Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Patterson-UTI Sees Escalating Rig Count as Customers Clamor for Super Specs

A proactive attack to defeat an oversupplied North American pressure pumping market and instead lean on advantaged high-tech drilling rigs lifted Patterson-UTI Energy Inc. (PTEN) to a better-than-forecast performance during the third quarter.

A record drilled but uncompleted (DUC) well count, exhausted customer budgets and the upcoming holidays have led to speculation that rigs will fall in the onshore. That’s not the case for PTEN’s top-of-the line machines, i.e. super spec Apex rigs, CEO Andy Hendricks said during a conference call Thursday to discuss results. He shared a microphone with Chairman Mark Siegel.

“In contract drilling, our rig count averaged 178 rigs during the third quarter, an increase of two rigs from the second quarter,” Hendricks said. “Demand for super spec rigs remains strong, and we expect our fourth quarter rig count will average 182.”

Super spec demand allowed PTEN to boost sequential rig revenue by an average of $410/day with rig revenue averaging $22,280/day. Rig operating costs/day averaged $13,810, resulting in a margin of about $8,470/day, a sequential increase of $200. More rigs also are being upgraded, with 12 retrofitted year-to-date through September and contracts in place for two in 4Q2018 and two in 1Q2019.

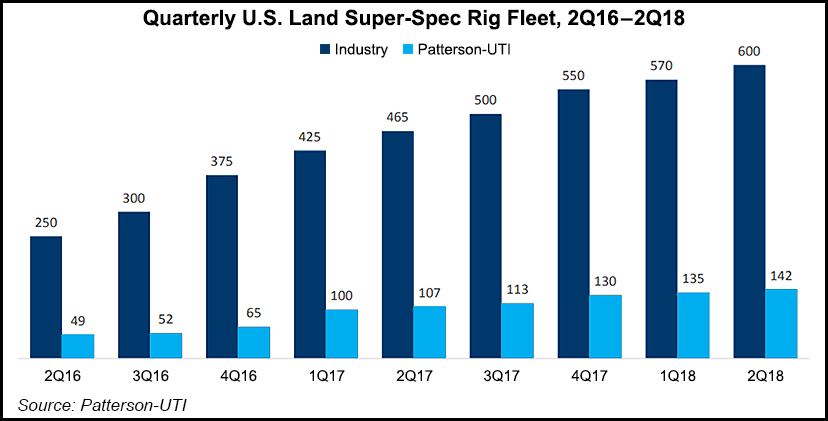

“We estimate that the current available supply of super spec rigs in the U.S. is approximately 625 rigs,” Hendricks said. PTEN has 145 super specs, along with 53 Apex rigs that still can be upgraded to super spec capabilities.

“However these upgrades will be reliant upon customer contracts and compelling economics,” he said. “We believe super spec rigs across the industry are largely sold out and operators realize they need to plan further again and consider higher price longer-term contracts in order to get in queue for incremental upgrade.

“We are already having customer conversation about incremental super spec rigs in 2019. This visibility gives us confidence that super spec drilling activity will continue to grow. Rates will continue to rise, and average contract durations will link them.”

The “major upgrades primarily consist of turning lower-capacity rigs, which were originally intended for shallower wells, such as those in the Barnett Shale, into rigs with current super spec capabilities,” Hendricks said. “Our major upgrades have similar components, specifications and expected useful lives as newbuild rigs, but require a significantly lower capital investment.”

While contract drilling remains strong, there is “softness” in pressure pumping, particularly in “Texas and Oklahoma, for the most part,” he told analysts. “We have the potential for recovery in 2019 because we are not seeing the drilling rig count slow down…”

The tale is in the drilling contracts, and PTEN has them in spades. At the end of September, term contracts provided for about $825 million of future dayrate drilling revenue, an increase of more than 20% from 2Q2018.

“Based on contracts currently in place, we expect an average of 127 rigs operating under term contracts during the fourth quarter, and an average of 81 rigs operating under term contracts during the 12 months ending Sept. 30, 2019,” Hendricks said.

Even with the “deteriorating market conditions,” PTEN still had better-than-projected revenue and gross margin for the pressure pumping unit too. Revenue in 3Q2018 was $422 million, down from $425 million in 2Q2018.

“We responded to oversupplied market conditions by reducing the number of marketed spreads and consolidating the work among the remaining spreads to reduce white space in the calendar,” Hendricks said. “We ended the quarter with 21 marketed spreads,” down from 25 at the end of June.

Patience is key, said the CEO. “We expect to be able to quickly reactivate these spreads, but we have no intention of doing so until market conditions improve.”

Improving conditions may only be a few months away, Siegel said.

“Fundamentals remain strong for U.S. onshore drilling and completion activity despite the near-term slowdown in pressure pumping,” he said. “Global economic growth continues to drive increasing demand for oil, while geopolitical issues and a sustained period of underinvestment in oil and gas projects constrain supply growth. Additionally, as we see it, the availability of spare oil production capacity, which may be needed to offset supply disruptions, is both dwindling and unproven.”

The near-term challenges are the result of exploration and production capital expenditure (capex) “budget exhaustion and pipeline constraints,” both of which should be temporary, Siegel said. Notably, “2018 capex budgets were set with oil prices significantly below current prices.”

As one of the leading super spec drilling rig providers in North America, PTEN has “visibility into both near-term drilling activity and longer-term completion demand,” according to Siegel.

“Customer appetite for term contracts on drilling rigs in a rising dayrate environment confirms that super spec drilling activity should remain strong and continue to drive the number of wells being drilled.”

While completion activity is slow today, the backlog of DUCs still is strong, “which bodes well for increasing demand for pressure pumping in the not too distant future.”

One time impairment charges from retiring rigs and losses in pressure pumping led to a net loss of $75 million (minus 34 cents/share) in 3Q2018, versus a year-ago loss of nearly $34 million (minus 16 cents). Excluding the one-time $67 million charges, losses would have been $21 million (minus 10 cents/share). Total revenues climbed year/year to $867 million from $685 million.

The one-time impairment mostly resulted from retiring 42 legacy rigs and related equipment, which totaled $48.4 million. Another $17.4 million was for pressure pumping equipment losses.

“Based on the strong customer preference across the industry for super spec drilling rigs, we believe the 42 rigs being retired have limited commercial opportunity,” Hendricks said. “The pressure pumping equipment is primarily obsolete sand handling equipment, which has been replaced with more efficient sand solutions.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |