Shale Daily | E&P | Earnings | NGI All News Access | Permian Basin

Permian-Focused Laredo Petroleum Aims to Maintain Output Levels, Deliver Positive FCF in 2020

Permian Basin independent Laredo Petroleum Inc. is aiming to maintain oil and total hydrocarbon output levels and achieve higher free cash flow (FCF) in 2020 compared to 2019, according to CEO Jason Pigott.

For the first quarter of 2020, Laredo is forecasting total production in the range of 81,200-81,700 boe/d, and oil output of 26,800-27,300 b/d.

By comparison, the company reported full-year oil production of 28,429 b/d in 2019, up 2% year-over-year (y/y), while total hydrocarbon output climbed 19% to 80,883 boe/d.

“During 2019 we successfully completed our transition to a returns-focused, free cash flow-oriented strategy,” Pigott said. “We substantially improved well productivity, aligned staffing with our moderated development plan and continued to drive down both our well costs and operational expenses.”

Pigott highlighted “two accretive acquisitions” in the oilier window of the Midland sub-basin of West Texas, through which “we expect to further improve margins and capital efficiency and drive our oil mix above 40% by 2022.”

He added, “Our development program over the next three years is designed to maintain production levels, generate positive projected free cash flow at $50/bbl and deliver more than $100 million in projected free cash flow at $55/bbl.”

Laredo expects to complete 28 gross (27.7 net) widely-spaced horizontal wells with an average completed lateral length of 8,500 feet in 1Q2020.

The company said it is moving forward as planned at its recently acquired position in Howard County in West Texas, where two of the company’s four drilling rigs have been deployed and a third is expected early in March.

“The first well of Laredo’s first 15-well package in Howard County has been successfully drilled and completion operations are expected to commence on the full package during the second quarter of 2020,” the company said, adding that it “is in negotiations with multiple third-party suppliers of oil, natural gas and water infrastructure services and does not expect costs for these services to be significantly different from those on the company’s established acreage base.”

During full-year 2020 Laredo hedged 9.6 million bbl of oil, comprising 7.2 million bbl at $59.50 West Texas Intermediate and 2.4 million bbl $63.07 Brent, as well as 23.8 million MMBtu of natural gas at $2.72/MMBtu Henry Hub.

Laredo reported a net loss of $241.7 million ($1.04/diluted share) for the fourth quarter of 2019, compared to a profit of $149.6 million ($0.65/diluted share) for the similar period in 2018.

For full-year 2019, Laredo posted a net loss of $342.5 million ($1.48/diluted share), versus a profit of $324.6 million ($1.39/diluted share) in 2018.

The quarterly loss included a non-cash full cost ceiling impairment charge of $222.7 million, while the full-year loss included a non-cash full cost ceiling impairment charge of $620 million.

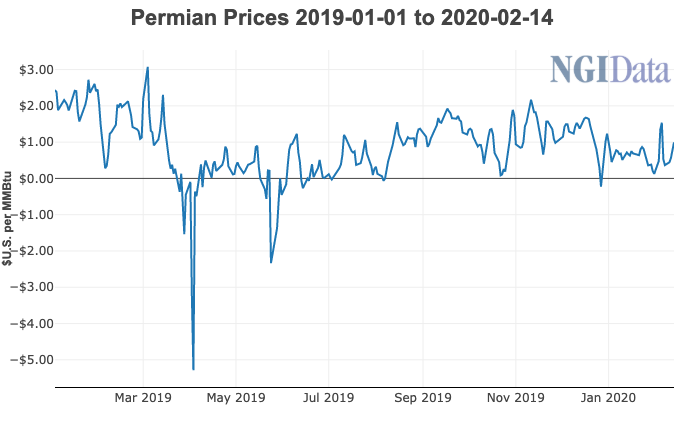

The company attributed the asset write-downs to volatility in prices for oil, natural gas liquids, and natural gas.

Laredo reduced capital expenditures by 25% y/y in 2019, generating $59.7 million of FCF.

Oil and total hydrocarbon production for 4Q2019 totaled 27,296 b/d and 83,968 boe/d, beating guidance by 5% and 10%, respectively.

“The primary driver of oil production exceeding expectations…was the outperformance of the nine-well Sugg/VonGonten package,” which is currently exceeding Laredo’s Upper-Middle Wolfcamp oil type curve by 39%, Laredo said.

Total proved reserves grew by 55 million boe and proved oil reserves rose by 17 million bbl as of year-end 2019, increases of 23% and 27%, respectively, from end-2018.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |