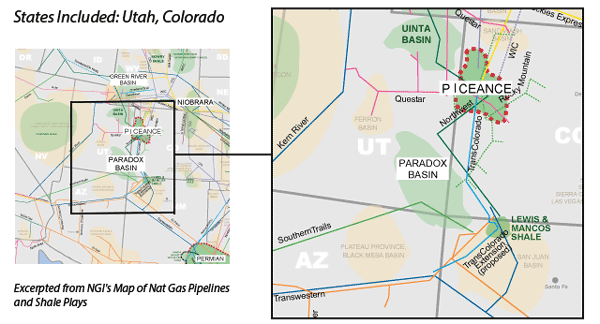

View more information about the North American Pipeline Map

Background Information about the Paradox Basin

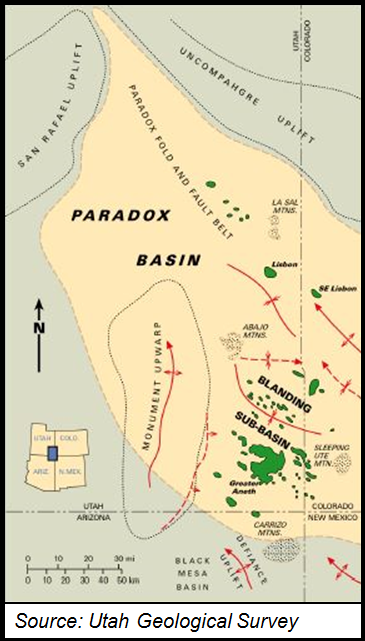

Located mostly in Southeastern Utah and Southwestern Colorado, the Paradox Basin traditionally has been known more for its conventional oil and gas production. The Aneth Field, discovered in 1956 and operated today by Resolute Energy, has produced more than 450 million barrels of oil over its lifetime, and was a top 40 field in terms of proved U.S. oil reserves as recently as 2009. Much of the production in the Aneth is now done using tertiary CO2 flooding. On the natural gas side, the Ute Dome and Barker Dome had produced respective cumulative totals of 6.9 Tcf and 4.7 Tcf at one point in 2010.

MDU Resources subsidiary Fidelity Exploration & Production noted in its June 2013 Investor Presentation that the Cane Creek “could be substantial for [our] company,” with estimated gross EURs 250 to 1000+ MBOs per well. The company earmarked $180 million, or roughly 40% of its 2014 total capital budget, to the Paradox Basin, mostly to drill an additional 17 appraisal and development wells in the Cane Creek. But the results of that program were not up to par.

The company announced in September 2014 that it was revising its 2014 earnings guidance downward because of “challenges” in its Paradox drilling program.

Kent Wells, former CEO of Fidelity, said they were completing an analysis of three nonproductive wells it recently completed to determine if they needed to be stimulated through hydraulic fracturing (fracking) or another means, or whether the wells were damaged in the way they were drilled.

“I would say the results from the wells were disappointing, and we realize we have to change our completion design to make those wells economical,” Wells said. “We’ve been very fortunate [in this basin], we have never had to frack a well, which is kind of rare in today’s world. We have been able to use our natural completions, and get very good wells, but in the future I think we will need to make a shift to stimulate the wells to get the production we’re looking for. Whether that is fracking or some other technique, we don’t know yet. We’ve been working on this for quite a while.”

Wells also had noted that Fidelity had been having trouble keeping production up on some of its high-producing Paradox wells, and thus, he previewed the fact that 2014 production would be “weak.” Oil wells that were delivering 600-800 b/d dropped down in the 300-500 b/d range, he said.

In the fall of 2015, Bismarck, ND-based MDU sold Fidelity, in five separate deals, with proceeds and tax benefits of about $450 million. The transactions included operations in the Paradox Basin (mostly natural gas and natural gas liquids). The sale had been previewed for the better part of the past year (see Shale Daily, Nov. 3, 2015). In announcing the sale, MDU senior executives indicated that the E&P business was racking up some sizable operating losses for the year, topping $1.2 billion for the first nine months of 2015. It was not divulged who the buyers were.

Prior to the MDU sale, in early 2014, London-based Rose Petroleum plc formed a subsidiary, Rose Petroleum Utah LLC, to acquire a 75% working interest across 195,000 net acres in the Uinta and Paradox Basins of eastern Utah for $2 million, plus carry obligations. Rose was expected to make five cash payments to Rockies Standard Oil Company LLC through November 2015 and be responsible for project carryover obligations of $9.5 million in the Mancos Shale and $7.5 million in the Cane Creek Shale of Grand and Emery counties, UT. Rockies Standard will retain a 25% working interest across the acreage. (see Shale Daily, March 17, 2014).

The drilling program will target the Mancos Shale, which is similar to the Niobrara in Colorado. Rose Utah will develop its Mancos leases south of the San Juan Basin, where Encana Corp. and WPX Energy Inc. have drilled about 60 Mancos wells and are producing more than 20,000 b/d of oil. Rose said that its Cane Creek leases are 12 miles north of Fidelity.’s Cane Creek Field in an area where some vertical wells have produced more than 1 million bbls of oil. Rose Utah will first be required to drill three Manco wells and one Cane Creek well in order to earn its 75% working interest in the acreage.

Bill Barrett Corporation has led the effort in the gassier Gothic and Hovenweep Shale plays, which have true vertical depths between 5,500’-8,850’ (the Hovenweep is slightly shallower than the Gothic). BBG announced initial excitement over its first two horizontal wells in its Yellow Jacket prospect within the Gothic Shale in the third quarter of 2008, but subsequent results have been mixed. BBG drilled two more exploratory Yellow Jacket wells in 2012 to test the oil portion of that play, but we believe those turned out to be dry holes.

There is no doubt that low natural gas prices in recent quarters haven’t been helping BBG’s exploratory efforts in the Paradox. In fact, the company made very little mention of the Yellow Jacket (which the company now calls the combination of the Gothic & Hovenweep Shales) in neither BBG’s 2014 10-K filing with the Securities & Exchange Commission nor its September 2014 Investor Relations presentation, other than to note it owns more than 209,000 net acres in the play. BBG has 78,410 net acres in the Paradox that are set to expire in 2015, and given current low natural gas prices, along with the company’s stated focus on the Wattenberg field in the DJ Basin, we would not be surprised if BBG elected to let most, if not all, of those expiring acres go.

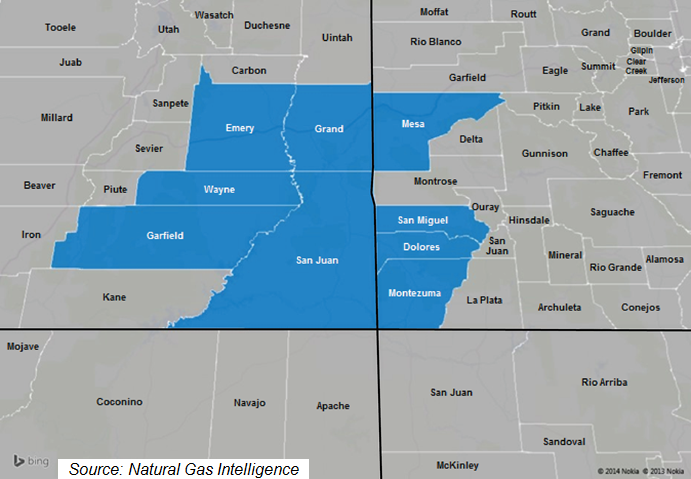

Counties

Colorado: Dolores, Mesa, Montezuma, San Miguel

Utah: Emery, Garfield, Grand, San Juan, Wayne

Local Major Pipelines

Natural Gas: Northwest Pipeline, Southern Trails, TransColorado

Crude Oil: Western Refining

NGLs: Rocky Mountains (Enterprise)

More information about Shale Plays:

Utica | Permian | Bakken | Tuscaloosa Marine Shale | Haynesville | Rogersville | Montney | Arkoma-Woodford | Eastern Canada | Barnett | Cana-Woodford | Eaglebine | Duvernay | Fayettville | Granite Wash | Horn River | Green River Basin | Lower Smackover / Brown Dense Shale | Mississippian Lime | Monterey | Niobrara – DJ Basin | Oklahoma Liquids Play | Marcellus | Eagle Ford | Upper Devonian / Huron | Uinta | San Juan | Power River

Shale Daily

Shale Daily