Ovintiv Inc., whose portfolio stretches from Western Canada to West Texas, is seeing costs for materials and labor rising, but inflationary pressures and capital guidance are being kept in check with operational efficiencies, executives said Wednesday.

CEO Doug Suttles, who is retiring, presided over his final conference call on Wednesday, ushering in a new era with President Brendan McCracken at the helm. During the call to discuss quarterly results, the executive team shared how best practices are being put to work across North America’s onshore.

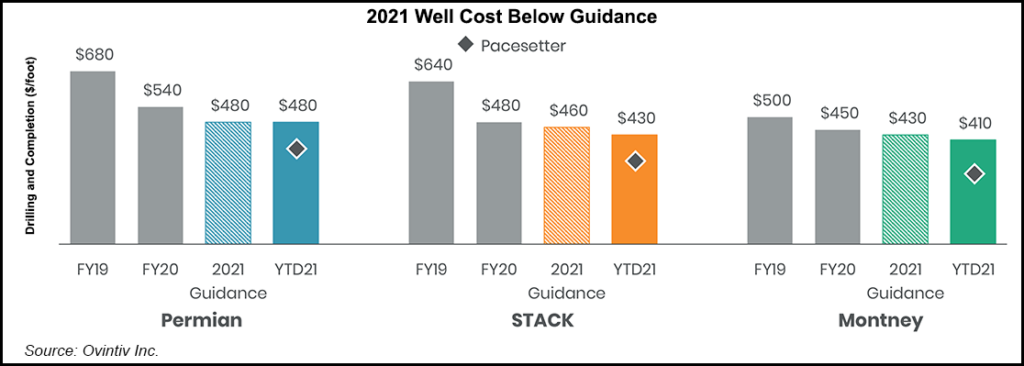

“We have seen inflationary attention on certain items, but we are more than offsetting these pressures with operational efficiencies, leaving our original full year capital guidance untouched,” CFO Corey Code said.

Ovintiv...