E&P | NGI All News Access | NGI The Weekly Gas Market Report

Patterson-UTI Idles U.S. Pressure Pumping Crews, Slows Rig Upgrades

Patterson-UTI Energy Inc., which supplies onshore drilling and pressure pumping equipment, has idled three U.S. fracture fleets since the start of the year and has tabled rig upgrades that lack term contracts.

The Houston-based oilfield services firm’s rig count averaged 183 in the final quarter of 2018, up five from the third quarter, but when oil prices collapsed, some of the exploration and production (E&P) customers began to release rigs, CEO Andy Hendricks said during a conference call Thursday.

“Recently, with the sharp rebound in oil prices above $50, we have seen an improvement in operator sentiment,’ but the rig count is expected to be off in the first quarter, averaging around 174 rigs. “We could still go down from where we currently are operating 175 rigs,” dropping another six or seven. “But we don’t anticipate this going below the upper 160s…

“We’ve seen some change in sentiment, and so we’re just going to have to see how this plays out. Not all the operators have finalized their plans and so I would say this is still fluid.”

There was a “huge swing in sentiment from what we saw in the second half of December to where we ended up in January,” he told analysts. “And I think the challenge for us is that operators haven’t confirmed their plans.”

West Texas Intermediate is likely to remain relatively steady at $50-55/bbl this year, he said.

Based on near-term activity levels, capital expenditures have been cut 27% year/year to $465 million.

Fourteen major rig upgrades were completed last year to the Apex fleet, and another one was upgraded during January. Going forward, however, that pace is likely to slow.

Within the company fleet of 198 Apex rigs, “149 have super-spec capabilities and the remaining 49 rigs could all be upgraded to super-spec capability,” Hendricks said. “Given the significant capital investment for major upgrades, we required term contracts for major upgrade…

“We have not delivered any major drilling rig upgrades without a term contract nor do we intend to do so,” he said during a conference call.

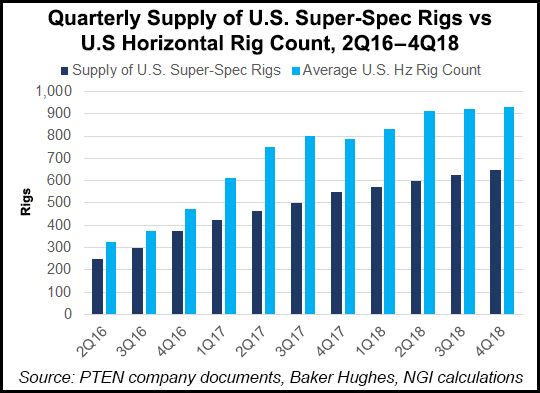

He called 2018 “a year of continued bifurcation in the U.S. drilling market” with super-spec rigs gaining market share because of their efficiency and reliability. The current available supply of super-specs in the United States is pegged at 650, “and we believe current industry utilization for super-spec rigs is in the mid-90% range.”

While the bottom half of the fourth quarter slumped, across the board the company’s average rig revenue, costs and margin on a per-day basis were better than expected. While caution is the watchword going forward, the fourth quarter results were remarkably strong.

Term contracts for drilling rigs in place at the end of 2018 provide $770 million of future dayrate drilling revenue. Based on contracts now in place, about 122 rigs under contract are expected to operate during 1Q2018, with 78 now under term contract for 2019.

Average daily rig margins also increased during the final period, Henricks noted.

“Day rates for super-spec rigs were strong during the fourth quarter, leading to an increase in average rig revenue per day of $690 to $22,970,” he said. Meanwhile, efficiencies improved operating costs, decreasing on average by $230/day to $13,580.

Lower exploration and production activity late last year, as well as “budget exhaustion” dented the pressure pumping business in the fourth quarter. To make up for the shortfall in revenue, the company worked to improve performance, with the fourth quarter showing “increasing internal efficiencies with reduced nonproductive time and an increase in average number of pumped stages/day,” said the CEO.

“With the weakness in commodity prices late in the fourth quarter, operators have been delaying starting new completion projects in the first quarter, and pricing remains extremely competitive. As such, we have made the decision to idle spreads rather than work at unreasonably low prices.”

The company ended December with 20 active fleets, or spreads, but it has idled three since then.

“The magnitude and speed of the oil price decline during the fourth quarter was surprising, even for those who have witnessed many major fluctuations in oil prices,” Chairman Mark Siegel said. “The timing of the sharp decline no doubt impacted plans for first quarter 2019 drilling and completion programs. With oil prices in the mid-$50’s, operator sentiment has improved.

“However, we suspect some of our E&P customers will wait to see if these prices, or possibly even higher prices, remain in effect before solidifying their drilling and completion plans. If oil prices do move higher, we expect activity levels will improve.”

Net losses in 4Q2018 totaled $201 million (minus 93 cents/share) from year-ago net profit of $195 million (88 cents). The year-ago quarter included a positive gain from U.S. tax reform. The company recorded a one-time impairment charge in 4Q2018 of $211 million; excluding the charge, net losses would have been $9 million (minus 4 cents/share). Revenues were $796 million in 4Q2018, versus $787 million a year earlier.

Net losses for 2018 totaled $321 million (minus $1.47/share), compared with profits in 2017 of $5.9 million (3 cents). Excluding impairments recorded for the third and fourth quarters of 2018, the net loss for 2018 would have been $74.7 million (minus 34 cents/share). Revenues in 2018 totaled $3.3 billion, versus $2.4 billion in 2017.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |