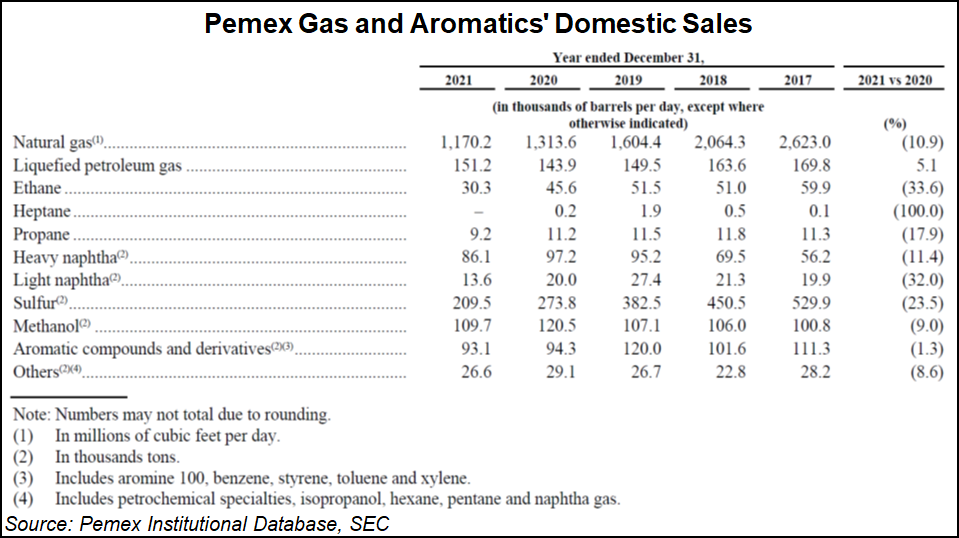

Mexico’s state giant Petróleos Mexicanos (Pemex) saw domestic sales of natural gas decrease by 10.9% year/year in 2021, the firm said in its recently released 20-F annual report to the U.S. Securities and Exchange Commission.

Sales dropped from 1.313 Bcf/d in 2020 to 1.170 Bcf/d last year, Pemex said. This decrease “was mainly because private companies have the option to purchase natural gas from other marketers,” according to the filing, which was for full-year 2021.

“To reverse the loss of the natural gas market, for the July 2021-June 2022 cycle, a commercial strategy was designed based on maintaining competitive prices in the domestic market to recover customers that once belonged to Pemex,” the company said.

Pemex also upped its imports of natural gas from the...