NGI Archives | NGI All News Access

Piedmont Taking Minority Stake in Constitution Pipeline Project

Piedmont Natural Gas is investing $180 million in Marcellus Shale-focused Constitution Pipeline Co. LLC to join Williams Partners LP and Cabot Oil and Gas Corp. as an equity holder in the project.

In February Williams Partners and Cabot announced the project to carry Marcellus gas from northern Pennsylvania to northeastern markets (see Shale Daily, Feb. 22). The project is scheduled to be in service by March 2015. Piedmont’s Piedmont Constitution Pipeline Co. LLC will have a 24% stake. Piedmont is a distribution company that serves more than 1 million customers in North and South Carolina and Tennessee.

“Piedmont’s equity participation in the Constitution Pipeline project aligns very well with our strategic focus on expanding our investments in complementary energy-related businesses as a means of enhancing shareholder value,” said Piedmont CEO Thomas Skains.”

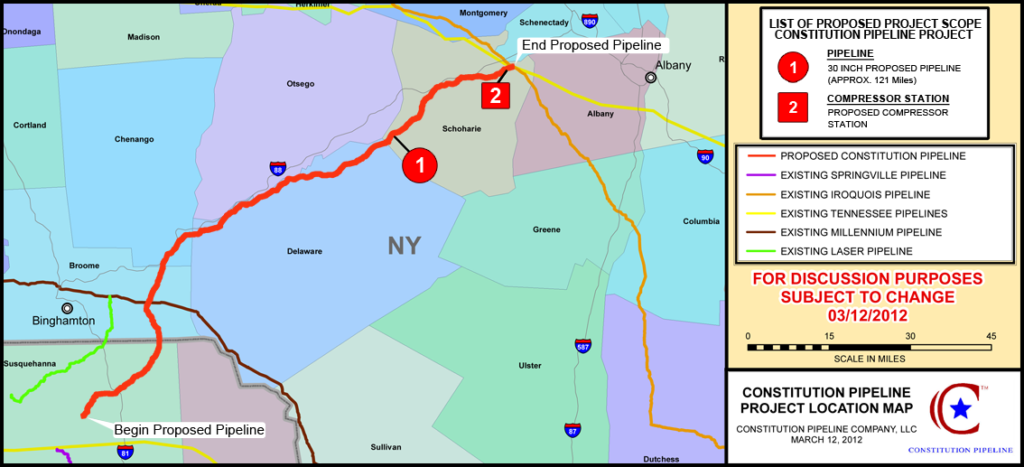

An affiliate of Williams Partners will construct, operate, and maintain the 30-inch diameter, 121-mile pipeline. It is being designed to transport up to 650,000 Dth/d from established Marcellus production areas in Susquehanna County of northern Pennsylvania. The pipeline will connect with the Iroquois Gas Transmission and Tennessee Gas Pipeline systems in Schoharie County, NY, and is already fully contracted with long-term commitments from established producers operating in Pennsylvania, Piedmont said.

The distribution company will not be a customer of Constitution, Piedmont said. Williams Partners will maintain a 51% stake in the pipeline, while Cabot will have a 25% share.

“Williams Partners enjoys a long-term, mutually beneficial relationship with Piedmont as a customer on our Transco pipeline system and as a joint venture partner in existing pipeline and storage infrastructure projects in North Carolina,” said Williams Partners CEO Alan Armstrong. “Constitution is a key component of the Susquehanna Supply Hub that Williams Partners is expanding to connect Marcellus Shale producers like Cabot and Southwestern Energy with the highest-value markets.”

Besides the Transco relationship, Piedmont is an investor in Cardinal Pipeline Co. LLC, which Williams Partners operates, noted Nick Giaimo, Piedmont manager of capital markets and investor relations. The two also are partners in the Pine Needle LNG Co., he said.

Giaimo said Piedmont had been looking to the Marcellus and infrastructure projects there as a means to deploy capital. With Constitution, Piedmont can earn a regulated return, which it favors, that is better than the regulated return available from local distribution company (LDC) assets.

“It’s also in a business that we’re familiar with,” he said. “We operate transmission pipeline now with all the power generation projects that we do for Duke Energy…We’ve made these kind of investments before…We provide a good amount of expertise on transmission pipelines. This kind of investment is consistent with the utility path and, in fact, it’s going to earn regulated pipeline returns, which have been consistently above LDC returns.”

Giaimo said Piedmont had no plans to acquire LDC assets in the Northeast that would be served by constitution.

Construction of Constitution is expected to begin in April 2014. Constitution Pipeline is in the pre-filing process with the Federal Energy Regulatory Commission and plans to file a formal certificate application in spring 2013.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |