E&P | NGI All News Access | NGI The Weekly Gas Market Report

Permian Activity Declines as U.S. Rig Count Down Two

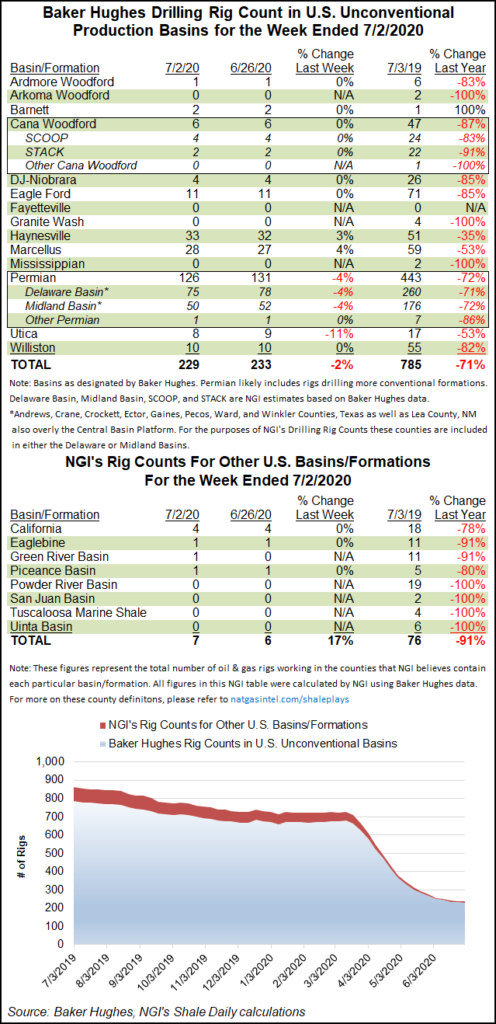

Driven by declines in the Permian Basin, the U.S. rig count fell two units overall to drop to 263 for the short holiday week ending Thursday (July 2), according to the latest numbers from Baker Hughes Co. (BKR).

Changes for the week included a three-rig decline in oil-directed drilling, partially offset by the addition of one natural gas-directed rig. The combined U.S. count ended the week 700 units behind the 963 rigs active at this time last year, BKR data show.

Four horizontal units exited the patch on the week, while two vertical units were added. Land drilling fell by three units overall; one rig was added in the Gulf of Mexico, which ended with 12 rigs, halving its year-ago total of 24.

The Canadian rig count increased by five rigs for the week, including three gas-directed rigs and two oil-directed. The combined Canadian count of 18 compares with 120 rigs active in the year-ago period.

The North American rig count finished the week at 281, versus 1,083 in the year-ago period.

Among major plays, the Permian dropped five rigs overall for the week, falling to 126, from 443 rigs a year ago. The gassy Haynesville and Marcellus shales each added one rig for the week, while the Utica Shale dropped one rig.

Among states, New Mexico dropped two rigs on the week, while Louisiana and Ohio each dropped one. West Virginia and Wyoming each added one rig, according to BKR.

It was a week marked by difficult news for U.S. onshore operators facing down numerous challenges in the era of Covid-19.

Prior to the start of the work week, Chesapeake Energy Corp., once a symbol of the American natural gas industry’s revival and a disruptive leader that helped spark the nation’s unconventional boom, filed for Chapter 11 protection to wipe out $7 billion of debt.

The following day, Lilis Energy Inc., which plies its exploration talents across the Permian, also sought voluntary protection under Chapter 11 to reduce debt.The day after that, Covia Corp., which provides proppants for oil and gas well operations across North America, filed for bankruptcy, making it the third U.S. energy company in three days to seek Chapter 11 protection. In its petition to reorganize under Chapter 11, Covia management cited the “unprecedented backdrop from the Covid-19 pandemic and recent energy price shocks” as factors behind the move.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |