E&P | NGI All News Access | NGI The Weekly Gas Market Report

Permian Natural Gas Output Seen Rebounding Sharply, with Pipe Constraints Likely from 2023 Onward

Natural gas production from the Permian Basin is expected to return to record levels by late 2021 and reach 16 Bcf/d by the end of 2023, although delayed pipeline approvals could limit takeaway capacity beginning in 2023, according to new analysis by Rystad Energy.

The 16 Bcf/d figure, which assumes a $45-50/bbl West Texas Intermediate (WTI) oil price environment for 2021-2023, is a 2 Bcf/d downward revision from Rystad’s pre-coronavirus forecast, analysts said Tuesday.

Rystad’s analysts expect the reactivation of curtailed oil production to drive rapid growth in basin-wide gas supply during the second half of 2020, “although further growth might be delayed until mid-2021 when activity is expected to recover substantially.”

RBN Energy LLC analyst Jason Ferguson tweeted Monday that Permian gas production averaged 11.41 Bcf/d last week, down 0.04 Bcf/d from the prior week.

Year-to-date gas production from the basin averaged 11.65 Bcf/d through April, according to the Railroad Commission of Texas, up from 11.61 Bcf/d for full-year 2019.

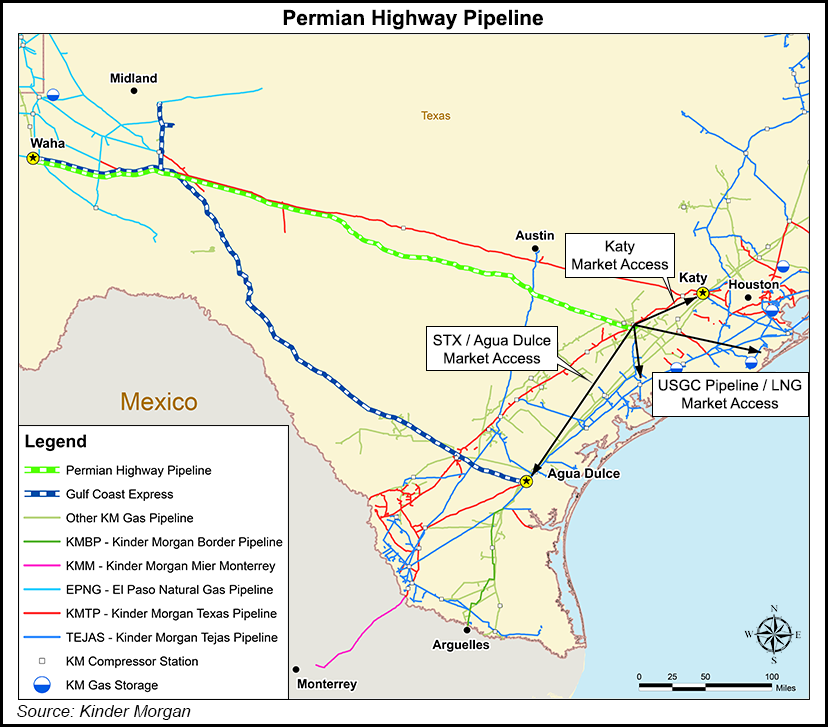

Rystad analysts remain confident that the Permian Highway Pipeline, aka PHP (2 Bcf/d), and Whistler Pipeline (2 Bcf/d) projects are moving ahead, offering outlets for gas from the Waha area in West Texas to reach the Gulf Coast, South Texas and Mexico.

Kinder Morgan Inc. executives said in their 2Q2020 earnings presentation that PHP is slated to be fully operational in early 2021.

MPLX LP, scheduled to present 2Q2020 earnings on Monday (Aug. 3), said in 1Q2020 Whistler was on track to enter service in the second half (2H) of 2021.

“For other pipelines, however, serious concerns about feasibility remain and many projects have been delayed or put on hold,” Rystad analysts said. They noted that the Pecos Trail Pipeline is now on hold, and the Permian to Katy (P2K) pipeline “also appears to be inactive.”

Tellurian Inc., meanwhile, “has continued to advertise its future global gas market hub” around its proposed liquefied natural gas export terminal in Louisiana, Driftwood LNG, which would be served by, among other sources, the company’s proposed Permian Global Access pipeline, “but the likelihood of any investment decisions in the short term remains low from our perspective,” the Rystad team said. The LNG developer in June said it could scrap the $4.2 billion pipeline in order to reduce costs.

As for Mexico exports, analysts highlighted that Fermaca’s Villa de Reyes-Aguascaliente-Guadalajara (VAG) pipeline finally entered service in June, completing the firm’s Waha-to-Guadalajara or “Wahalajara” system.

In a high-case scenario, Rystad is forecasting West Texas-Mexico gas exports to average 1.5 Bcf/d throughout 2H2020-2021, but in a lower case, exports remain flat at 0.7 Bcf/d.

Between May 2019 and April, West Texas-Mexico exports fluctuated between 0.58 Bcf/d and 0.67 Bcf/d.

“Regardless of the state of West Texas-Mexico exports, we conclude that in a $45-50 WTI world, there will be a need for new gas takeaway projects from the Permian as early as 2023-2024,” said Rystad’s Artem Abramov, head of shale research.

“If these projects are not approved early enough, the basin might end up with another period of degradation in local differentials and potentially increased gas flaring.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |