OPEC-Plus To Ease Production Cuts as Conflicting Factors Keep WTI Around $40

The Organization of the Petroleum Exporting Countries and its allies, aka OPEC-plus, has agreed to ease coordinated oil production cuts to 7.7 million b/d from the August-December period from the May-July amount of 9.7 million b/d.

The decision announced Wednesday to start turning the taps back on comes amid a tightening of the global supply/demand balance as large economies reopen following the first wave of Covid-19.

The OPEC-plus Joint Ministerial Monitoring Committee (JMMC) said Wednesday compliance to the output cuts in June by the alliance as a whole was 107%, highlighting additional voluntary cuts by Saudi Arabia, the United Arab Emirates and Kuwait.

However, countries that failed to meet their allotted cuts in May and June must submit compensation plans to the OPEC Secretariat by the end of July explaining how they will meet the remaining balance of their assigned cuts during the July-September period.

Adherence to the compensation plans by over-producing countries, namely Iraq and Nigeria, remains “a potential instability in the bargain,” analysts at Clearview Energy Partners LLC said Wednesday.

Rystad Energy’s Paola Rodriquez-Masiu, senior oil markets analyst, expressed a similar view, saying it’s “unlikely” that the compensation plans will be fulfilled.

“In the case of Iraq, we believe that the target set to compensate the alliance is overambitious given Iraq’s dire economic need for oil revenues right now,” the analyst said. “Getting the country’s production below 4 million b/d will be an uphill battle.”

Continued regional outbreaks of the pandemic add another layer of uncertainty to the oil market rebalancing.

Analysts at Raymond James & Associates Inc. noted on Thursday that India’s Bihar state, with a population of 125 million, was entering a two-week lockdown, “this being by far the largest of the ‘lockdowns 2.0’ that we have seen this summer.”

The pandemic continues to rage in the United States as well, where the five-day rolling average of daily confirmed cases stood at an all-time high of 64,302 as of Thursday, according to Johns Hopkins University.

Despite the pandemic, the Energy Information Administration (EIA) reported a draw of 11 million bbl on U.S. commercial petroleum inventories for the week ended July 10, versus analyst estimates of a 1.2 million bbl draw, the Raymond James analysts said, a bullish signal for oil prices.

However, “Having worked their way up from the epic trough set in April,” U.S. oil prices remain “stalled around the $40 level amid mixed signals on the pace of global economic recovery,” the Raymond James team led by Pavel Molchanov said.

The West Texas Intermediate (WTI) contract for August delivery was trading at $40.74/bbl on Thursday afternoon, down 46 cents from Wednesday’s settle.

“Price related production shut-ins in the U.S. and elsewhere had been needle-moving in April/May but are decreasing,” Molchanov’s team said.

“Covid-related disruptions in transportation and economic activity have largely subsided, but as shown by headlines in recent weeks from around the world, there are more instances of governments pausing or even reversing the reopening process.”

Even more concerning than the current Covid headlines, analysts said, is the potential impact on demand of a second wave of the virus this winter in North America.

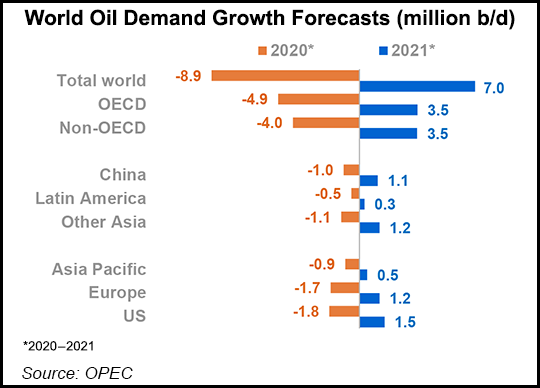

In its July Monthly Oil Market Report published Tuesday, OPEC said it expects global oil demand to fall by 8.95 million b/d in 2020 versus 2019 to average 90.72 million b/d, a 100,000 b/d upward revision from the previous month’s forecast.

When OPEC-plus first announced the curtailments in April, the alliance said the 9.7 million b/d cuts would apply to May and June, before tapering to 7.7 million b/d in July.

However, delegates in June agreed to extend the May and June cuts through July in response to the still sizable Covid-induced supply imbalance.

The next meetings of the OPEC-plus Joint Technical Committee and the JMMC are scheduled for August 17 and August 18, respectively.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |