Eagle Ford Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Pioneer Jettisoning Most Onshore Projects to Become Permian Pure-Play

Legacy onshore producer Pioneer Natural Resources Co. is putting all of its money on the Permian Basin, announcing it plans to divest nearly all of its U.S. portfolio to direct all attention to West Texas.

CEO Tim Dove on Wednesday said the divestments would be of all “non-Permian” projects, including in the Eagle Ford Shale, the Raton Basin and the West Texas Panhandle.

“That will result in making Pioneer a pure Permian Basin player,” and specifically a Midland sub-basin producer, Dove said. He acknowledged the overhaul, while a long time in the making, would be a difficult one.

Assets up for sale “have been part of our portfolio for decades, in some cases, multiple decades, and they’ve been significant contributors to the company’s success over the years…We believe, though, that taking these steps will be a positive for the company on many fronts.”

Pioneer is the largest acreage holder in the Midland sub-basin of West Texas, with about 550,000 gross acres in the northern portion of the play and 200,000 gross acres in the southern Wolfcamp joint venture area.

It now has 70,000 acres held by production in the Eagle Ford in South Texas that are on the market. Eagle Ford net production averaged 27,000 boe/d in 4Q2017, weighted equally to oil, natural gas and liquids. It separately plans to divest the Sinor Nest Wilcox field, also in South Texas.

The Raton properties in Colorado and New Mexico to be sold include all of the producing natural gas wells and associated infrastructure. Net output averaged 86 MMcf/d in the last quarter of 2017. The West Panhandle properties in Texas to be sold produced 7,000 boe/d in 4Q2017, 55% weighted to natural gas liquids, 25% to natural gas and 20% to oil.

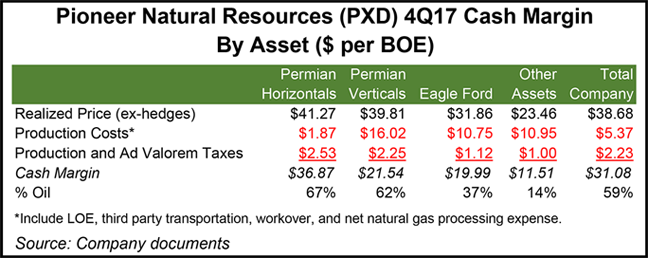

A Permian-only focus should increase reported revenue/boe, reduce operating expenses and improve margins, Dove said. Revamping to a more oil-weighted operation “I think helps in the face of current commodity prices.”

Data rooms are scheduled to open by early March, but sales may take time to execute “simply because there are a lot of moving parts and, needless to say, there’s a few assets that need to be dealt with.”

Pioneer, one of the biggest Permian producers, today has 20 rigs working in the Wolfcamp formation, a number that is expected to remain static this year. For the year, 250-275 wells are planned.

The Houston-based independent also issued its fourth quarter results, with net income of $665 million ($3.87/share).

Total production in the quarter was 305,000 boe/d, up 11% sequentially. Total Permian oil production increased 26% in 2017 from 2016. Pioneer placed 64 wells on production in the basin during the final three months.

“We are in year two of our 10-year plan and remain committed to achieving oil production greater than 700,000 b/d and total production greater than 1 million boe/d in 2026,” Dove said.

This year’s capital program is to be funded by cash flow “if oil prices average approximately $58/bbl,” he said. “Looking forward, the breakeven oil price to fund our planned capital program declines to approximately $50/bbl in 2020 and $40/bbl in 2026.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |