NGI The Weekly Gas Market Report | LNG Insight | Markets | NGI All News Access

OPEC Calls for Bigger Oil Production Cut Through Midyear, with Overall Reductions Through 2020

In another sign of the impact on energy demand from the worldwide coronavirus, the Organization of the Petroleum Exporting Countries (OPEC) on Thursday recommended that members reduce global crude output through the end of the year, with an additional adjustment through June.

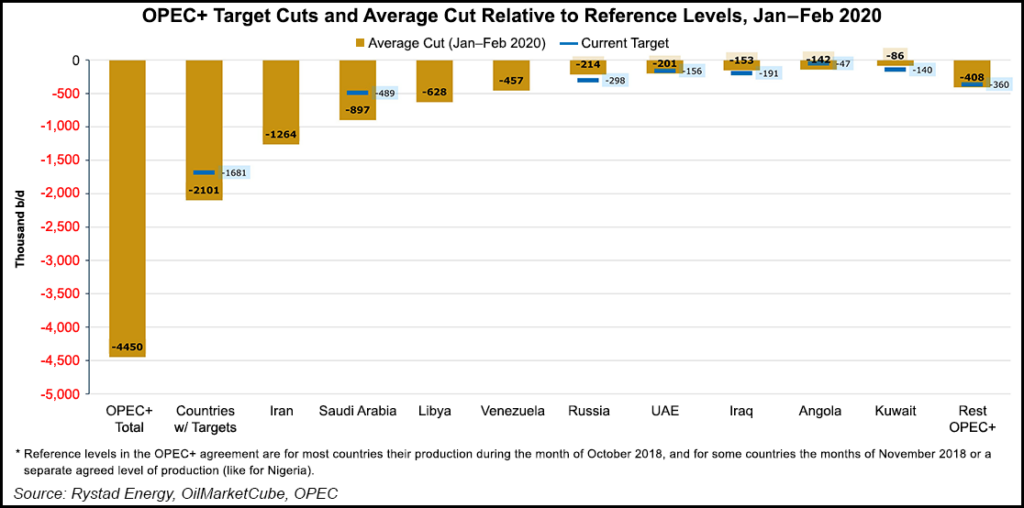

Last December the Saudi-led cartel and its allies, including Russia, had agreed to reduce collective output by around 1.7 million b/d. In concluding a special, or “extraordinary” meeting in Vienna on Thursday, OPEC recommended the reduced output level extend through the end of the year.

In addition, because of “current fundamentals and the consensus on market perspectives,” OPEC recommended a further adjustment of 1.5 million b/d through the end of June.

The additional cut would be applied pro-rata between OPEC, whose members collectively would reduce output by 1.0 million b/d, and allied producing countries, which would slash oil production by another 0.5 million b/d.

The Covid-19 virus, as it is known, “has had a major adverse impact on global economic and oil demand forecasts in 2020, particularly for the first and second quarters,” OPEC noted. Global oil demand growth in 2020 is now forecast to be 0.48 million b/d, down from a forecast in December of 1.1 million b/d.

“Moreover, the unprecedented situation, and the ever-shifting market dynamics, means risks are skewed to the downside,” it said. The “further impact of the Covid-19 outbreak on oil market fundamentals necessitates further continuous monitoring.”

The member countries at the conference, led by Algeria Energy Minister Mohamed Arkab, who is president of the cartel, asked for “continued commitment to achieving and sustaining balance and stability in the market.” The conference members emphasized the ongoing dialogue with consuming countries.

“Member countries are resolute and committed to being dependable and reliable suppliers of crude and products to global markets,” OPEC said.

The next OPEC meeting is scheduled for June 9.

Rystad Energy Inc. estimated Thursday that more than one-half of global oil demand growth may be lost this year, even with reductions by OPEC and its allies.

“The impact on demand growth has been staggering, if not unprecedented, with February’s crude demand dropping by a shocking 4.6 million b/d, led by a 2.9 million b/d month-on-month drop in Chinese crude runs,” Rystad analysts said.

Rystad’s pre-coronavirus global oil growth estimate was 1.1 million b/d for 2020, which was cut by 25% last month. The data now points to a more pessimistic outlook, with oil growth estimated to be only 500,000 b/d, “assuming that the Covid-19 epidemic will largely be contained by the end of June, which in turn implies a further downside risk,” analysts said.

“We have modeled out three likely outcomes of the OPEC-plus meeting, and not a single one of them comes close to bridging the supply-demand balance,” said Rystad’s Bjørnar Tonhaugen, head of oil markets.

According to a market update by Kpler, the coronavirus “had real and noticeable effects on Chinese demand and associated supply chains in February.” The manufacturing PMI, or purchasing managers’ index, “finished the month deep in contractionary territory (35.7%),” with the associated sub-PMI measures, except for the producer price index, or PPI, “also finishing below the key 50% inflection level.”

Kpler analysts said the focus going forward may center “on whether product departure levels pull back amid a continuation in limited refinery throughput. If export levels remain strong well into March, this could signal a possible continuation in overly weak Chinese product demand.”

Regarding liquefied natural gas imports into China during February, Kpler said Chinese imports “largely followed seasonal norms” and ended the month at 4.183 million tons (mt), down by only 0.21 mt year/year.

“The 14-day moving sum mimicked 2019 behavior,” said the Kpler team, “bottoming out mid-month (1.35 mt) before trending higher to finish at 2.4 mt by the end of February.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |