Shale Daily | E&P | NGI All News Access | NGI Weekly Gas Price Index | Permian Basin

Parsley Grabbing More West Texas Leasehold in $400M Deal

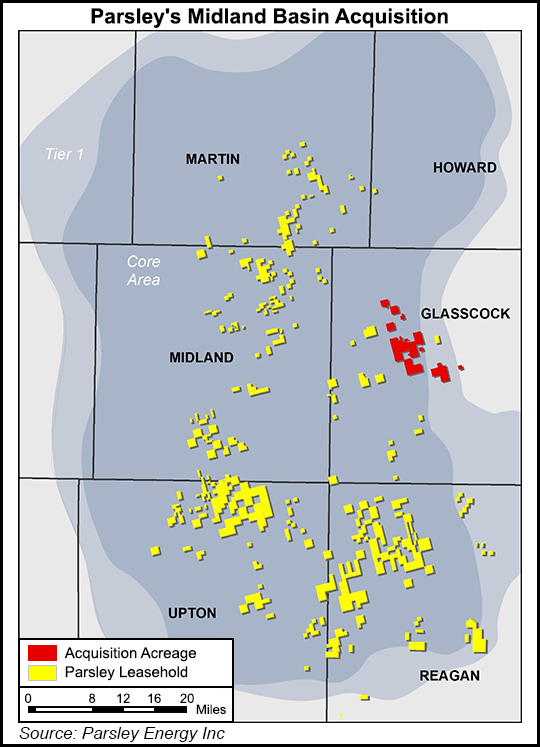

West Texas-focused Parsley Energy Inc. continued its Permian Basin spending spree on Monday, agreeing to pay $400 million for a bolt-on leasehold in the Midland sub-basin.

Including the latest transaction, Parsley since December 2015 has spent $1 billion-plus to build its Permian arsenal (see Shale Daily, May 24; April 5; Dec. 10, 2015). The deal came the same day that Permian competitor Concho Resources Inc. agreed to a $1.625 billion cash-and-stock transaction to acquire 40,000 net acres, also in the Midland (see related story).

Parsley’s transaction with an undisclosed party, scheduled to be completed in early October, would add 9,140 net leasehold acres in Glasscock County, where it already is working. Estimated production currently is 270 boe/d net from 60 net vertical wells. Mineral and overriding royalty interests boost net revenue interest by about 5% on average. On the identified drilling locations, average working interest is 92%, with 99% of the leasehold already held by production.

“The pending acquisition of leasehold and associated assets establishes Glasscock County as another key development area for Parsley Energy,” CEO Bryan Sheffield said. “Offset well performance and initial results on our first horizontal well in the area suggest that the properties to be acquired may compete with the best of our existing horizontal drilling inventory, and the acquisition of associated royalty interests boosts the return profile of these properties.

“We continue to build a high-quality acreage footprint consisting of favorably distributed development areas that can accommodate significant rig count additions, and we believe this acquisition represents an important step toward a large-scale, basin-wide development program that can generate sustainably strong production and cash flow growth.”

The Glasscock deal, according to Parsley, has an estimated 215 net horizontal drilling locations in the Lower Spraberry and Wolfcamp A/B formations, based on 660-foot between-well spacing and average lateral lengths of 7,500 feet. Additional horizontals are possible in the Middle Spraberry, Wolfcamp C and Cline Shale formations.

As a bonus, pre-existing facilities and infrastructure include five saltwater disposal wells to facilitate ongoing development.

Parsley’s first producing horizontal on Glasscock County acreage that it acquired in May is the Dwight Gooden 6-7-01AH, which is about 2.5 miles west of the bolt-on leasehold. The well was completed in the Wolfcamp A interval with a 5,890-foot stimulated lateral and registered a peak 30-day initial production rate of 1,161 boe/d, or 197 boe/d per 1,000 stimulated feet.

Normalized to 7,000 lateral feet, Parsley management said the Dwight Gooden well “is outperforming the company’s 1 million boe estimated ultimate recovery type curve for Midland Basin Wolfcamp A/B wells by 10% after almost 90 days of production, generating 82% oil during that timeframe.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 | ISSN © 2158-8023 |