Permian Losses See U.S. Rig Count Sink Further

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |

Natural Gas Prices

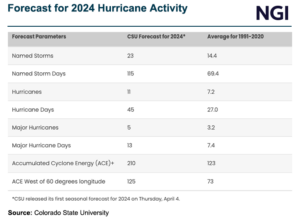

Foreseeable risks from swelling natural gas inventories and an active hurricane season in the Atlantic Basin could bring more volatility to commodity prices in the coming months, a market expert said this week at an industry conference. The looming threat of hurricanes, which forecasters are predicting to be more frequent this season, will be “an…

April 19, 2024By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.