Earnings | NGI All News Access

Ovintiv Touts Permian, Anadarko, Montney Gains, Brings Online 32,000 Boe/d of Shut-In Volumes

North American explorer Ovintiv Inc. has brought back online substantially all of its shut-in volumes of 32,000 boe/d, including 18,000 b/d of crude and condensate voluntarily curtailed in the second quarter, CEO Doug Suttles said Wednesday.

Suttles during the quarterly conference call credited efficiencies achieved by reducing costs and the workforce, as well as financial flexibility, in helping to overcome challenges from Covid-19. “During a very challenging period, we took advantage of the tremendous flexibility we have built into our business and performed exceptionally well through the first half of 2020 — maintaining a sharp focus on driving efficiencies in every part of the company and positioning Ovintiv to thrive in 2020 and beyond,” he told analysts.

“Our culture of innovation is allowing us to drive down drilling and completion costs, enhance margins through durable cost savings and strengthen our capital efficiency outlook. We are even more confident in our ability to deliver the 2021 scenario we discussed last quarter, which maintains scale and our strong capital structure while generating free cash flow at modest commodity prices.”

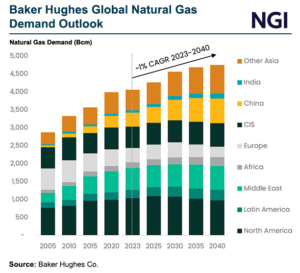

During the conference call Suttles noted that oil and gas demand, as well as pricing, remains low. Mid-cycle oil pricing is forecast by management at around $50/bbl. Natural gas prices “clearly are looking like and setting up fundamentally to be potentially very strong next year. But longer term, we still think that $2.75/Mcf range” is likely the longer term price.

Activity levels in the unconventional shale and tight resource plays are going to be focused around an uncertain economic recovery and the impact from the pandemic, Suttles said.

“There’s lots of discussion and a lot being written about the longer-term impacts of the significant reduction of capital,” Suttles said of Ovintiv and its peers.

“Clearly, shale has shrunk a lot over the past few months, and I think plans like ours will be relatively common,” which is to shrink/stabilize activity for the next six quarters.

Production for the quarter averaged nearly 537,000 boe/d, down from year-ago output of 591,800. Natural gas output was 1.61 Bcf/d, compared with 1.55 Bcf/d in 2Q2019.

Ovintiv fetched an average realized oil price of $39.70/bbl in 2Q2020, versus $60.14 in the year-ago period. Natural gas averaged $2.09/Mcf from $2.22, while realized natural gas liquids prices were on average $17.78/bbl versus $29.57.

Into 2021, “the vast majority of capital” is to be distributed in Ovintiv’s “Big 3” North American plays, the Permian, Anadarko and Montney, said Suttles. As of Wednesday, Ovintiv had seven rigs across the three plays, with three in the Permian and two each in the Anadarko and Montney.

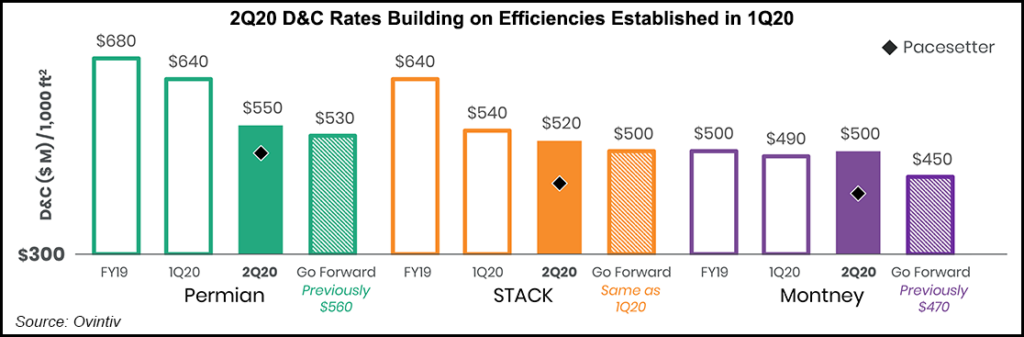

Even with the lower commodity prices, Ovintiv set record-low well D&C costs in the Big 3 core assets. The portfolio also has base properties in the Bakken and Eagle Ford shales, as well as the Uinta and Duvernay formations.

In the Permian, production averaged 111,000 boe/d. On average, four rigs were in operation, one less than in 1Q2020, with 23 net wells drilled and 13 turned in line (TIL). Today three rigs are in operation.

Ovintiv touted its simulated fracture learnings in the Permian, which it said resulted in a 19% improvement in D&C well costs compared to average 2019 well costs.

In Oklahoma’s Anadarko, output averaged 144,000 boe/d. Three rigs on average were in operation, half of the number running in the first quarter. Thirteen net wells were drilled with 17 TIL. Two rigs are running in the play today. Fourteen wells within the STACK formation, aka the Sooner Trend of the Anadarko Basin mostly in Canadian and Kingfisher counties, have been D&C’d for under $5 million this year, Ovintiv noted.

“The pacesetter D&C well cost is now $4.4 million, representing a 30% reduction from 2019 average results,” management said.

Within the natural gas-rich Montney in Western Canada, total output averaged 203,000 boe/d, 24% weighted to liquids. The company averaged two rigs, down from five in 1Q2020. Twelve net wells were drilled, and eight were TIL. Ovintiv is currently running two rigs in the play.

Within the Montney, Ovintiv achieved a record completion rate on a recent four-well pad in Pipestone of 3,450 feet, a 45% improvement from the 2019 average. First half 2020 D&C well costs averaged $480/foot in Pipestone, representing a 14% improvement over last year’s average costs.

More quarterly earnings coverage by NGI can be found here.

The North American-focused independent has 25% fewer employees today than it did in 2013, along with a much tighter and more efficient portfolio. D&C costs overall were down 15% from 2019 average results, about three-quarters of the way to an estimated 20% reduction in 2021. Total costs of $11.23/boe were nearly 8% lower sequentially.

Capital investments in 2Q2020 were $252 million, almost 70% below spending in 1Q2020. The company also moved rapidly from its March operated rig count of 23 rigs to seven by mid-May. Completion activities were halted across the portfolio during the quarter.

Estimated cash cost savings for this year have been increased to $200 million-plus, with nearly half of the savings already achieved. Most savings are expected to be durable long term, management said. Meanwhile, planned capital investments this year have been reduced to $1.8 billion, at the low end of previous guidance.

Based on efficiencies to date, fourth quarter crude/condensate output is forecast to be 200,000 b/d higher than the previous year-end exit rate guidance.

The recent strong well results have increased management’s confidence in a 2021 “stay-flat” crude and condensate scenario with $1.4-1.6 billion in capital spending. All excess cash flow in the next 18 months is to be allocated to debt reduction.

Net losses in 2Q2020 were $4.4 billion (minus $16.87/share), versus year-ago profits of $336 million. Included in the latest results was a one-time impairment of $3.25 billion primarily from reducing the value of proved reserves. Other charges included $568 million for a deferred tax asset valuation, and hedging losses totaled $679 million. In addition, an $81 million restructuring charge came from cutting the workforce by one-quarter.

Ovintiv is substantially hedged on near-term, benchmark oil price risk. For 3Q2020, 175,000 b/d of oil is hedged at an average price $45.06. Natural gas hedges are also in place on 1.4 Bcf/d at an average price of $2.53/Mcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |