E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Permian Pure-Play Concho Pulling Back Spending, Still Growing Production

Permian pure-play Concho Resources Inc., one of the largest operators in the basin, is pulling back the reins on capital spending in 2019, but it still plans to boost oil production and grow free cash flow (FCF).

The operator is working to fold in assets efficiently that it acquired after taking over RSP Permian Inc. last year in a $9.5 billion acquisition, creating a mega-Permian operator.

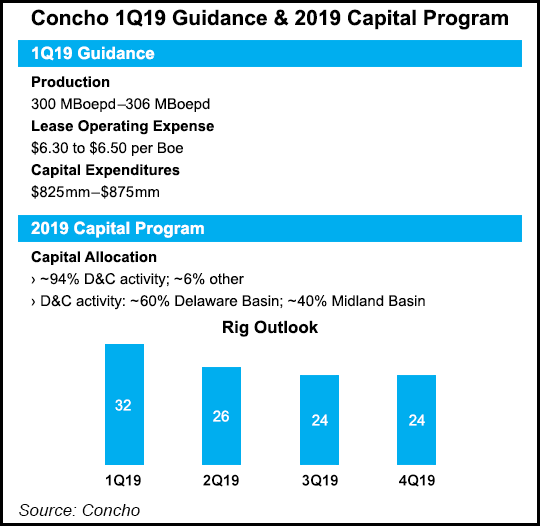

The Midland, TX-based independent reduced its capital expenditures (capex) budget for 2019 to $2.8-3.0 billion, the midpoint of which is 17% below preliminary capex of $3.5 billion unveiled in October. About 94% of the capex is earmarked for drilling and completion costs, with activity focused on “large-scale manufacturing projects” across its portfolio.

Plans are to increase oil production by 26-30% and total production 21-25% in 2019. The company said it expects 1Q2019 production to average 300,000-306,000 boe/d.

“When we put this plan together, we were thinking it’s really very similar to what we were thinking in November,” CEO Tim Leach said during a quarterly earnings call Wednesday. “We’re trying to be conservative and generate FCF…This reduction just is that: a pace that will give us additional FCF that also gives us substantial growth of production.”

Leach said there was “a big change in the amount of FCF” the company could generate between an oil price of $50 and $60/bbl. “As you look into the future, that range of pricing is very good for us and I think that we can demonstrate that we can grow the company to acceptable growth rates and start to generate a free cash yield that competes,” he said.

FCF from operating activities was about $2.6 billion in 2018, exceeding the $2.5 billion in cash used for investing.

Leach said Concho “wants to be at the forefront” in discussing more consolidation in the Permian.

“I think you’re going to see the entire industry working on that,” Leach said. “The FCF that we generate from our business, though, doesn’t need to go into consolidation. The FCF was kind of what runs our business, runs our capital program and provides cash flow to shareholders. I think about those two things separately.”

Concho reported production of 307,097 boe/d in 4Q2018, a 45% increase from the year-ago quarter and 7% higher sequentially. Oil production averaged 198,957 b/d in 4Q2018, a 53% increase year/year and up 8% sequentially, while natural gas production averaged 648.8 MMcf/d, up 33%.

Full-year production averaged 262,937 boe/d in 2018, up 36% from 2017. The increase was driven by a 41% increase in oil production, which averaged 167,811 b/d. Natural gas production averaged 570.8 MMcf/d in 2018, up 29% from 2017.

Concho operated on average 34 rigs in 4Q2018, compared to 31 rigs in 3Q2018. During the fourth quarter, the company drilled 117 gross operated wells, of which 64 were in the Delaware sub-basin and 53 were in the twin Midland sub-basin. Concho completed 92 gross operated wells (56 Delaware, 36 Midland) and put 81 gross operated wells (54 Delaware, 27 Midland) on production.

For the full-year, Concho drilled 311 gross operated wells (195 Delaware, 116 Midland). completed 281 (184 Delaware, 97 Midland) and placed 242 (150 Delaware, 92 Midland) into production.

The company is currently running 34 rigs, 22 in the Delaware and 12 in the Midland, and is utilizing seven completion crews. Concho plans to average 32 rigs in 1Q2019, but it plans to reduce the count to an average 26 rigs in 2Q2019 and 24 in the second half of the year.

In the Delaware, Concho cited strong results from its Gettysburg and Square Bill projects in Lea County, NM. Gettysburg, which includes five wells targeting the Third Bone Spring formation, recorded average 30- and 60-day peak production rates of 2,018 boe/d and 1,857 boe/d, respectively (79% oil). The average lateral length at Gettysburg was 6,989 feet. At Square Bill, four wells targeting the Third Bone Spring and the Wolfcamp A zone had average 30- and 60-day peak production rates of 2,015 boe/d and 1,874 boe/d, respectively (82% oil). The average lateral length at Square Bill was 7,088 feet.

Meanwhile, in the Midland, Concho recently completed its Windham TXL project in Midland County, TX. The project, which includes 11 wells targeting the Lower Spraberry formation and the Wolfcamp B zone, had average 30- and 60-day peak production rates of 1,303 boe/d (83% oil) and 1,187 boe/d (82%), respectively, with an average lateral length of 7,670 feet.

Concho reported net income of $1.51 billion ($7.55/share) in 4Q2018, compared with year-ago profits of $267 million ($1.79). For the full-year, net income was $2.29 billion ($13.25/share) from $956 million ($6.41) in 2017. Quarterly operating revenue totaled $1.07 billion, up from $780 million. Full-year operating revenues totaled $4.15 billion, versus $2.59 billion in 2017.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |