Markets | NGI All News Access | NGI Data

Physical NatGas Beats Resilient Futures; November Up A Penny Despite Bearish EIA Data

Next-day natural gas bounded higher in Thursday’s trading despite the tendency for physical traders to attempt to get deals done ahead of the 10:30 a.m. EDT release of inventory data by the Energy Information Administration (EIA).

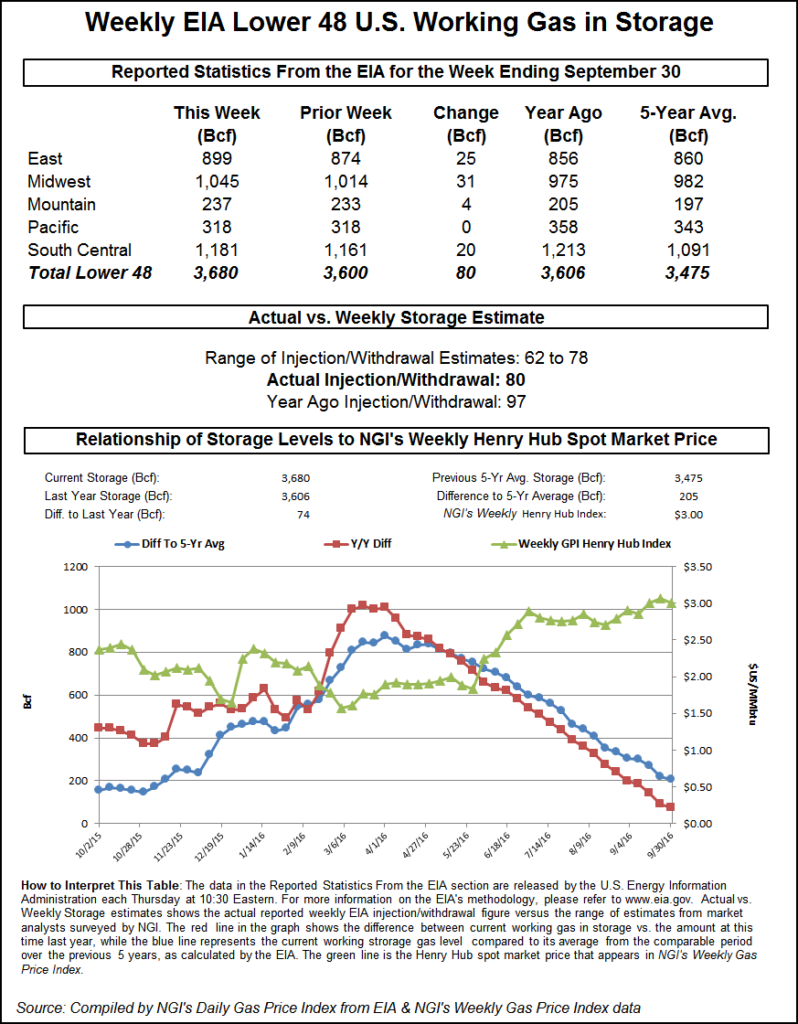

With the exception of spot weakness in the Marcellus and Mid-Atlantic, most market points posted solid double-digit gains, and the NGI National Spot Gas Average rose 8 cents to $2.61. EIA reported a storage injection of 80 Bcf, about 10 Bcf above expectations, and although futures sank initially, they staged a healthy rally going into the end of the session. November managed a gain of eight-tenths of a cent to $3.049 and December was higher by 2.2 cents to $3.282. November crude oil gained 61 cents to $50.44/bbl.

EIA reported build of 80 Bcf and caught traders by surprise. November futures reached a low of $2.972 immediately after the figures were released, and by 10:45 a.m. November was trading at $2.994, down 4.7 cents from Wednesday’s settlement.

“It’s trying to get itself back over $3,” said a New York floor trader shortly after the number was released. “If it can get back over $3.01, you will see confidence come back. To me the market still looks good. It did its dance when the number came out and now its holding.”

“The larger-than-expected 80-Bcf build suggests that producers may be ramping up supply ahead of the winter or that power sector demand has faded more quickly than anticipated as temperatures cool seasonally,” said Tim Evans of Citi Futures Perspective. “Either way, it suggests more robust storage injections for the weeks ahead.”

Inventories now stand at 3,680 Bcf and are 74 Bcf greater than last year and 205 Bcf more than the five-year average. In the East Region 25 Bcf was injected and the Midwest Region saw inventories increase by 31 Bcf. Stocks in the Mountain Region rose 4 Bcf, and the Pacific Region was unchanged. The South Central Region added 20 Bcf.

Recent weakness in Marcellus and Mid-Atlantic pricing has been prompted by a lack of eastern storage, analysts say. “While production has trended down across the country for most of the summer, we saw a dramatic change this weekend that may cause ripples at least until we get into the winter months,” said Jeff Richter, principal at EnergyGPS, a Portland, OR-based trading and risk management firm. “Coming out of summer, power burns in the East started to move back to seasonal normal. As demand started to wane, the overall supply-demand balance started to loosen, creating an oversupplied condition in the daily pipeline balancing. Normally there would be storage capacity available to soak up excess gas keeping pipeline pressures in check. After last years warm winter, there is a lack of storage capacity in the East available at the end of this inventory season.”

Taking a look at Dominion storage, “you can see it has been running at a similar rate as last year when it comes to injection, but the starting point was much higher coming out of the winter. This has left the month of October with little room to inject assuming the recent history is an indication to its storage capacity,” he said.

“That lack of storage space this past weekend combined with the excess gas on the system left no other alternative but to put the daily cash prices at many producing hubs below producer costs. As a result, we saw cash prints as low as $0.30 across the Marcellus and Utica basins. These multi year lows had some producers scrambling to shut in their wells as ‘producer’ economics became the lever to pull to help balance the pipeline system.”

In physical trading Marcellus and Midcontinent points struggled to gain the traction seen in the rest of the market. Gas on Dominion South shed a nickel to 88 cents, and gas on Tennessee Zn 4 Marcellus fell 4 cents to 80 cents. Gas on Transco-Leidy Line was quoted 7 cents lower at 85 cents.

Mid-Atlantic prices fared little better. Gas bound for New York City on Transco Zone 6 skidded 5 cents to $1.02, and deliveries to southeasternmost Pennsylvania, Trenton, and southern New Jersey on Transco non-NY North changed hands 8 cents lower at $1.00.

Major market centers for the most part posted double-digit gains. Gas at the Chicago Citygate rose 9 cents to $2.90, and gas at the Henry Hub added 13 cents to $2.99. Parcels on El Paso Permian gained 13 cents to $2.76, and gas at the SoCal Citygate changed hands 15 cents higher at $3.05.

For the moment, Hurricane Matthew hasn’t prompted any decrease in power demand. “While many Florida cities along the Atlantic Coast are currently under hurricane warnings, there does not appear to be demand destruction occurring,” said industry consultant Genscape in a Thursday morning report. “Demand in Florida dipped day over day from the 5th to the 6th, especially nominations to power plants and citygates; however, figures are still within the seven-day average.

“Looking to other potentially impacted markets, temperatures in Atlanta, Charleston and Raleigh are forecast to hold steady through the storm. Demand in most SEMA [Southeast Mid-Atlantic] markets has begun the slow descent typical of the shoulder season. Temps are no longer scorching, and this upcoming storm will not be able to suppress temps into heating degree territory.

“Combined with the weekend’s general impact on demand, weather and demand figures should remain reasonably stable.”

At 2 p.m. EDT Thursday the National Hurricane Center (NHC) reported that Hurricane Matthew was 125 miles east-southeast of West Palm Beach Florida and moving to the northwest at 14 mph. Maximum sustained winds were up to 140 mph, and NHC projected that Matthew would migrate up the east coast of Florida, Georgia and the Carolinas.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |