The sweeping Inflation Recovery Act, which cleared the Senate over the weekend, offers many positives for the energy sector, according to Occidental Petroleum Corp. CEO Vicki Hollub.

Houston-based Oxy, as it is better known, held its second quarter conference call Thursday, helmed by Hollub and her executive team.

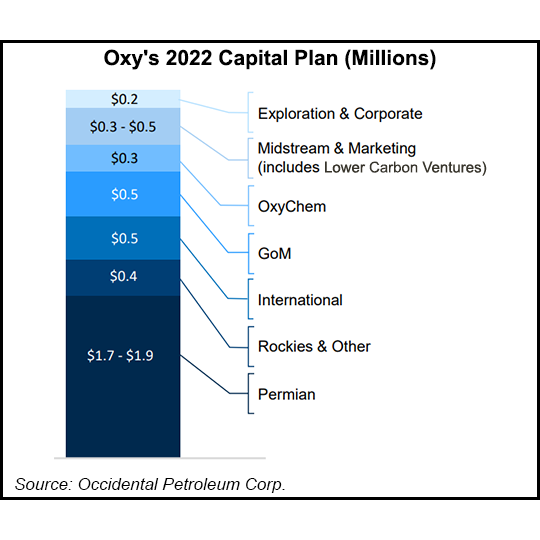

The exploration and production (E&P) independent has a queue of U.S. oil and natural gas projects, from the deepwater Gulf of Mexico (GOM) to the Permian and Denver-Julesburg (DJ) basins. Also in the works are carbon capture sequestration and utilization (CCUS) facilities, along with a massive direct air capture (DAC) project to be sited in the Permian.

Oxy’s portfolio is primed for many of the credit and tax provisions in the Senate Democrats’ Inflation...