E&P | Eagle Ford Shale | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

PDC Needs Board Shake Up, Better Strategy, Says Shareholder Kimmeridge

PDC Energy Inc. is facing an uprising from within, as private equity Kimmeridge Energy Management Co. LLC, which owns 5%, called for a board revamp and strategy do-over.

Kimmeridge, which in late February said it would seek to revamp performance at the exploration and production (E&P) company, nominated three candidates to stand for election at the annual meeting, including the private equity’s founder Ben Dell.

“Despite holding enviable assets, we believe PDC has consistently delivered poor financial and operational performance across a host of critical metrics,” Dell said. “In addition, management has repeatedly appeared to be unwilling to meaningfully address the company’s failings, which has, in our view, resulted in a steep discount to PDC’s intrinsic value. The election of three new directors will instill much needed accountability and a fresh perspective at the company. It’s certainly time for change.”

According to Dell, the E&P sector overall has become increasingly “uninvestable” because of high selling/general/administrative expenses that are not related to actual production. “Under the watch of PDC’s current board, the company continues to resoundingly check each of these value destructive boxes while claiming a ”commitment to capital efficiency,’” he said.

During the 4Q2018 conference call held earlier this month, PDC executives laid out plans for the year, which include a focus on the Denver-Julesburg (DJ) Basin in northeastern Colorado and the Permian in West Texas. The company in February said it would reduce year/year capital spending by 15% to $810-870 million, with production forecast to increase by 20% to 46-50 million boe.

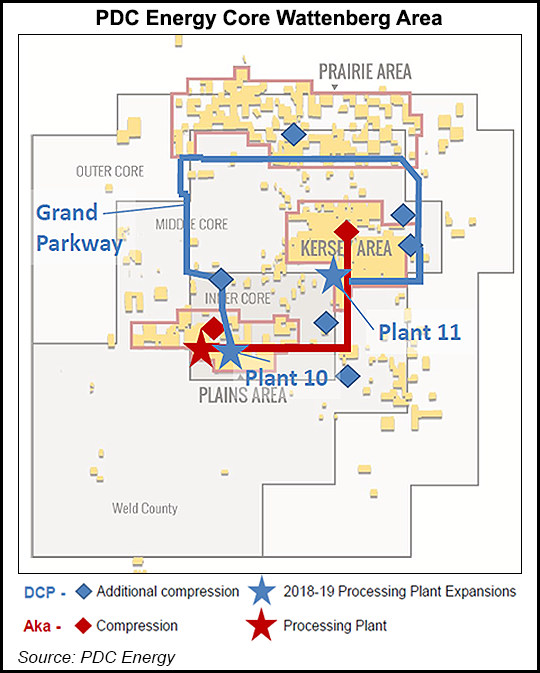

PDC plans to spend 60% of its capital this year in the DJ’s Wattenberg field, which accounted for 84,000 boe/d in 2018 of a total 110,000 boe/d.

Kimmeridge’s proposed board nominees “are solely committed to doing what is in the best interests of the company and all of its stockholders over the near and long term,” Dell said.

Dell co-founded the energy-focused private equity firm in 2012. Rather than partner with separate management teams, Kimmeridge is designed to identify, own and operate its assets directly. It maintains an in-house geology and operating team with experience across all major E&P functions.

PDC entered the Permian in 2016 after buying assets managed by Kimmeridge.

Kimmeridge also was an investor in Denver-based Resolute Energy Corp., another Permian operator, and Dell had encouraged management to improve shareholder value. Kimmeridge has been a vocal supporter of consolidating small operators in the Permian to improve their overall value. Resolute late last year agreed to a $1.6 billion tie-up with Permian rival Cimarex Energy Co., also based in Denver.

Kimmeridge also owns about 8% of Houston-based Carrizo Oil & Gas Inc., and last year it urged E&P to sell its Eagle Ford Shale portfolio or merge with a Permian competitor to increase value. According to its 4Q2018 results, the Eagle Ford assets still provide the majority of production.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |