Infrastructure | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Permian Activity Slides but U.S. Oil Patch Posts Modest Gains Overall, Says BHGE

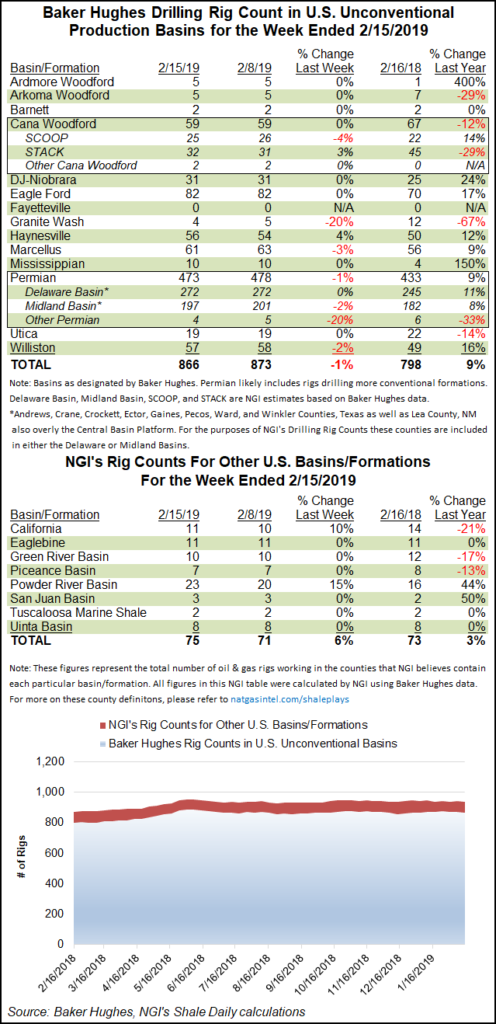

Drilling activity in the United States held steady for the week ended Friday (Feb. 15), despite a drop in the number of rigs running in the most active onshore play, the Permian Basin, according to data from Baker Hughes, a GE Company (BHGE).

The U.S. rig count climbed two units to end the week at 1,051, outpacing the year-ago tally of 975 rigs. The addition of three oil-directed rigs offset a net loss of one natural gas-directed unit domestically.

Land activity declined by one unit overall, offset by gains in the Gulf of Mexico, which added two units to reach 21 rigs, and by one unit going to work in inland waters. Twelve directional units returned to action on the week, while eight horizontal units and two vertical units packed up shop, according to BHGE.

In Canada, 16 rigs departed for the week, including 10 gas-directed and six oil-directed, leaving the rig count at 224, down from 318 a year ago. The combined North American rig count ended the week at 1,275, down 18 units from the 1,293 rigs running at this time last year.

Among the major basins, the Permian posted the largest move for the week, as five units exited the patch to leave the West Texas and southeastern New Mexico play with 473 units. That still easily outpaces the 433 rigs running in the Permian a year ago.

Also among plays, the gassy Haynesville Shale added two rigs for the week, while another gas-focused play, the Marcellus Shale, saw two rigs depart. The Granite Wash and Williston Basin each dropped one rig for the week.

Among states, Louisiana led with four rigs added for the week to grow its tally to 66, up from 59 a year ago. Wyoming wasn’t far behind, adding three rigs to reach 37, up from 30 in the year-ago period.

Notable declines among states included Pennsylvania, which saw three rigs exit the patch, while New Mexico and Texas each saw two rigs depart, coinciding with the down week in the Marcellus and the Permian.

Also among states, Alaska, California and West Virginia each added a rig week/week, while North Dakota and Oklahoma each dropped one rig, according to BHGE.

Breakeven prices on prime U.S. onshore acreage over the past two years generally have been in the range of $30-40/bbl of West Texas Intermediate (WTI), but the “best performers” are uncovering resources below $20, according to Rystad Energy.

The consulting firm identified the top unconventional performers in the Lower 48 by basin and acreage in a report issued recently at the annual NAPE Summit in Houston.

“Even at $45/bbl WTI, 40% of U.S. shale oil projects will still thrive,” Rystad partner Artem Abramov said.

Meanwhile, a tally of January permitting conducted by Evercore ISI suggests U.S. producers may be looking to exploit more oil and natural gas targets in Wyoming’s Williston, in California and in Texas.

According to the January data compiled by Evercore’s James West and his team, domestic permitting activity during January was the strongest in five years and significantly better than in December.

Permitting increased month/month to 6,570. Wyoming led the way during January, hitting 4,200, up 1,029 from December. The state’s permitting activity, centered around exploration and development in the Williston’s Bakken/Three Forks targets, has risen steadily over the last six months.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |