E&P | NGI All News Access | NGI The Weekly Gas Market Report

Patterson-UTI Sees U.S. Rig Count Stabilizing, Fracturing ‘Bump’ as Lower 48 Drilling Improves

Houston-based Patterson-UTI Energy Inc. CEO Andy Hendricks on Thursday credited solid relationships with its exploration customers and “top tier performance” as Covid-19 decimated demand in helping to stem losses during the second quarter.

The contract drilling specialist saw its earnings and revenue tumble, but shuttering facilities, laying off crews and stacking equipment improved the bottom line. It’s all about who you know, Hendricks said during a conference call with financial analysts.

“We work with some of the largest oil companies, and we work with private operators that nobody’s ever heard of but that are well capitalized. We’ve had relationships for a long time.”

Those bonds helped the Houston-based oilfield services giant as it “acted decisively to scale down our business,” Hendricks said. Indirect support costs were trimmed, cutting about $100 million a year.

As the impact from Covid-19 took hold, the company in April cut capital expenditures by 60% from 2019 to $140 million. A number of facilities were shuttered to reduce direct operating costs in line with activity declines. Executive compensation was reduced by more than 50%. And a decision was made to close up the drilling operations in Canada, which are now being marketed.

“On a quarterly run rate basis, we expect to recognize substantially all of the cost savings in the third quarter,” Hendricks said. He had warned that the rig count would tumble, a prognostication that has proved true.

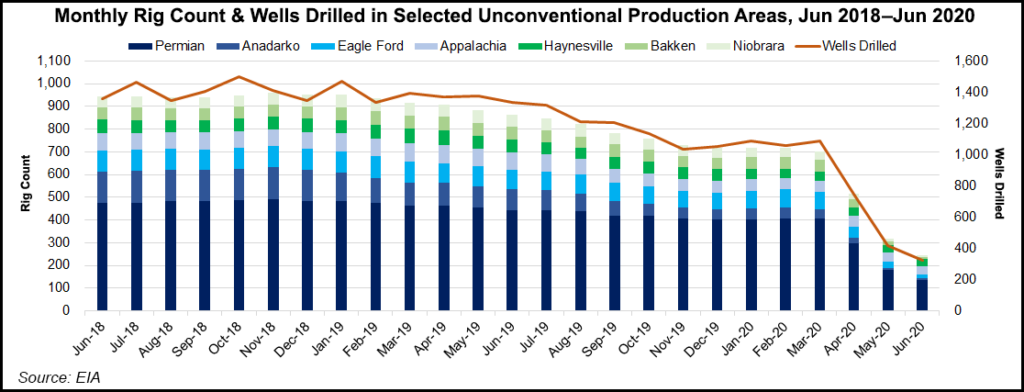

The company average count was “in line with expectations” at 82 rigs, sharply lower than a year ago, when 157 rigs were working the fields. During June, only 65 rigs were in operation, and the count is unlikely to strengthen through September.

“Recently, the rate of decline in the industry rig count has slowed, and we believe our rig count has stabilized,” Hendricks said. The third quarter rig count likely won’t budge beyond 59, “in line with our current rig count.”

Even with exploration and production (E&P) customers eschewing activity, the contract drilling segment also exceeded expectations.

Average rig revenue/day was $22,970, and the rig margin averaged $11,280/day. Included in the latest quarter was an $8.6 million benefit in lump-sum early termination revenue, as E&Ps canceled rig contracts. In 2Q2019, the average rig revenue/day was $24,230, with margins of around $10,230/day.

Contract drilling operating losses tumbled to $30.7 million from year-ago income of $16.5 million.

U.S. contract drilling operating days fell by almost half from a year ago to 7,450 from 14,323. In Canada, zero operating days were recorded, versus 62 a year ago. Given the somber outlook for the Western Canadian oil and gas drilling market, the assets are up for sale, Hendricks noted.

At the end of June, term contracts for drilling rigs provided $335 million of future dayrate drilling revenue.

“Based on contracts currently in place, we expect an average of 51 rigs operating under term contracts during the third quarter,” with on average 38 rigs now under contract through the first half of 2021, Hendricks said.

More quarterly earnings coverage by NGI may be found here.

The pressure pumping business was challenging, Hendricks noted, but quarterly activity and profitability fell in line with expectations.

“We’d underperformed in pressure pumping, and we needed to show the market we could run it the way it needed to be run,” Hendricks said. “This quarter finally highlighted, during very difficult challenges, that we have a lot of ability in pressure pumping.”

The company held on average four fracturing spreads during the quarter, “better than some competitors,” but it was a “very difficult and challenging environment. I don’t want to understate that.”

Fracture pricing “still is a big challenge,” and it “was before we got into this downturn.” There were drop offs in pricing during 2019, and that has never recovered.

“But we do see some opportunity for activity in the third quarter,” said the CEO. “We are also cautious about how much work we take on. We don’t want to spend money and accelerate operating expenses,” but there is little visibility into the fourth quarter. In addition, the final three months typically are a period when activity declines because of holidays and weather events.

Still, “we do think we can get a 10% bump in the third quarter. But that’s about the most visibility we have at this point.”

The costs to reactivate fracturing spreads would be “minimal. If we need to reactivate a press, it wouldn’t take much because some spreads were working just a few months ago,” Hendricks said. “The near-term activation would be a minimal cost. We could bring people on fairly quickly without a lot of overhang on compensation costs.”

Revenue plunged to $59.5 million from $251 million in 2Q2019, with a gross margin of $3.3 million versus $44.9 million.

The deep decline in the Lower 48 was evident in the fall-off in fracturing jobs, which plummeted to 35 in 2Q2020 from the year-ago total of 122. The average revenue for each job declined to $1.55 million from $2.01 million. Margins per total job slumped to around $17,500 from $142.5 million.

Margins as a percentage of revenue slumped to 5.5% from almost 18% a year ago.

Layoffs, facilities closures and the decision to exit unnecessary vendor contracts led to restructuring costs of $31.3 million in the pressure pumping business. Still, the efficiency moves down the line should result in “making our pressure pumping segment leaner and more competitive,” Hendricks said.

The directional drilling business also saw a sharp retreat in 2Q2020, with revenue off at $11.74 million from $50.22 million a year ago. Margins fell into negative territory at minus $523,000 from year-ago profits of about $8 million. Margins as a percentage of revenue also reversed to minus 4.5% from a year ago, when they topped 16%.

Net losses in 2Q2020 totaled $150 million (minus 81 cents/share), versus a year-ago loss of $49.4 million (minus 24 cents). Revenue plunged to $250 million from $676 million. Included in the 2Q2020 results were one-time charges related to restructuring and impairments of $17.5 million. The impairments included a $9.2 million charge to reduce the carrying value of a deposit for future sand purchases and $8.3 million to close the Canadian drilling operations.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |