Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Permian ‘Best Place to Be,’ Says Pioneer Natural CEO

Dallas-based Pioneer Natural Resources Co., which has peeled off assets to keep the focus solely on the Permian Basin, produced above guidance in the third quarter, with more of its oil and gas heading to the Texas coast for export.

The independent produced 288,000 boe/d in the Permian during 3Q2018, a 5% sequential increase, with oil output up 7% sequentially to 186,000 boe/d. Sixty-nine horizontal wells were placed on production between July and September.

Permian production now is forecast to increase in 2018 by 19-24% year/year. Companywide, output reached 321,000 boe/d, reflecting the sale last summer of the Raton and West Panhandle assets.

“The Permian Basin continues to be the best place to be in the shale oil business, providing unmatched resource potential and opportunity, and delivers highly productive wells, strong cash margins and robust returns,” CEO Timothy Dove said. “We see this in our financial results as our return on capital employed is expected to be greater than 10% for 2018, benefiting from a low-cost basis in our Permian Basin acreage.”

Firm transportation (FT) agreements to move Permian oil south and natural gas west is providing a financial backstop, Dove said.

“We are continuing to deliver quite a large volume of oil to the Gulf Coast, about 165,000 b/d in the third quarter, under…FT contracts and about 130,000 boe/d were exported. Those numbers will be increasing. In fact, our FT capacity goes up beginning in November to 185,000 b/d and over 200,000 b/d in early 2019…This will become an even bigger part of our results as we move forward and we continue to see the benefits of incremental pricing as a result.”

More than 90% of the Permian oil volumes will be on FT contracts and receive Brent-related pricing, “a tremendous positive for the company,” he said. Pioneer has “no exposure today for Midland oil pricing through 2020…”

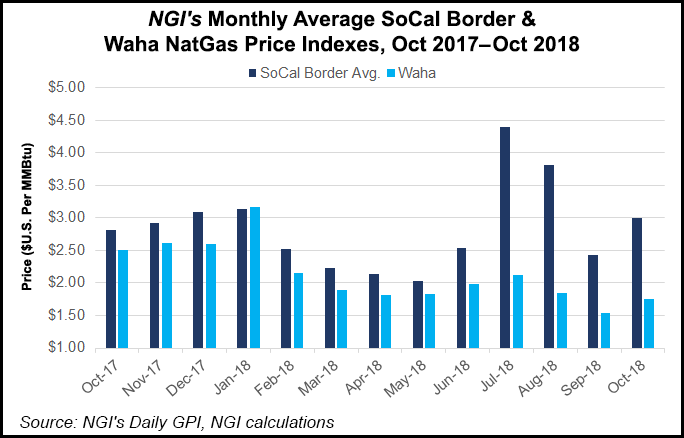

For natural gas, about 70% of the Permian volumes are delivered under firm pipeline contracts tied to the Southern California gas price index, with the remainder sold primarily under term contracts at Waha pricing. Southern California-priced gas sales during 3Q2018 received an uplift of about $1.00/Mcf versus Waha sales, Dove said.

Pioneer operated 22 horizontal rigs in the Permian between July and September and plans to add two rigs in December to support the 2019 plan. About 250-275 wells should be on production this year.

In mid-September, Pioneer also secured a long-term supply agreement for West Texas sand with U.S. Silica Holdings Inc., one of the largest providers for fracturing operations. The agreement would “represent 30% to 40% of our sand supplies when this kicks in in the first quarter of 2019, at roughly half the cost of our average current supply of sand,” Dove said.

Pioneer expects to complete its divestitures by year end to give it pure-play Permian status, the CEO told analysts. Among other things, the Sinor Nest oil assets in South Texas are being sold for $132 million by the end of the year. Pioneer also is working to sell its remaining Eagle Ford Shale properties.

The largest acreage holder in the Midland sub-basin of West Texas with about 750,000 acres, during 3Q2018 brought online its first successful multi-zone pad in the Stackberry appraisal program in Martin County.

The company is able to drill horizontal wells across the contiguous area with lateral lengths of 7,500-14,000 feet. A completion optimization program launched in 2015 has continued to gain traction, allowing the company to combine longer laterals with optimized stage lengths, clusters/stage, fluid volumes and proppant concentrations. The objective was to improve well productivity by allowing more rock to be contacted closer to the horizontal wellbore.

In 2013 and 2014, the initial fracture stimulation design, aka “Version 1.0,” consisted of proppant concentrations of 1,000 pounds/foot, fluid concentrations of 30 bbl/foot, cluster spacing of 60 feet and stage spacing of 240 feet. Since then, fracture stimulations have been enhanced to achieve optimum production at optimum efficiencies.

During 3Q2018, 44 horizontal wells were completed using “Version 3.0-plus” designs, with 39 placed on production in the quarter.

“Results from the 104 Version 3.0-plus wells completed in 2017 and 2018 are demonstrating cumulative outperformance of approximately 35% compared to Version 3.0 completions in equivalent areas,” Dove noted.

Sales volumes in 3Q2018 averaged 321,000 boe/d, with oil sales averaging 195,000 b/d. Natural gas liquids sales averaged 63,000 b/d, while gas sales averaged 378 MMcf/d.

Pioneer fetched an average realized price for oil of $57.54/bbl in 3Q2018. Without the FT contracts, management noted, that price would have averaged $68.33/bbl.

Production costs averaged $9.51/boe. Drilling and completion capex in 3Q2018 totaled $835 million.

Based on the ongoing asset divestiture process, Permian oil production in 2019 now is forecast to average 188,000-194,000 b/d. Overall Permian output is forecast at 293,000-303,000 boe/d. Production costs are expected to average $9.00-11.00/boe.

Net income was $411 million ($2.39/share), versus year-ago loss of $23 million (minus 13 cents).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |