NGI The Weekly Gas Market Report | E&P | Mexico | NGI All News Access | NGI Mexico GPI

Pemex’s Quarterly Profits, Production on Divergent Paths

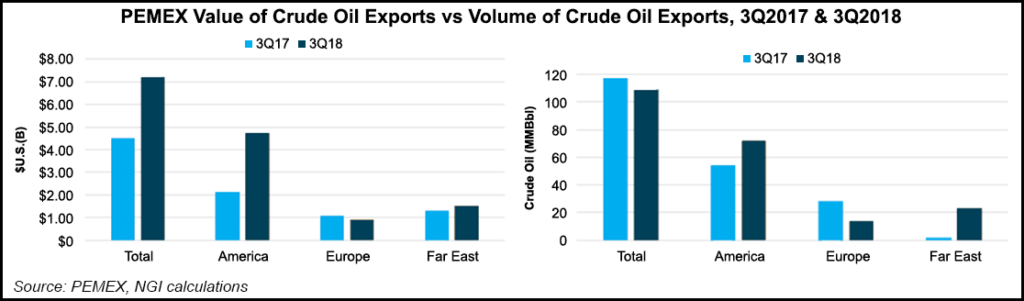

A recovery in international crude oil prices and a boost in domestic sales lifted state-owned Petroleos Mexicanos (Pemex) in the third quarter, its final report before a new regime takes office.

Third quarter net profit was 26.8 billion pesos ($1.38 billion), a sharp improvement from the 101.8 billion pesos ($5.1 billion) loss in the year-ago quarter. The positive results were attributed to gains in oil prices and an 18% increase in domestic sales, helped by the liberalization of prices in gasoline and diesel, the company said.

Natural gas production declined by 5.5% from a year ago to 3.864 Bcf/d. Production of dry gas from plants was 2.41 Bcf/d, off 10.2%.

Total crude production also declined, down 3% from 3Q2017 to 1.827 million b/d. The production goal for the year was originally set as 1.95 million b/d but was then reduced to 1.83 million b/d. Pemex now estimates it will produce 1.82 million b/d next year.

The incoming Mexican administration, led by President-Elect Andrés Manuel López Obrador, is set to take office on Dec. 1. López Obrador has promised a nationalist agenda that he maintains will provide Pemex with a $4 billion injection of capital to boost output and begin the construction of another refinery.

Many analysts claim that the money is likely to be spent needlessly, but López Obrador has brushed off criticism. Following a landslide victory in July, he will be the first Mexican president of the democratic period to enjoy an overall majority in Congress.

He has said he plans to increase crude output by the end of his six-year presidency to about 2.6 million b/d.

Outgoing Pemex CEO Carlos Alberto Treviño emphasized that the current administration regards stability as its priority.

“Petróleos Mexicanos continues with efforts to maintain stability in both the financial and operative fronts,” he said. The shallow water discoveries, including Manik and Mulach, are estimated to have proved, probable and possible reserves of 180 million boe, and “are the fruition of years of exploratory works and allow us to incorporate reserves to our portfolio, which will eventually, turn into production.

“On the financial front, the execution of operative and commercial strategies aimed at generating value along all our business lines, has allowed us to strengthen Pemex’s financial balance, and reduce the company’s indebtedness rhythm. Pemex is on the right track to provide full feasibility to its operations over the medium and long-terms.”

In other words, Trevino suggested a steady-as-she-goes policy rather than the fireworks that López Obrador appears to favor. Trevino is to be replaced by Octavio Romero, an agronomist who is a longtime political ally to López Obrador.

Pulso Energetico think tank director Pablo Zarate said the Pemex quarterly results “are good, undoubtedly boosted by the surge in world oil prices and several improvements in financial management. As for the future under the new regime, we’ll have to wait and see whether in the calculation of their targets they can hit the sweet spot where value and volume meet.”

The mainstay of Pemex crude production remains the Ku-Maloob-Zaap complex, aka KMZ, in the Sound of Campeche. But KMZ crude is heavy, and three of the six Pemex refineries are unable to process heavy crude.

However, López Obrador has sharply criticized the current Pemex management for importing light crude for the first time in half a century in order to meet the requirements of its refineries.

Meanwhile, Vista Oil & Gas SAB de CV, which is traded on the Mexico Stock Exchange, reported income of $117 million and a net profit of $9 million in the third quarter in a filing Thursday. This is the first year in which the company has traded on the Mexican market.

Vista is controlled by Miguel Galuccio, a former head of the Argentine state-owned company YPF, where he acquired recognition as a developer of the South American nation’s unconventional deposits. Galuccio also is a former executive of No. 1 oilfield services operator Schlumberger Ltd.

Though incorporated in Mexico, most of Vista’s operations are in Argentina. However, it recently formed a joint venture with Monterrey-based Jaguar Exploración y Producción de Hidrocarburos SAPI de CV. Jaguar is a unit of Grupo Topaz, the creation of Dionisio Garza Sada, a former chief of Grupo Industrial Alfa SAB de CV, the family firm of the largest and most powerful industrial dynasty in Mexico.

Garza Sada, long a proponent of the private sector development of Mexico’s natural gas potential, last year took a stake in more than half of the 21 blocks awarded in an auction of areas in the Burgos Basin.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |