NGI Mexico GPI | E&P | NGI All News Access

Pemex Natural Gas Output to Rise 50% by 2024, CEO Says

Mexico’s national oil company Petróleos Mexicanos (Pemex) plans to ramp up natural gas production by 50% in the next six years, to reach 5.7 Bcf/d by the end of 2024, CEO Octavio Romero Oropeza forecast on Saturday.

Speaking at an event to unveil President Andrés Manuel López Obrador’s 2019 exploration and production (E&P) plan for Pemex, Romero said the growth will mainly be driven by associated gas, as Pemex plans to boost crude oil production to 2.4 million b/d from 1.75 million b/d over the same span.

Pemex plans to add 73,000 b/d of production by December 2019 from 20 fields, Romero said, comprising 16 shallow water fields and four onshore.

Of the offshore fields, 12 are off the coast of López Obrador’s home state of Tabasco, where the government is building an $8 billion oil refinery, with the other four in Campeche bay.

Three of the onshore fields are in Tabasco as well, while the fourth is in Veracruz.

López Obrador’s proposed 2019 national budget, which he presented to legislators on Saturday as well, includes increases of 18.5% for the Pemex budget and 12.2% for state power utility Comisión Federal de Electricidad (CFE).

Under the plan, Pemex’s budget would rise to 464.6 billion pesos ($23.1 billion), while CFE’s would increase to 387.6 billion pesos ($19.3 billion).

Pemex plans to focus upstream investment on shallow water and onshore conventional fields in the southeastern states of Veracruz, Tabasco and Campeche, López Obrador said, as well as onshore conventional fields in northern Mexico.

The strategy is at odds with warnings by some experts that Mexico must invest in deepwater and unconventional E&P if the country wants to maintain output growth over the long-term.

“We’re going to invest where we know there is oil and that it costs us less to extract it,” López Obrador said.

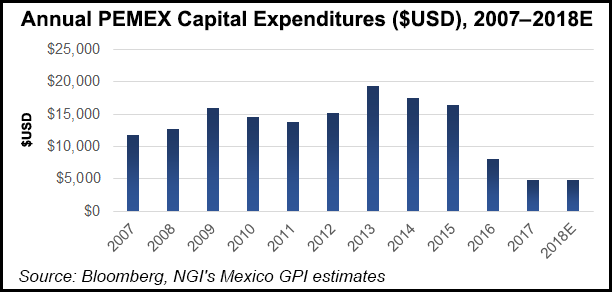

Although the current trend of declining oil production by Pemex began in 2004 and has continued uninterrupted ever since, Romero cited cuts to Pemex’s E&P budget since 2014 as “the fundamental reason” for the output slide. However, he did not mention the plunge in global oil prices that began in late 2014.

“As if that weren’t enough,” he said, “the destination of these scarce resources also played an important role, since 41% of the money assigned to exploration was channeled to deepwater projects, where in any case we wouldn’t see the first drop of oil until 2025.”

Under the new regime, Pemex will instead invest “where we’ve always been successful,” Romero said.

In order to reverse the nearly 15-year output slide, Pemex plans to concentrate on increased drilling, repairing wells at fields already in production, enhanced recovery techniques in mature fields, and “the opportune development of new fields discovered with the new exploration strategy,” Romero said.

Romero also said “over-regulation” by Mexico’s energy regulatory agencies, namely the Comisión Nacional de Hidrocarburos (CNH) and Comisión Reguladora de EnergÃa (CRE), was “one of the obstacles” impeding the timely development by Pemex of its fields.

López Obrador’s budget includes cuts of 30.3% for CNH and 31.1% for CRE.

Neither Romero nor López Obrador offered forecasts of oil and gas production from the 110 contracts awarded through bid rounds between 2015 and 2018. Both, however, said that the rounds, and the 2013 constitutional energy reform that made them possible, have so far failed to live up to promises of investment and production growth.

López Obrador has suspended the bid rounds, which are conducted by CNH, for three years, and said they will only resume once the already awarded projects start producing.

Despite the new government’s criticism of CNH and the reforms, the planned strategy of maximizing associated gas output from existing fields through enhanced recovery techniques aligns with several measures recommended in a policy document published in September by CNH titled “Natural Gas: A Few Proposals for the Development of the Local Industry.”

However, the document also highlights the importance of bid rounds at regular intervals, and of developing a national plan for unconventional E&P, both of which are opposed by the López Obrador government.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |