Shale Daily | Bakken Shale | E&P | Marcellus | NGI All News Access | Permian Basin

Permian Gains Give Oomph to U.S. Drilling Permits in June, but Recovery to 2019 Levels Not in Sight

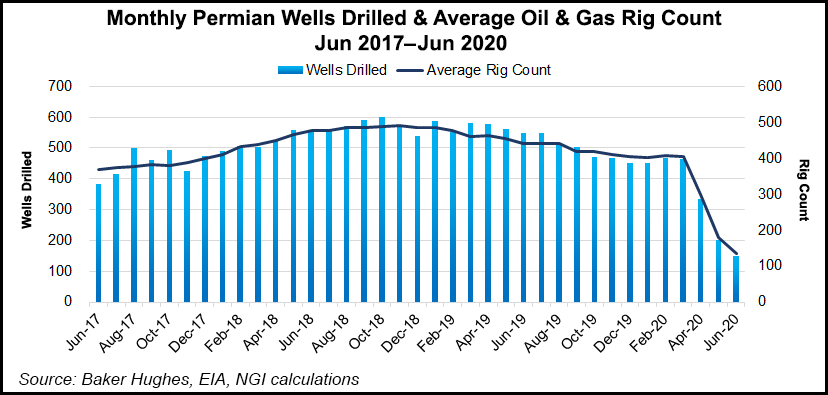

Requests for U.S. drilling permits improved in June following a brutal April and May, with the Permian Basin still the top region for operators, according to Evercore ISI.

The analyst firm each month compiles permitting statistics for the Lower 48 and offshore using federal and state data. Covid-19 and low commodity prices had crushed permit requests in April, with May possibly the bottom, analyst James West said.

According to Evercore, 1,238 permits were approved in June, up by 166 month/month (m/m). However, permitting was off by 66% year-to-date and 77% from June 2019.

Most of the new permitting activity in June was focused on the Permian, with 109 more m/m, and in the Bakken Shale, which had 11 more requests than in May.

“Permian operators received approval for 381 wells with 70% generated by public companies, 2% by equity sponsored operators, and the remainder originated from private ones,” West noted.

“Improving activity was mainly related to the majors,” which requested 30 more permits than in May, and from large-cap exploration and production (E&P) companies, which requested 31 more m/m.

The Bakken permit count improved in June to 67, 11 higher m/m. Public E&Ps requested 94% of all the permits, Evercore noted. Operators also increased their permit requests in the Mississippian Lime, up by 11 from May, and in Oklahoma’s Woodford formation, with nine more permits requested.

The year-to-date oil permit count at mid-year stood at slightly under 10,000, with more than one-third (36%) for the Permian, Evercore noted. However, Permian permitting remained sharply lower, off by around 32% year/year at 3,618 to date.

While the permit count is down from 2019, there has been a “steep fall” in the Powder River Basin, off by 97% year/year, and in the Denver-Julesburg (DJ)/Niobrara formation, which has seen permitting decline by 80%, Evercore analysts noted.

Natural gas permitting also has slumped sharply, with the mid-year total at 1,128 in June, down by 48% year/year. The decline was blamed primarily on a deceleration in the Marcellus Shale, which had seen permits decrease by 54%.

Meanwhile, in the other big dry gas play, the Haynesville Shale, private operators drove an uptick in permits during June, with 25 more requests m/m. Gas permits in the play stood at 142 in June, up by 40 m/m.

Meanwhile, Ohio regulators, who oversee permitting in the Utica Shale, authorized 16 wells to be drilled, up by 15 m/m, with 36% for plugging and abandonment (P&A), according to Evercore.

The pace of P&A permitting has slowed elsewhere in the biggest oil plays, according to Evercore. Permian P&A permits declined in June to 480, down 64% m/m, while Bakken permits decreased by 13, or 13%.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |