NGI All News Access | Earnings | Infrastructure

Pacific Northwest Utilities Step Lightly on Different Paths Through Pandemic

Two Pacific Northwest natural gas-plus utilities reported Friday their separate approaches to maintaining essential services in the midst of the Covid-19 lockdown.

On separate conference calls, Portland, OR-based NW Natural reported steady results in 1Q2020, supported by its recent transition to acquiring a series of local water utilities, and Spokane, WA- based Avista Corp.’s combination gas-electric utilities in four states collectively absorbed a large quarterly earnings drop amid losses in nonutility ventures.

“We have adapted to a new-normal in the last few weeks, limiting social interactions and taking every precaution to fight the virus and continue essential services,” said NW Natural CEO David Anderson.

Avista CEO Dennis Vermillion said his utilities in Alaska, Idaho, Oregon and Washington state are doing everything they can to negotiate “these difficult, uncertain times. Many are suffering unprecedented hardships during the Covid-19 pandemic — people are hurting, businesses are hard hit, and communities are challenged.”

Vermillion said 1Q2020 earnings were “below expectations, the nonutility businesses showed losses, and we are expecting more losses at the nonutility businesses for the remainder of the year, considering overall market declines and Covid-19 impacts.”

Vermillion and CFO Mark Thies said the pandemic is “impacting all aspects of our business, as well as the global, national and local economies.” They see no reason the utilities cannot continue to operate effectively and reliably, but they said that at some point the ability of some suppliers, vendors or contractors to perform could be hindered.

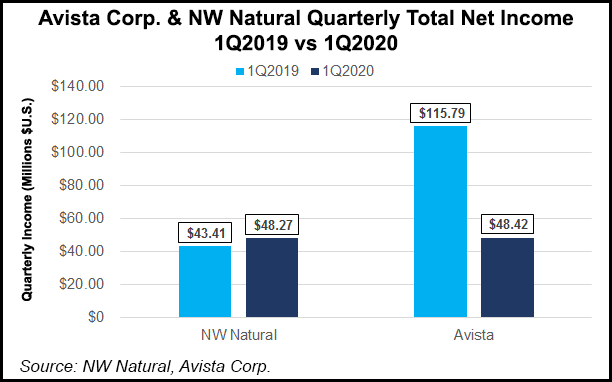

Avista Corp. reported 1Q2020 earnings of $48.4 million (72 cents/share), compared with $115.8 million ($1.76) for the same period in 2019.

NW Natural has closed on acquisitions of four small water utilities so far this year, including its first in Texas. The company’s growth initiatives regarding the production and sale of renewable natural gas and the expansion into the water utility sector are on track and should remain so for the rest of the year, Anderson said.

With $110 million invested in them already, “the water utilities are performing well during the pandemic,” Anderson said. “We’ve implemented a business continuity plan across all the companies and we have leveraged our natural gas expertise to provide centralized resources and planning.”

NW Natural reported 1Q2020 earnings of $48.2 million ($1.58/share), compared to $43.4 million ($1.50) for the same period last year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |