Earnings | E&P | Mexico | NGI All News Access

Pemex Posts Rare Quarterly Profit as Oil Prices Swing Upward

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |

Earnings

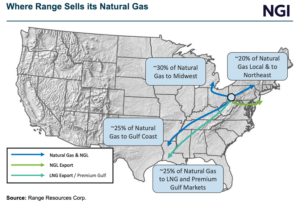

Range Resources Corp. kept natural gas production steady through the first quarter, even as others pulled back, and it expects to maintain the same pace through 2024. The Appalachian Basin pure play’s executives reiterated to analysts during a call to discuss first quarter earnings on Wednesday that they intend to hold output flat this year.…

April 25, 2024Natural Gas Prices

By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.