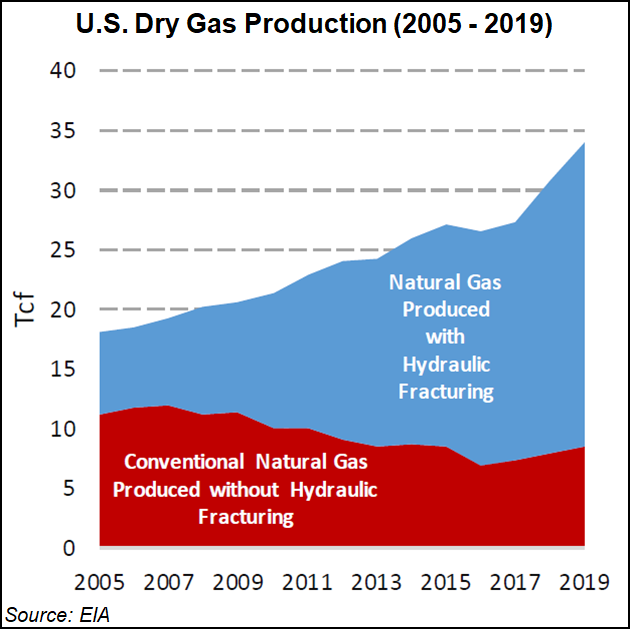

A ban on hydraulic fracturing, a key technique used to complete unconventional oil and natural gas wells, could reverse U.S. production growth and lead the country backwards to become a net importer once again by as soon as 2025, the outgoing Trump administration warned in a report issued Thursday.

The Department of Energy’s (DOE) outgoing Secretary Dan Brouillette in an 80-page analysis said if the completions technique known as fracking were not allowed to continue, it could sharply fray domestic output.

The DOE analysis “suggests natural gas price implications under a hydraulic fracturing ban would be considerable, with an estimated 244% increase from the 2019 level, reaching $8.80/MMBtu by 2025,” Brouilette said.

The Trump administration had requested the...