NGI All News Access | E&P | Infrastructure

Pandemic Rapidly Depleting Rigs as U.S. Natural Gas Count Down Four

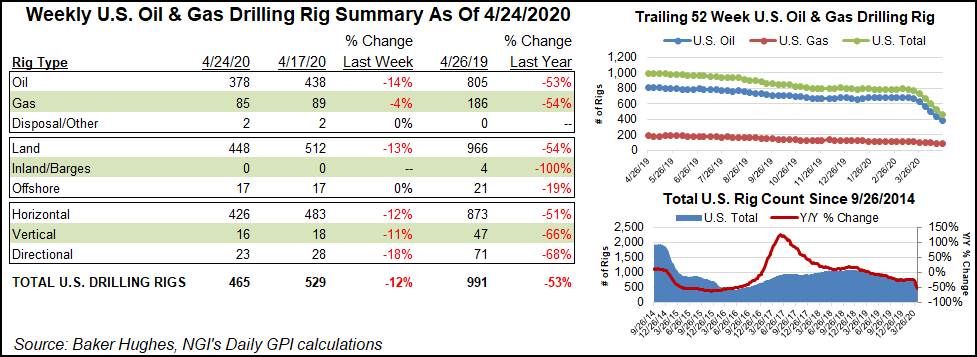

The U.S. natural gas rig count fell four units to 85 during the week ended Friday (April 24), while yet another steep drop-off in oil-directed activity sent the overall domestic tally tumbling below the 500-unit mark, according to the latest figures from Baker Hughes Co. (BKR).

What was once extraordinary has now become routine, as the overall weekly U.S. count declined by more than 60 units for the fourth week in a row, shedding 64 rigs to end at 465. Along with the four gas-directed rigs departing, losses for the week also included 60 oil-directed units. The U.S. count has fallen by 327 units since March 13 and now sits 526 units behind its year-ago total, BKR data show.

All of the declines in the United States for the week were for land rigs, with the Gulf of Mexico holding steady at 17 rigs. Five directional units and two vertical units joined 57 horizontal units in exiting the patch.

The Canadian rig count ended the week at 26, down four, with a one-rig increase in oil-directed drilling partially offsetting the departure of five gas-directed units.

The overall North American rig count finished at 491 rigs, less than half of the 1,054 rigs active at this time a year ago.

Among major plays, oil-focused drilling regions unsurprisingly posted the heaviest losses on the week. This was especially true for the Permian Basin, which lost 37 rigs to fall to 246, well off of 460 rigs in the year-ago period. The Eagle Ford Shale and Williston Basin each dropped seven rigs week/week.

Elsewhere among plays, the Cana Woodford and Marcellus Shale each dropped three rigs, while the Arkoma Woodford, Denver Julesburg-Niobrara and Haynesville Shale each dropped one rig.

Among states, Texas shed 31 rigs during the period, followed by New Mexico, which dropped 14. North Dakota posted a seven-rig decline on the week, while Oklahoma saw a net decrease of four rigs. California and West Virginia each dropped three rigs, while Colorado and Louisiana each dropped one.

It was another wild week for oil markets. The May West Texas Intermediate (WTI) contract made history when it settled deep into negative territory to open the work week, reflecting an unprecedented surplus of oil and lack of demand amid the Covid-19 pandemic.

Rystad Energy’s Louise Dickson, oil markets analyst, called the WTI plunge “unprecedented and seemingly unreal” following the historic collapse. “The most simple explanation for negative oil prices is that midstream players are now paying ”buyers’ to take oil volumes away” as available storage capacity runs out.

This means “pricey shut-ins or even bankruptcies could now be cheaper for some operators, instead of paying…to get rid of what they produce.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |