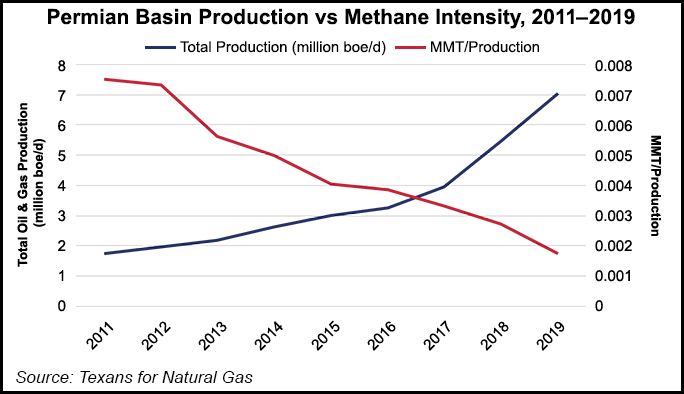

As the oil and natural industry pivots toward producing cleaner energy and controlling emissions, an analysis by a Texas association of independent producers and royalty owners found that methane intensity in the Permian Basin has declined from 2011-2019 even as production surged to record levels.

Conducted by Texans for Natural Gas, a project of the Texas Independent Producers and Royalty Owners Association (TIPRO), the analysis found that between 2011 and 2019, methane emissions intensity fell by 77% in the Permian. At the same time, oil production in the basin increased by over 300%, with the production of oil and natural gas surpassing 7 million boe/d in 2019 alone.

The analysis, “Flaring Progress in the Permian: Leading the World,” also used data from the World Bank to...