Bakken Shale | NGI All News Access | NGI The Weekly Gas Market Report

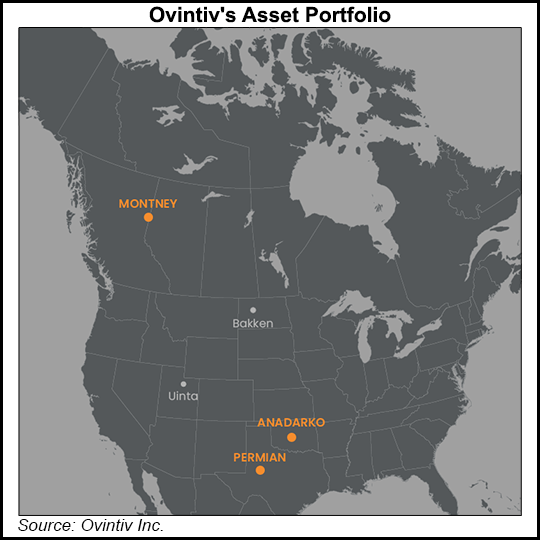

Ovintiv Casts Off Portions of Uinta, Bakken Portfolios, but Share Buybacks Accelerate

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |