Shale Daily | Coronavirus | E&P | Earnings | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Phillips 66 Sees Fewer ‘Investable Opportunities’ as Lower 48 E&Ps Scale Back

Fuel demand is slowly returning as social distancing measures from Covid-19 are eased, but while consumption may be edging higher, Phillips 66 plans to maintain the prudent approach to 2021, CEO Greg Garland said last week.

The Houston-based management team discussed first quarter performance for the energy manufacturing and logistics company during a conference call with analysts.

For now, Phillips 66 is focused on “conserving cash and maintaining strong liquidity to manage through this unprecedented downcycle,” Garland said. Share repurchases were suspended in March. Actions are underway to reduce costs by $500 million this year. Consolidated capital spending has been cut by $700 million from guidance.

[Want to see more earnings? See the full list of NGI’s 1Q2020 earnings season coverage.]

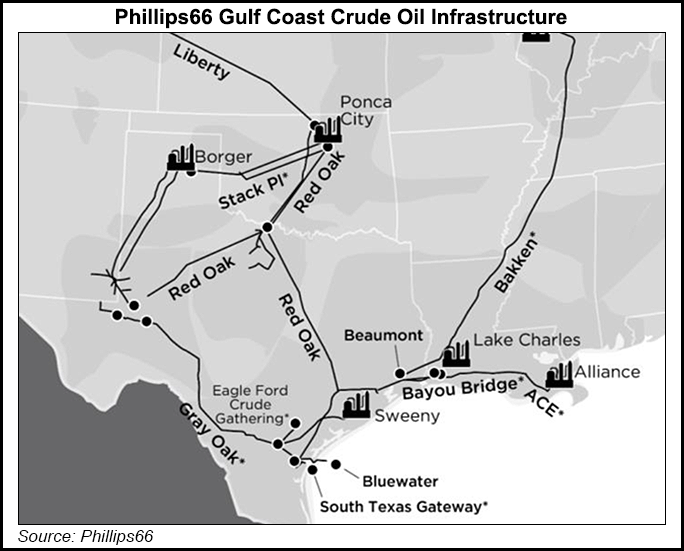

Projects also have been deferred, including the Red Oak Pipeline, which would move crude from the Midcontinent to the Gulf Coast by way of the Permian Basin. Also shelved is the Liberty Pipeline, as well as projects at the Sweeny hub near the Houston Ship Channel to serve more Permian capacity.

“We deferred some turnarounds until later this year, and also into 2021,” Garland said. “We’ve reduced refinery runs across the system in response to lower product demand and margins.In April, our crude capacity utilization was in the high 60% range.”

The outlook is murky at best, said Garland, a 40-year energy industry veteran. Offering a “single-point-in-time forecast in the middle of the crisis is always dangerous and often wrong. And that was true when crude was $100 and crude is $20…”

Management views its business through the lense of the mid-cycle, he said. “We think that’s the appropriate way to do it. We’ve had this 60-40 allocation framework, 60% to reinvest back in our business and 40% return to shareholders. We still think that’s a good framework.”

In the current crisis, however, “liquidity is king,” the CEO said. The double-digit capital expenditure reductions by exploration and production (E&P) companies are going to scale back “investable opportunities” for midstream operators into 2021.

“While we’re a long way to December when we would normally set our capital budget, today, I would tell you, we would probably guide to the low end of that…just in terms of the organic investable opportunities that meet our hurdle rates.”

Regarding potential mergers and acquisitions (M&A) that may come as competitors’ fortunes fall, “never try to catch a falling knife,” Garland said. “The best thing is we don’t have to do anything on the M&A front. We have great opportunities to create value for our shareholders so we can be highly selective. There’s a lot of examples out there today of folks who have done the M&A side of it, and it’s really hard to create value doing that.”

Garland said there is going to be consolidation in the upstream and midstream sectors into 2021, and “given the stress levels that people have, there could be opportunity to pick up assets, if not even whole companies…You’ll see us look at everything, but we’ll be very, very careful and very selective about what we might do.”

The demand for fuel is beginning to pick up, a sign that social distancing measures that have kept people off the road and out of the airports are easing.

In Western Europe “at the worst of the demand destruction we were down about 70%” said Executive Vice President Brian Mandall, who oversees Marketing and Commercial. “We’ve seen things come back. We’re about 50% now. In Germany and Austria, they’re starting to open up those communities a little bit. Bigger stores can now open.

“If you come over to the U.S., we were seeing 40%, 50% demand destruction depending on rural or urban areas. Now that’s up to about 35%, so things are getting better.”

The company is matching utilization with demand. It got as low as 65% utilization, “when demand was at its worst,” Mandall said.

On the gasoline demand side of the equation, consumers driving to and from work account for around 35% of consumption, said Investor Relations chief Jeff Dietert. “Recent statistics show over 90% of the U.S. population under some form of lockdown, and the pace of recovery is going to be driven by the impact of Covid-19 and the relief from these policies…

“As people come back to work and start driving, they’ll be greeted with lower gasoline prices down about 40% year-on-year at retail and support from a $6 trillion stimulus package, which should support recovery as well.”

Net losses in 1Q2020 totaled $2.5 billion, (minus $5.66/share), compared with earnings of $204 million (44 cents) in 1Q2019. One-time impairments in 1Q2020 totaled $2.9 billion.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |