Shale Daily | E&P | Infrastructure | NGI All News Access

Permian, Marcellus Each Drop Two Rigs, Says Baker Hughes

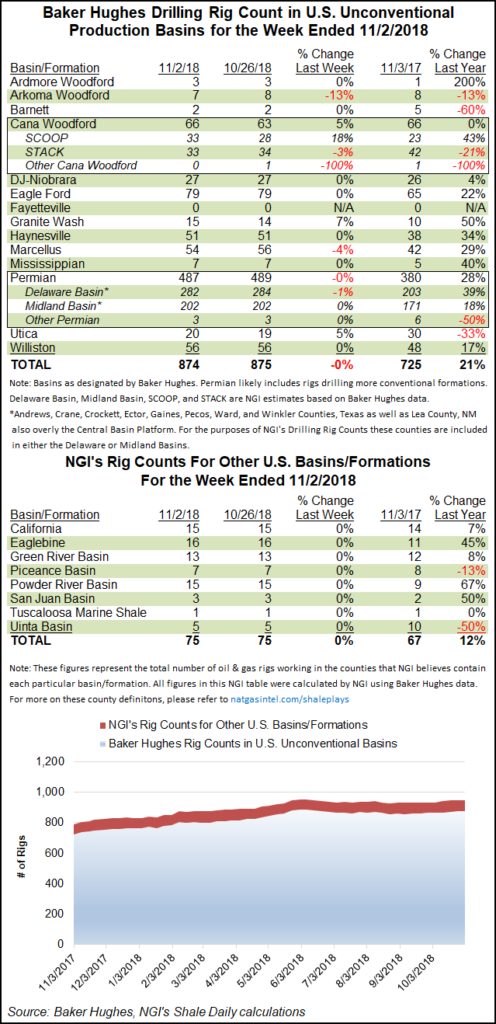

Driven partly by declines in Texas and in the Permian Basin, the U.S. rig count fell by one to 1,067 for the week ended Friday (Nov. 2), according to data from Baker Hughes, a GE Company (BHGE).

The United States dropped one oil-directed rig overall, while natural gas-directed drilling finished flat week/week (w/w). Two horizontal units were added, while three vertical units packed up, according to BHGE. Total U.S. offshore rigs fell by one to 18, while land rigs finished even at 1,046.

Canada saw three oil-directed units exit the patch for the week, offsetting a net increase of one gas-directed rig and putting the overall Canadian rig count at 198 for the week, up from 192 a year ago. The combined North American rig count ended the week at 1,265, up 175 from the year-ago period.

Two of the most active U.S. onshore plays, the Permian and the Marcellus Shale, each dropped two units w/w to finish at 487 and 54 rigs, respectively, both still easily outpacing their year-ago tallies.

The Cana Woodford added three rigs w/w to reach 66. This includes an increase of five rigs in the SCOOP (aka, the South Central Oklahoma Oil Province) offsetting declines of one rig in the STACK (the Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties) and in the “Other Cana Woodford” category, according to a more detailed breakout of BHGE data by NGI’s Shale Daily.

Also among plays, the Granite Wash and Utica Shale each added one rig, while the Arkoma Woodford dropped a rig.

Among states, Texas dropped four rigs w/w to fall to 533 (444 a year ago), while Kansas, Pennsylvania and West Virginia each saw one rig exit the patch. Coinciding with the gains in the Cana Woodford, Oklahoma added three rigs. Louisiana, New Mexico and Ohio added one rig a piece.

BHGE reported its 3Q2018 earnings results earlier in the week, and like its oilfield services peers, it reported an uptick in its international business, as well as the strongest performance for the offshore market in several years. The North American market also “continues to be resilient,” CEO Lorenzo Simonelli said.

“Drilling-related activity remains stable, which bodes well for our portfolio. We see softness in fracture-related completions activity as the North American pressure pumping market weakens into the fourth quarter.”

Takeaway capacity constraints in the Lower 48 “are leading to an increase in drilled but uncompleted wells,” but “drilling-related activities remain stable” worldwide. “The North American rig count was up 10% in the third quarter, primarily driven by the seasonal Canadian recovery. The U.S. rig count was up 1%. Internationally, rig count was up 4% with increases across Africa, Asia and Latin America.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |