E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Permian’s Parsley, Jagged Peak to Tie Up in $2.27B Merger

Permian Basin explorer Parsley Energy Inc. on Monday agreed to buy private equity-backed Jagged Peak Energy Inc. in an all-stock transaction valued at $2.27 billion.

The agreement, including $625 million of Jagged Peak debt, brings together two explorers that have holdings across the Permian Delaware and Midland sub-basins. The transaction would value Quantum Energy Partners-backed Jagged Peak at around $7.59/share, an 11.2% premium to its closing price last Friday (Oct. 11).

“The combination of Parsley and Jagged Peak is a natural fit,” said Parsley CEO Matt Gallagher. “Jagged Peak’s oily, high-margin asset base slots in nicely to our returns-focused development approach, its acreage footprint and water infrastructure dovetails into our legacy Delaware Basin position, and its corporate culture aligns with our core values.

“In short, we now have a premier Delaware Basin business that rivals our foundational Midland Basin business. This transaction also creates tangible synergies that will enhance our corporate free cash flow profile and will be shared by the combined shareholder base.”

The transaction, in which Parsley would own 77% of the combined company, is expected to be completed by the end of March and has been unanimously approved by each board.

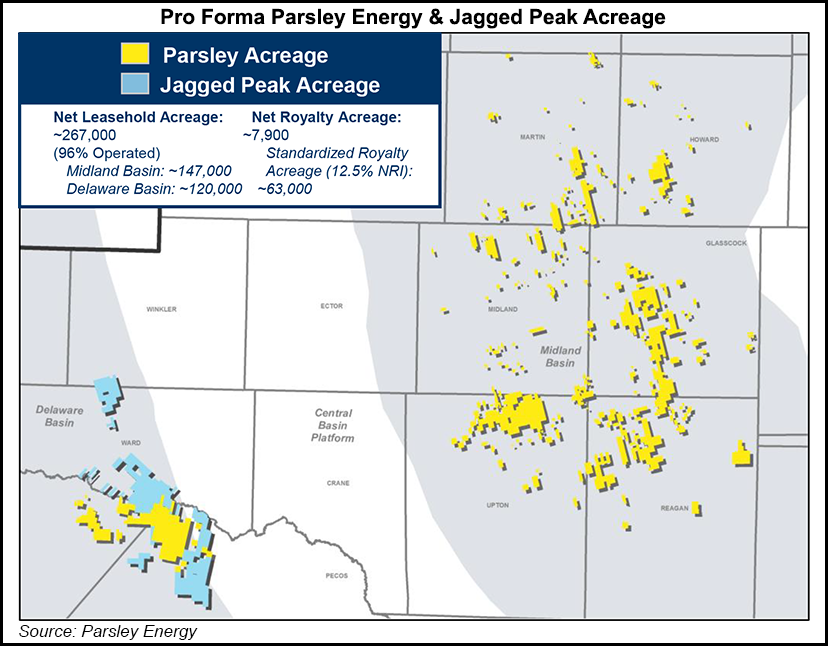

On a pro forma basis, Parsley would have 267,000 net acres in the Permian, comprised of 147,000 net acres in the Midland and a 120,000 net acre footprint in the Delaware.

“The combined assets of Jagged Peak and Parsley Energy are a great fit that create a stronger combined Permian company,” Jagged Peak CEO Jim Kleckner said. “Our team has made tremendous progress to increase efficiencies as we evolved to pad development on our acreage position.”

Quantum Energy CEO S. Wil VanLoh, Jr., a Jagged Peak director, said, “The inevitable consolidation in the Permian has started, and Jagged Peak made a decisive move to team up with the right partner…The combination of the two companies will create a unique platform that will benefit from scale, capital allocation optionality, and peer-leading economics…that we believe will represent one of the most compelling investment vehicles in the Permian.”

The combination is expected to generate general and administrative savings of around $25 million in the first year and $40-50 million of annual savings thereafter, translating to a net present value of $250-300 million.

Parsley also expects to see further synergies over time, including reduced well costs in the Delaware. Parsley estimates its current average drilling, completion and equipment cost in the Delaware is $1,100-1,150/lateral foot. By applying scale advantages and employing collaborative best practices, it expects to see well cost savings of at least $100/lateral foot across Jagged Peak’s remaining inventory in the Delaware.

Jagged Peak has invested nearly $90 million developing fresh and produced water infrastructure across its acreage position, which should easily combine with Parsley’s existing water assets.

In addition, both Parsley and Jagged Peak recently have added to their 2020 hedge positions, “and a majority of the combined company’s expected 2020 oil production is subject to hedge protection,” they noted.

For the third quarter, Parsley expects net oil production of 91,200-91,700 b/d, translating to 5-6% sequential growth. During 3Q2019, Parsley placed on production 35 gross operated horizontal wells with 95% average working interest and average completed lateral lengths of 10,000 feet. Capital expenditures in the quarter are estimated at $315-325 million.

Going into 2020, Parsley said it would remain committed to a growing free cash flow profile using a $50 West Texas Intermediate oil price assumption for its baseline capital budget.

Assuming Jagged Peak’s contribution in 2020, Parsley estimates that capital expenditures next year of $1.6-1.9 billion should translate to oil production of 126,000-134,000 b/d. Parsley in 2020 plans to deploy 15 development rigs and four-to-five fracture spreads on average. Five development rigs are to operate in the Delaware.

Once the deal is completed, Parsley’s board is to be expanded to 11 directors with two members from the current Jagged Peak board. The combined company would be led by Parsley’s executive management team and remain headquartered in Austin, TX.

Tudor, Pickering, Holt & Co. is serving as Parsley’s financial adviser, while Kirkland & Ellis LLP is legal counsel. Citi and RBC Capital Markets LLC are serving as financial advisers to Jagged Peak and Vinson & Elkins LLP is legal counsel.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |