E&P | NGI All News Access | NGI The Weekly Gas Market Report

OPEC Cuts Likely Embolden U.S. E&Ps, but Improved Well Economics Still Key

The energy world may be looking to the Organization of the Petroleum Exporting Countries (OPEC) for price stability to gain confidence in future project investments, but in North America, a fragmented group of operators may not have the time or capital to focus on global supply cuts or temporary oil price improvements, according to analysts.

OPEC in late November formally agreed to its first global oil production reduction in eight years, with plans to reduce output by 1.2 million b/d effective Jan. 1.

“While a price bump would improve cash flow needed for operations, particularly for heavily leveraged independents, it is not a long-term solution in competing with some cost-advantaged OPEC producers,” said Douglas-Westwood (D-W) Ltd. consultant Andrew Meyers, who is based in Houston. Since May close to 200 rigs have been raised in North America, partly because of the slight increase in commodity prices, but mostly because operators have improved well economics.

Drilling efficiencies actually maxed out earlier this year, as the operating rig fleet was whittled down to the the best-rated rigs, Meyers said. As the rig count has increased, efficiencies should continue to dwindle as additional rigs, including legacies and lower-spec equipment, reenter the market.

Cheaper Sands, Closer to Home

“The focus for operators is now largely concentrated on completions for cost savings and improved production,” Meyers said. “Well architecture changes such as longer laterals, increased sand loading and alternate material usage for savings has improved well NPV [net present values] by as much as 50% or more in some cases.”

One trend taking hold, using less expensive regional sands that are abundant and close to wellsites, is underway, particularly in Texas, as, for example, Encana Corp. noted in its 3Q2016 conference call. Those types of economic improvements also would be positive news for the 3,000-plus inventory of drilled but uncompleted oil wells (DUC), Meyers said.

“The Permian Basin has the largest inventory of DUCs and can benefit from the improved well designs and locally sourced proppant. While the OPEC-provoked oil price increase is warmly welcomed, companies would rather focus on what they can control.”

Wells Fargo Securities LLC’s senior analyst David Tameron and his team said OPEC’s reduction should put a floor under crude prices. And that means U.S. exploration and production (E&P) companies should be “off to the races,” emboldening domestic operators to ramp up. Producers have suggested they were planning to budget 2017 using $50/bbl West Texas Intermediate (WTI), and OPEC’s announcement “simply gives management teams more justification to get aggressive.”

However, there may be headwinds.

A survey of industry executives conducted by Wells Fargo before OPEC’s news indicated that most U.S. E&Ps were going to use WTI prices of around $50/bbl to develop 2017 capital budgets.

“We’ll still have to see where absolute prices are come mid-January/early February, but we now have more confidence in that $50/bbl,” Tameron said. “Most E&Ps have already begun ramping activity in 4Q2016, and some signaled an early 2017 ramp. So, given the already optimistic nature of the industry…the OPEC announcement simply gives management teams more justification to get aggressive.”

Shale Production Masks Offshore Decline

Wells Fargo’s price deck currently is $57/bbl, and it is forecasting that its covered E&Ps will set capital expenditures (capex) 44% higher in 2017 from 2016 levels. Using $50/bbl, capex budgets for its E&Ps “would be up closer to 30% from 2016 levels.”

Meanwhile, Rystad Energy analysts expect global liquid production to remain at current levels into next year, while demand grows, which in turn should reduce stored oil considerably.

“This will be the second year in a row in which global oil production fails to grow,” said Rystad’s Espen Erlingsen, vice president of analysis. “Shale is the least vulnerable, while offshore continues to be the victim since OPEC’s decision in November 2014.”

Rystad’s analysis shows that shale output should grow significantly beginning in 2018, with an annual addition of 1 million b/d, while offshore should see a production decline. Both shale and OPEC production “will play an important role in making sure that enough oil will flow to the market over the next year. Offshore sanctioning activity is at its lowest since the 70’s, and the effect of this will become increasingly visible, with a long term decline in the non-OPEC non-shale production expected.”

Evercore ISI’s James C. West called the OPEC agreement “one small step for OPEC, one giant leap for North America,” and said it “was sweet relief for an embattled industry on the precipice of an international upturn…” The “display of cooperation” was important for the health of the industry, but it also “served as a strong pull-through for an investment community that didn’t necessarily buy into the underlying fundamentals.”

Regardless of the output reductions, worldwide oil output was set to decline in 2017, while demand likely is going to increase 1.2 million b/d, according to market analysts.

“The OPEC cut simply hastens the tightening,” West said. If there were no deal, crude oil prices would have retreated toward $40/bbl while the Oil Service Sector Index “likely would’ve been dragged down with it (and we’re buyers of the dips).”

Raymond James & Associates Inc.’s analyst team, led by J. Marshall Adkins, said the mega-rally brought about on the OPEC announcement delighted energy investors but “all that matters (for now) are higher oil prices.” It’s worthwhile to ask, why now? What made the Saudi Arabia-led cartel willing to cut production after torpedoing the oil market in November 2014 with a production surge?

A Saudi Win

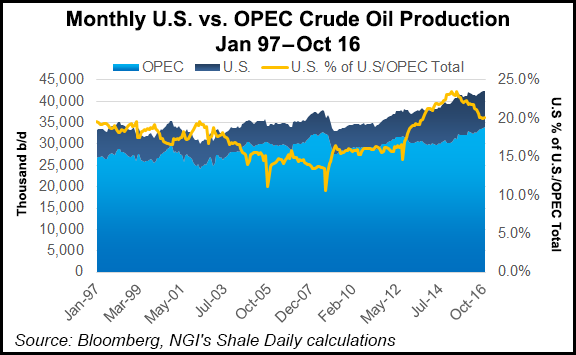

“First, most obviously, Saudi has more or less won the price war,” Adkins said. Non-OPEC supply in 2016 is down by close to 1.0 million b/d (or 1.5%), with sharp declines in the United States, China, Mexico and Colombia. “Another 5 million b/d-plus of long-lead-time projects — in Brazil, Canada, and many other geographies — have been canceled or delayed, the effect of which will show up later this decade.”

If OPEC had kept oil prices low for another year, there also would have been the possibility that sharply declining supply outside the cartel would drive oil prices sharply higher in 2018 and beyond, leading to demand destruction, Adkins said. In addition, Iran no longer has any spare capacity and “no near-term prospect” of flooding the market.

The Saudi economy also is “undeniably feeling the pain of the austerity measures the government has been forced to take” because of low oil prices, which means the downturn has hit close to home, Adkins noted. “We hear one prince even had to downsize his yacht from 400 feet to a mere 200!”

Finally, even though the Saudi oil rig count has more than doubled in the past few years, the country’s oil inventories have collapsed in the past year. “This tells us that Saudi was probably producing more than it really wanted to (or had capacity to) produce,” Adkins said. “Put simply, Saudi was going to cut anyway, so why not get others to jump on the bandwagon.”

Absolute inventory levels matter, but supply days are more relevant, according to Raymond James. Inventory levels in the OECD — the Organisation for Economic Co-operation and Development of which the United States and Canada are members — were set to contract late next year even without OPEC’s action. Analysts said it’s likely OECD inventory levels peaked in 3Q2016.

Buy the Gas Dip

“While days of supply is likely to remain above 30 days of supply for the first half of 2017, OECD oil inventories should drop under the 30 days threshold in the second half of 2017,” Adkins said. “In anticipation of these falling inventories, we think the market will drive oil prices higher early in 2017.”

Mizuho Securities USA Inc.’s equity research team said the “real opportunity” from OPEC’s announcement may actually favor natural gas-heavy E&Ps that underperformed following the news. Buy the gas dip, said Timothy Rezvan, managing director of Americas research. Some of the gassier onshore E&Ps were in the red on the OPEC announcement, but “we suspect these equities were funding vehicles for hedge accounts looking to fund further oil exposure,” he said.

“As fall temperatures finally arrive (albeit three weeks before winter) and the secular improvements in demand for U.S. natural gas remain strong, we believe the 2017/2018 growth outlook for gassy E&Ps remains attractive. We also note that the 2017 New York Mercantile Exchange Henry Hub gas strip has now rallied to $3.30/Mcf, and the 2018 strip has rallied to $3/Mcf, allowing these companies to nudge up average hedge prices from current levels.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |