Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

PDC Boosting 2018 Capex to Cover Wattenberg, Permian Development

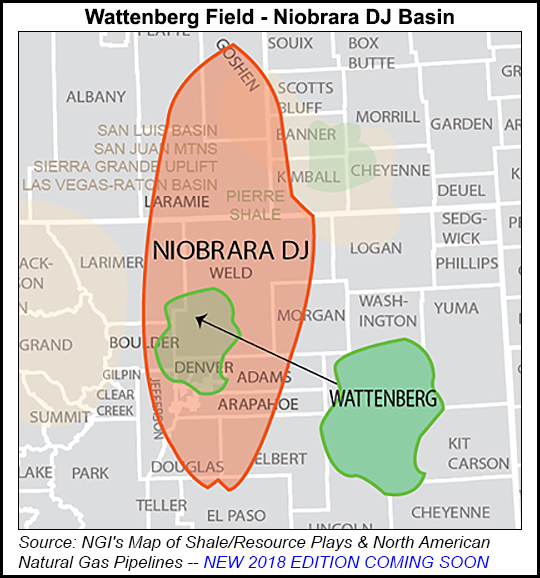

PDC Energy Inc. said this week it would budget $850-920 million next year to keep the focus on Colorado’s Wattenberg field and the Permian Basin’s Delaware sub-basin.

The company has allocated $480 million in capital expenditures (capex) to the Wattenberg, where it develops the Niobrara and Codell formations. Another $395 million would go toward its West Texas Delaware assets in Reeves and Culberson counties, which were acquired last year. Delineation efforts in Texas, are to continue next year, including the first downspacing tests on the eastern side of the company’s acreage.

PDC’s 2018 capex plan is ahead of the $725-755 million it committed to this year’s operations. Year/year production in 2018 is forecast to increase 25% to 38-42 million boe, or 104,000-115,000 boe/d. The company intends to continue focusing on an oilier production mix after turning away from Appalachian natural gas. The independent also plans to sell its 62,450 net Utica Shale acres in Ohio sometime early next year.

Production growth is expected to be “modest” in the early part of 2018, with a ramp expected later on from Wattenberg processing expansions late next year, while Delaware turn-in-lines are scheduled throughout the year. Year/year oil production is forecast to increase 30%, with volumes expected to account for 42% of total production.

The company plans to run six rigs total in 2018, three in the Wattenberg and three in the Delaware. Plans call for spudding 131 wells and turning 139 to sales in the Wattenberg, while 22 wells are slated to be drilled and another 22 turned-in-line in the Delaware.

Also included in the Delaware capital program is $60 million to expand midstream infrastructure, including $20 million for building crude oil gathering systems in the eastern part of the company’s acreage. PDC expects to have those complete and moving volumes by 4Q2018. Other funds are to be allocated to non-operated drilling and completion, leasing, seismic and other expenses in the play.

Heading into the new year, exploration and production companies have been preaching capital discipline, highlighting early plans to spend within cash flow and to focus more sharply on investor returns rather than production growth. PDC said it’s aiming to be cash flow positive by 4Q2018, but added that it expects a $130 million outspend next year before that happens.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |