NGI The Weekly Gas Market Report | Coronavirus | E&P | Infrastructure | Markets | NGI All News Access

Patterson-UTI Capex Down 60% and Murphy Slices More; ExxonMobil Pushing PPE Manufacturing to Combat Covid-19

The energy industry remained in turmoil Thursday as the dual threats of Covid-19 and the oil price war decimated demand, leading to more operators announcing steep capital reductions.

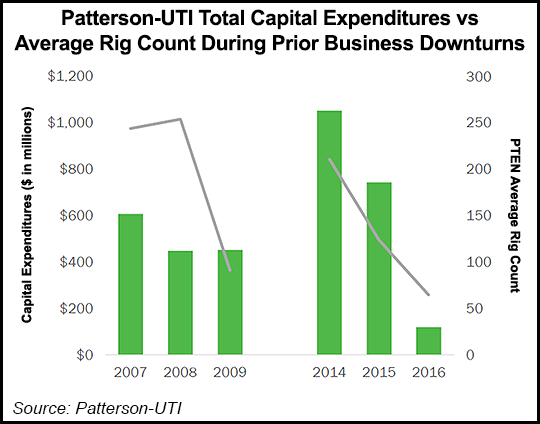

North American technology specialist Patterson-UTI Energy Inc. became one of the largest oilfield services (OFS) operators to join in the cost cutting, announcing Thursday it has trimmed capital expenditures (capex) by 60% to $140 million.

A “number of facilities” also are being shuttered as the Houston firm reduces direct operating costs in line with activity declines. And executive compensation has been reduced by more than 50%.

“The safety of our employees remains our top priority,” CEO Andy Hendricks said. “Patterson-UTI has effectively responded to other downturns in its more than 40-year company history. While the circumstances leading to this downturn may be different, our response will be guided by the same principles that have guided us through previous downturns.”

The firm’s drilling rig count was not significantly impacted in the first quarter, but “we do expect meaningful declines in April,” Hendricks said. “Pressure pumping activity levels responded more quickly, with a significant decline in the later part of the first quarter.”

Another OFS provider, TechnipFMC plc, which works in subsea, onshore, offshore and surface technology, has reduced capex by 30% to $300 million. About $100 million of annualized cost reductions are being made in Surface Technologies “primarily to address the sudden and sharp decline in North American activity.” Around $30 million of annualized costs also is being trimmed in corporate expenses.

El Dorado, AR-based Murphy Oil Corp. for the second time in less than a month has further reduced capex. The new guidance is $780 million, a 46% decrease from original guidance of $1.45 billion and down from March, when it had reduced spend to $950 million. The board also approved a 50% cut to the quarterly dividend to 12.5 cents/share.

“Significant” salary reductions also are on tap for Murphy executives, with compensation for the president/CEO slashed by 35%. President/CEO Roger W. Jenkins last month reportedly had a presumptive diagnosis for Covid-19, and in the interim CFO David R. Looney was at the helm.

Other executives will see their salaries reduced by up to 30%, with an average cut of 22%. Cash retainers for Murphy directors were lowered by 35%, with Chairman Claiborne P. Deming reducing his retainer by 70%.

“Murphy recognizes the reality of the current situation in the commodity markets, and we believe the reduction in dividends, capital expenditures, salaries and retainers are prudent steps to sustain the company for the long term,” said Deming. “We will continue to review our dividend and other items throughout the course of the year and make further adjustments if warranted.”

Midstreamers continue to react to circumstances too.

Oklahoma City-based Enable Midstream Partners LP is reducing total expansion capex for the year by 48%, or $115 million, which includes capital projects that are unlikely to contribute to 2020 revenue.

“The remaining expansion capital expenditures primarily represent projects to serve incremental firm transportation commitments or to support expected levels of contracted producer activity,” Enable said. The board for the general partner also approved a 50% reduction in the quarterly distribution to 16.5 cents/unit.

“Due to the sharp decline in commodity prices and producer activity across our footprint and the future business uncertainty created by the coronavirus pandemic, we are taking decisive action to fortify our financial position, protect our balance sheet and ensure liquidity to navigate these unprecedented market conditions,” said Enable CEO Rod Sailor. “We continue to work with our customers and to refine our costs and capital, not only to maintain maximum financial flexibility but also to ensure a high level of safe and reliable service.”

Meanwhile, ExxonMobil and the Global Center for Medical Innovation (GCMI) on Thursday launched multi-sector and joint development projects to help redesign and manufacture reusable personal protection equipment (PPE) for healthcare workers, such as face shields and masks, now in short supply because of the pandemic.

ExxonMobil plans to apply its experience with polymer-based technologies in combination with GCMI to develop and expedite third-party production of safety equipment that could be sterilized and worn multiple times. GCMI verifies, validates and accelerates development and commercialization of medical technologies.

Prototypes already are being tested and reviewed by the U.S. Food and Drug Administration. When approved, production could begin immediately, with ExxonMobil helping to identify manufacturers to process and deliver the masks to healthcare providers. According to ExxonMobil, some manufacturers have indicated they could produce as many as 40,000 masks and filter cartridges an hour.

ExxonMobil, an innovator in filtration fabric technology since the 1960s, has made its experts available to provide technical knowledge and deliver polypropylene from the company’s manufacturing sites in Baytown, TX, and Baton Rouge, LA. The raw materials would be expedited, if needed, for face mask assembly. The company also plans to help with supply chains to expedite deployment.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |