Marcellus | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Pennsylvania Attitudes on Tax Proposals Shifting as Act 13, Election Challenge Industry

As production continues to soar in Pennsylvania and it remains the only state in the country without a tax on oil and gas extraction, lawmakers are once again considering a severance tax that could find traction sooner rather than later.

Since 2007, when exploration and production began in earnest in the Marcellus Shale, both Republican- and Democratic- controlled legislatures in the state have failed to agree on the severance tax, engendering a debate that one source called “circular” and with no clear end in sight.

In recent years, though, the Marcellus has risen to become one of the largest gas fields in not only the United States but the world. According to the U.S. Energy Information Administration, Pennsylvania is the fastest growing gas producing state, with marketed natural gas production growing by 72% from 2011-2012. In its latest drilling productivity report, EIA estimated that Marcellus output would reach 14.23 Bcf/d in February to account for 18% of the U.S. production (see Shale Daily, Jan. 14).

About a dozen states have considered new severance taxes or a change to existing rates in recent years. But the production numbers in Pennsylvania are making it increasingly difficult for lawmakers and others to settle for what was once billed as a grand bargain: the state’s impact fee, also known as Act 13. Pushed by Gov. Tom Corbett following input from an advisory committee in 2011 (see Shale Daily, March 29, 2011), and passed by the legislature in 2012 (see Shale Daily, Feb. 15, 2012), the fee effectively collects 2% of the value of gas sold.

All unconventional wells drilled each year, no matter how much gas is produced, pay the same fee, with monies directed to local communities and state agencies, not the general revenue fund. However, both chambers of the General Assembly are considering whether to impose a severance tax and abandoned the fee altogether.

Couple a renewed tax debate, along with a recent decision from the Pennsylvania Supreme Court that struck down parts of Act 13 and remanded the impact fee to a lower court for further consideration (see Shale Daily, Dec. 20, 2013), and some clouds may be forming over the industry.

Eight people also want to challenge Corbett, who many believe to be vulnerable, during this year’s gubernatorial election. Most of those candidates back a severance tax and more stringent regulations for the oil and gas industry.

“Clearly, this issue needs to be moved forward. The recent decision by the supreme court only demonstrates that we need to take a closer look at Act 13. Not only did it fall short on zoning provisions as the court noted, but it fell short on the impact fee as well,” said state Sen. John Yudichak, who also serves as Democratic chairman of the Environmental Resources and Energy Committee. “When you see that production has increased by some 70% and the impact fee has actually gone down, generating less revenue for Pennsylvania, that shows it.”

This month, the Corbett administration released a long-awaited energy plan that highlights the strides made by the industry in recent years (see Shale Daily, Jan. 22). But even if the industry is a bright spot for the Keystone State, it is still forced to confront a political and legislative atmosphere struggling to cope with declining revenues and an economy still reeling in the aftermath of the Great Recession.

Pennsylvania’s unemployment dropped to 6.9% in December, the first time in five years that it has stood below 7%. Economists there say the decrease, like in other parts of the country, is not because more jobs have been added, but because job seekers are dropping out of the workforce and shrinking it.

What’s more, in November, the Pennsylvania Independent Fiscal Office identified a structural deficit — the long-term inability to bring in enough tax revenue to cover the cost of continuing current public services — in its five-year economic and budget outlook. The fiscal office estimates that total expenditures would increase by 4.1% annually between 2014 and 2019, while revenues will grow only by 2.8% in the same time.

As fiscal issues continue to confront the state, many contend that money from oil and gas production could help fill the gap, as it has in other producing states, like Texas. According to Corbett’s Energy Executive Patrick Henderson, $406 million in impact fees have been collected and distributed to local communities since 2012. The state has also collected $2.1 billion in other taxes from the industry, such as sales and corporate taxes.

He added that Corbett would not back down from a pledge against any new taxes on the industry. “One of the biggest comparisons we hear is that even Texas has a [severance tax] and we don’t. We believe that you have to look at the cumulative tax burden.”

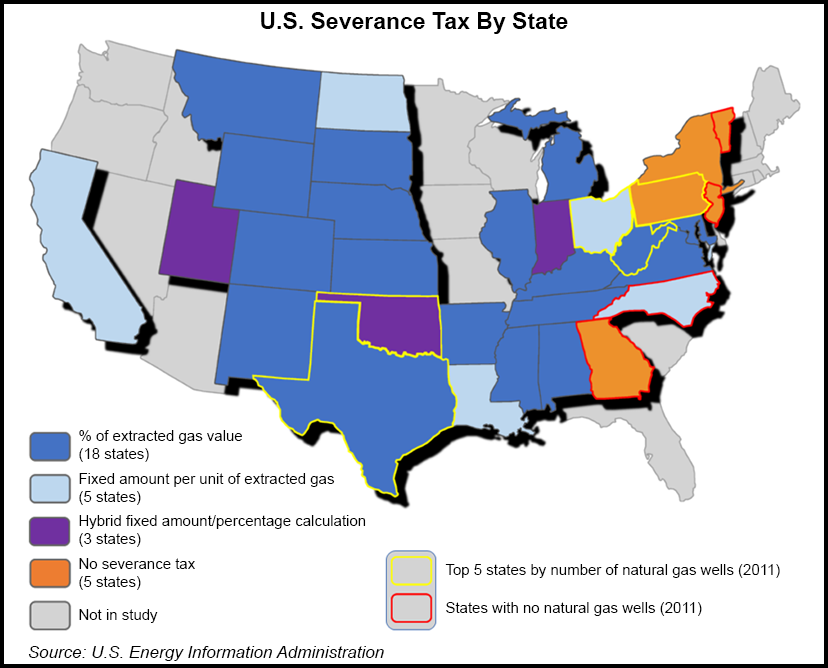

According to the Center for Energy Economics and Policy, 26 states levy a severance tax on natural gas. Eighteen states, such as Texas, have a tax based on a percentage of the market value of the gas extracted, while five states, including Ohio, levy a tax based on a fixed dollar amount. Others use a hybrid system.

Neighboring West Virginia, a mid-range volume producer, charges a 5% severance tax, while Texas has a rate of 7.5%. But unlike Pennsylvania, Texas residents pay no state income taxes and companies pay no corporate taxes. Pennsylvania’s corporate tax, which is nearly 10%, ranks it among some of the largest local and state tax burdens in the country.

“We want to grow the pie, not strangle it,” Henderson said, adding that the administration feels the impact fee has been successful.

“The governor has been very clear on this, we always go back to the point that the impact fee has seen real results.” He pointed to Democratic Gov. Ed Rendell’s administration, which pushed for a severance tax but failed to win enough support (see Shale Daily, Oct. 10, 2010).

“Prior to Gov. Corbett you had a governor and a Democratic controlled House of Representatives that still could not achieve any meaningful agreement on the rate at which production should be taxed,” he said. “We put out a proposal, negotiated with the legislature — who had their input on this — sat down and worked it out. This is not some artificial pie-in-the-sky proposal. It’s real and the state is seeing real dollars from it.”

Election Year Challenges

This year’s general election may serve as a referendum on the severance tax and Corbett’s energy-related policies. Views are mixed on whether support is truly building for a new production tax, but deep cuts to public education, infrastructure issues and problems in the state’s job market are fueling candidate proposals for a new tax, tying nearly every campaign debate to the state’s growing oil and gas industry.

“You’ll see in this race how this issue is going to play out and what the future of it will be in Pennsylvania. Corbett is on the other end, and we know people are on our side,” said Mark Bergman, a spokesman for U.S. Rep. Allyson Schwartz (D-Montgomery County), and a frontrunner in the Democratic primary to challenge Corbett. “The public is on our side. Look at what’s happened under Gov. Corbett with education cuts; property taxes have gone through the roof, and we’ve had constant budget problems year after year, all while we’re practically giving this natural gas away. People in Pennsylvania are just sort of scratching their heads wondering why we don’t have a severance tax in place like every other state.”

Yudichak and Bergman said the notion of a severance tax is gaining traction in the General Assembly, with fractures emerging in the Republican party on the issue. Rendell had called for a 5% severance tax. Yudichak had a proposal for a 3% rate on the table that failed in 2012 and a similar bill has recently been introduced by his former co-sponsor, Republican state Sen. Ted Erickson of southeast Pennsylvania.

In the House, two Republicans and two Democrats have introduced a bipartisan bill calling for a 4.9% severance tax.

“Every year, the budget battle becomes a tug of war for disability funds with no certainty until sometime around midnight each June 30,” said state Rep. Thomas Murt (R-Hartboro), who is co-sponsoring the House bill. “If this legislation is enacted, the waiting list for services will shrink and the pressure on our overburdened counties will be reduced. Most importantly we will end the annual budget ritual of wondering if the state will fund these critical programs.”

Yudichak said the cumulative tax burden on producers can no longer be factored into the debate. The legislature is working to phase-out the capital stock and franchise tax rate by 2016, which accounted for 26% of tax revenue in 1999 and just 6% of corporate revenue last year. The Pennsylvania Budget and Policy Center (PBPC) said in a report released in December that declining corporate taxes in the state are a major contributor to its long-term deficit as well.

Bergman said a severance tax is the “industry standard.” The Schwartz campaign released a position paper in September calling for a 5% tax rate on production (see Shale Daily, Sept. 6, 2013). Under the proposal, the impact fee would also be preserved. Both taxes, the PBPC has said, would generate $16.6 billion in revenue over the next decade.

“Allyson wants the industry to come to the state and be responsible,” Bergman said. “She wants them to drill safely and she wants to make sure all Pennsylvanians can profit from our natural resources.”

Other Democratic candidates, such as Rob McCord, the state’s current treasurer, and John Hanger and Katie McGinty, both former secretaries of the Pennsylvania Department of Environmental Protection, said they support a severance tax in addition to drilling moratoriums on state-owned lands.

On the Defensive

The industry has been effective in making a case against the constant chatter and countless proposals for a severance tax.

No other industry pays an excise tax to develop natural resources in the state, and the oil and gas industry claims they shouldn’t have to either. The majority of other states with a tax on production have delayed implementation, offer tax exemptions or credits and discount the tax in hard-to-reach areas. The industry also maintains, that, along with Ohio, Pennsylvania has some of the most comprehensive regulations in the country.

“When you’re talking about a severance tax from state-to-state, it’s really apples to oranges,” said Stephanie Catarino Wissman, executive director of the Associated Petroleum Industries of Pennsylvania (APIP), the American Petroleum Institute’s chief lobby in the state. “There’s an onerous corporate income tax here and we’re paying all those taxes that other states don’t have. The regulatory make-up in Pennsylvania is also very different, we have some of the most stringent oil and gas regulations out there, especially compared to other states that are just not on that level.”

Wissman said the APIP remains adamantly opposed to any severance tax in the state. She added that she didn’t feel any significant support was building for one in the General Assembly, at least not the kind that would generate a “groundswell needed to send anything to the governor’s desk.”

In a recent interview with NGI’s Shale Daily, Kathryn Klaber, the former CEO of the Marcellus Shale Coalition, said the industry in Pennsylvania is facing challenges at the moment (see Shale Daily, Jan. 24).

“Pennsylvania has really stood out as a place where this industry can flourish. What we’re facing right now with Act 13 is uncertainty as to what the returns are going to be like going forward,” she said. “That doesn’t mean Pennsylvania is out of the running for all this capital, but it’s a call to action from those who have benefited from the Marcellus to stand up and make things clear so policy makers can have support to make the right decisions.”

Henderson said Corbett, who received $1.3 million from the industry during his 2010 campaign, is vested in protecting those returns for both the state and operators.

“On the industry side, you want to know what the business climate is like. All you want to know is what the cost of doing business in the state will be,” he said. “Our point is that the impact fee has seen real results and we don’t want to send a signal that if you do well in Pennsylvania we’re going to think of ways to tax you even more.”

Ultimately, Yudichak said he believes it will take a new governor to get a severance tax passed in Pennsylvania.

“I didn’t hear a lot of pushback from the industry with them calling a responsible severance tax a game-changer. These companies are literally investing billions of dollars here and this is an opportune time to put something on the table,” Yudichak said. “The Marcellus is changing the energy landscape across the world and Pennsylvania is at the center of it. We have a second opportunity to learn from the mistakes we made with coal — the mistakes we still have to live with today.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |