NGI Mexico GPI | Markets | NGI All News Access

Pemex Casting Off Red Tape to Potentially Import More LNG

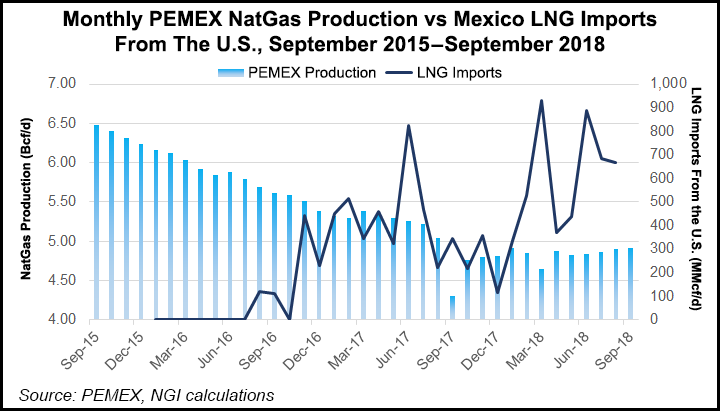

A top-level team of Mexican energy officials and regulators has reached an accord with state oil company Petroleos Mexicanos (Pemex) to allow the producer to renew purchasing liquefied natural gas (LNG), while eliminating penalizations under the previous system, a source close to the deal told NGI’s Mexico Gas Price Index.

Before January 2017, downstream regulator Comision Reguladora de Energia (CRE) mandated that the cost of any LNG imports be spread out among all users of the national gas pipeline and storage system, Sistema de Transporte y Almacenamiento Nacional Integrado de Gas Natural (Sistrangas). The application of a flat rate distorted transportation costs for what is a wide range of regions and users.

From January to June 2017, Pemex imported LNG and spread out the costs among its customers, which made it a less competitive marketer. Customer attrition ensued. Pemex stopped importing LNG, forcing Cenagas to import LNG to balance the system through most of September.

However, CRE regulations force Cenagas, the operator of the Sistrangas, to charge a penalty on LNG imports to discourage its demand. Pemex passed on the penalty to its customers, causing discontent among those not up to speed. This state of affairs continued until a meeting last month.

As a result of the meeting, Pemex will again import LNG, bypassing the penalties on Cenagas imports, the source said. Pemex will again pass on the LNG marginal price to customers, but without the penalty.

Pemex acquired 120 MMcf/d of LNG at the beginning of October. Any extra LNG was to be charged at the going rate for the fuel but without the extra penalization.

Pemex aims in the coming months to buy as much LNG as it can, possibly as much as 250 MMcf/d, which should be enough to meet the needs of its customers, the source said.

Even so, supply problems continue to abound in southern Mexico with every month that passes, sources said. Until, that is, the reconfiguration of the Cempoala compressor station is completed, likely in April, thus allowing the free flow in a southerly direction of gas from the Sur de Texas-Tuxpan underwater pipeline.

Pemex staff were unavailable to comment on Thursday or Friday about the potential LNG imports because of the company’s observance of Mexico’s traditional Day of the Dead celebrations.

For November, Pemex has told customers that it could not meet the full volumes requested for the month. Indeed, eight customers were told that they could not be assured of any supplies without interruption. All eight are close to compressor stations that receive no imported gas.

Pemex structures the management of demand. It provides its customers with information, in writing and with considerable clarity, that allows them to seek alternatives to natural gas, including compressed gas, liquefied petroleum gas or fuel oil.

The top-level team that has set up the system includes representatives of Pemex Exploracion y Produccion, the upstream subsidiary of the state company, as well as upstream regulator CRE, Comision Nacional de Hidrocarburos (CNH), Cenagas and the Centro Nacional de Control de Energia (Cenace), which controls the power market.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |