NGI The Weekly Gas Market Report | Earnings | Infrastructure | NGI All News Access

Oneok Sees Low Risk of Further Bankruptcies by Large Williston Players Despite Turmoil

Despite low oil prices and a massively oversupplied market, Tulsa-based midstreamer Oneok Inc. does not expect additional bankruptcies over the near-term from its large exploration and production (E&P) customers in the Williston Basin, management said Wednesday.

COO Kevin Burdick told analysts on a first quarter earnings call that Oneok’s Williston customers “are some of the most stable and well capitalized in the industry,” and that although one of its customers filed for bankruptcy protection in recent days, “we do not foresee additional significant bankruptcy risk among our largest customers in the region…”

Although Burdick did not specify which producer had filed for bankruptcy protection, Whiting Petroleum Corp. is the only major Bakken-focused producer to have done so in the wake of the pandemic.

He added that “smaller-scale private producers make up approximately 15% in aggregate of our total production from the region,” home to the prolific Bakken Shale.

“Many of our customers have announced a reduction in rig activity and in some cases are curtailing existing production,” Burdick said, adding that about half of the roughly 30 rigs currently operating in the Williston are on Oneok’s dedicated acreage.

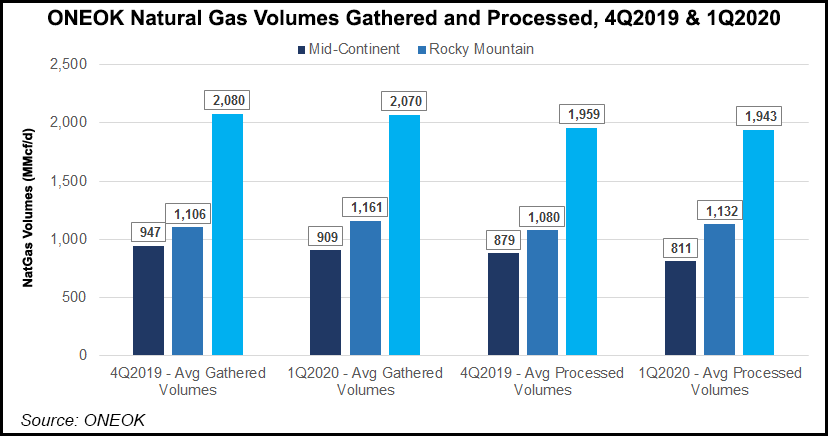

Since many of the shut-in Williston oil wells were previously flaring off large volumes of associated natural gas anyway, the impact of the drilling slowdown on natural gas volumes handled by processing and gathering infrastructure in the area has been less “than you would expect,” Burdick said.

In the Permian Basin, meanwhile, Burdick said about 70% of Oneok’s natural gas liquids (NGL) volumes come from the Midand sub-basin, which he called “one of the most resilient basins in the U.S.”

He added that as Oneok’s West Texas liquefied petroleum gas (LPG) pipeline expansion is fully completed in May, “we will continue to transition volumes away from offloads we currently have with third-party NGL pipelines onto our pipeline.”

Oneok will seek to capitalize on its NGL storage capacity in the months ahead, Burdick said, highlighting that more than half of the 27 million bbl of underground liquids storage capacity “is available to capture opportunities in the market.” Oneok is adding 1.5 million bbl of storage in the third quarter and expects to complete another 1.5 million bbl in 2021.

Burdick also noted that Oneok has added 3.5 million bbl of brine storage at the Mont Belvieu NGL fractionation and export hub in Texas.

Although crude oil storage is “a big commodity that everybody’s looking at” amid the current oil supply glut, Burdick said, “we do think our storage is better used as NGL…than it is for another product. But we do continue to evaluate the ability to repurpose our assets into other service.”

Oneok is seeing “seasonally strong demand” for propane both in North America and in global export markets, which is contributing to a strong relative price of propane relative to crude oil.

In the case of ethane, meanwhile, strong demand is “driving the price to near recovery economics in the Midcontinent,” Burdick said.

Oneok is pausing construction on several pending projects because of the current market turmoil, Burdick said, including the Bear Creek processing plant in the Williston, the MB-5 fractionator in Mont Belvieu and the third expansion of the West Texas liquefied petroleum gas (LPG) pipeline system.

All of the projects on hold can be restarted quickly when Oneok’s customers resume activity, he said.

CEO Terry Spencer said Oneok is “well positioned to realize earnings growth in 2020 and 2021 as NGL markets remain resilient and storage capacity is at a premium, despite the challenges our industry faces.”

Spencer also highlighted “the stability of our natural gas pipelines business, which has nearly 100% take-or-pay contract structures with primarily financially strong electric and utility customers.”

Oneok reported a net loss of $141.9 million (minus 34 cents/share) for the first quarter, compared with a profit of $337.2 million (81 cents/share) in the similar 2019 period.

The loss included a $641.8 million noncash impairment related “primarily to goodwill and long-lived assets in western Oklahoma, Kansas and the Powder River Basin in Oneok’s natural gas gathering and processing segment,” the company said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |