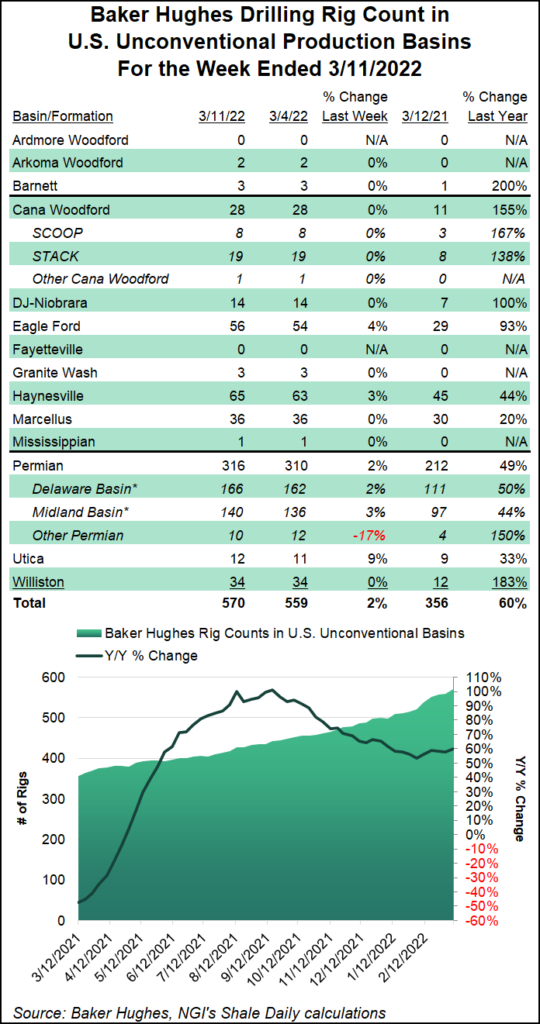

A big drilling activity increase in Texas, and in the Permian Basin in particular, sent the U.S. rig count soaring 13 units higher to 663 for the week ended Friday (March 11), according to updated numbers from Baker Hughes Co. (BKR).

Increases of eight oil-directed rigs and five natural gas-directed rigs saw the United States exit the week with 261 more active units than in the year-earlier period. U.S. land rigs increased by 14, partially offset by a one-rig decline in the Gulf of Mexico, according to the BKR numbers, which are based in part on data from Enverus.

Horizontal rigs increased by 12 week/week, while directional rigs increased by three. Partially offsetting was a two-rig decrease in vertical rigs.

The Canadian rig count, meanwhile, fell 11 units to end the week at...