with a capital expenditures (capex) budget of $3.3 billion, with most of it, $3.0 billion, for drilling, including $2.17 billion in the northern Spraberry/Wolfcamp, $205 million in the southern Spraberry/Wolfcamp, and $545 million in the Eagle Ford.

The company is currently operating 16 rigs in the Spraberry/Wolfcamp, up from five rigs at the end of 2013. According to Pioneer, the rigs deployed there are drilling mostly three-well pads. The company said it expects to have 125 wells in the Spraberry/Wolfcamp and the Eagle Ford placed into production during the first half of 2014, increasing to 175 wells during the second half of the year.

“Looking beyond 2014, we expect to continue to ramp up our horizontal rig count in the Spraberry/Wolfcamp by five to 10 rigs per year, and more than double production by 2018 as compared to 2013,” Sheffield said.

During 2013 and the first quarter of 2014, Pioneer said it placed 23 horizontal oil wells into production across its northern position in the Spraberry/Wolfcamp. Of those 23 wells, the company said production data from 17 wells targeting the Wolfcamp A, B and D intervals, and six wells targeting the Lower Spraberry Shale, continued to support strong estimated ultimate recoveries (EUR) and internal rates of return (IRR).

According to Pioneer, EURs ranged from 575,000 boe to 1 million boe across the various Spraberry and Wolfcamp intervals; before-tax IRRs ranged from 45% to more than 100%.

The company said it plans to drill about 140 wells in the northern Spraberry/Wolfcamp and place about 90 wells into production during 2014. In the southern acreage shared by the JV, Pioneer plans to drill about 115 horizontal wells and place about 100 wells into production by the end of the year.

Pioneer said it is also currently operating 11 vertical rigs in the Spraberry field, with about 200 wells expected to be drilled in 2014. About 90% of the vertical drilling in the field is to target the Strawn and Atoka intervals.

“With only 11 rigs running, vertical production is expected to decline in 2014 by approximately 10%,” Pioneer stated. “The company expects to further reduce its vertical rig count going forward, allowing it to devote more of its capital to higher-rate-of-return horizontal drilling.”

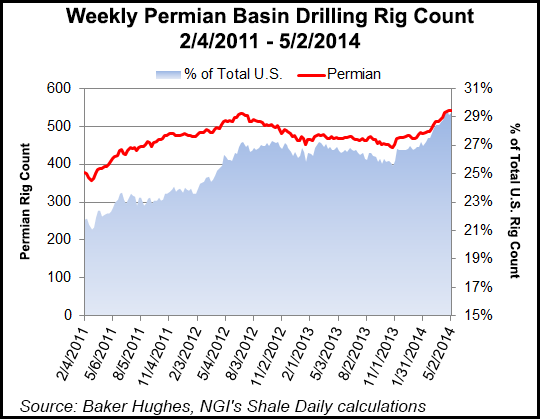

The total number of rigs the industry operates in the Permian Basin has been on the rise over the past six months, reaching 542 on April 25, according to Baker Hughes data. That’s up from 448 rigs on October 18.

In the Eagle Ford, Pioneer said it placed 12 wells targeting the upper portion of the play into production through mid-April, as the company continued its downspacing and staggering program (see Shale Daily, Nov. 6, 2013).

Analysts were agog about Pioneer’s performance.

Wells Fargo Securities LLC analysts Gordon Douthat and David Tameron issued an outperform rating for Pioneer stock and said the news was positive. “[The] transition from resource growth to production growth [is] underway with first quarter production ahead of guidance, us and [Wall Street],” they said. “[The] 2014 ramp [is] backend weighted, but [this is] a good start to the year in our view.”

BMO Capital Markets Corp.’s Phillip Jungwirth and A.J. Donnell concurred on Wednesday, issuing a market perform rating for Pioneer. “Bottom line, a solid quarter, and while 2Q is weaker than expected, Pioneer looks poised for strong growth in 2H, and we’re raising estimates slightly following the release,” they said. “That said, our view that Pioneer offers minimal upside on a valuation basis is unchanged…”

Topeka Capital Markets analyst Gabriele Sorbara issued a hold rating. “After the [markets closed Tuesday], Pioneer reported strong 1Q results [showcasing] its execution with production, earnings and cash flow exceeding expectations,” Sorbara said. “We are pleased with the quarterly results, although find it difficult to apply a higher multiple with the company’s current growth profile.”

Pioneer reported net income of $123 million (85 cents/share) for the first quarter, compared with $109 million (77 cents) during the year-ago quarter. Adjusted net income for 1Q2014 was $183 million ($1.26/share). Revenues were $963 million for 1Q2014, up 25.6% from the $767 million in revenue a year earlier.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |