Infrastructure | Earnings | NGI The Weekly Gas Market Report

Oneok Says Natural Gas, NGL Volumes Rebounding Sharply Across Lower 48 as Upstream Activity Resumes

Tulsa-based midstreamer Oneok Inc. has seen a sharp increase in natural gas and natural gas liquids (NGL) throughput across its operating areas in recent weeks, management said Tuesday.

After bottoming out in May and June, volumes are rising as exploration and production (E&P) customers bring curtailed production back online and commodity prices stabilize, CEO Terry Spencer told analysts during the firm’s second quarter earnings call.

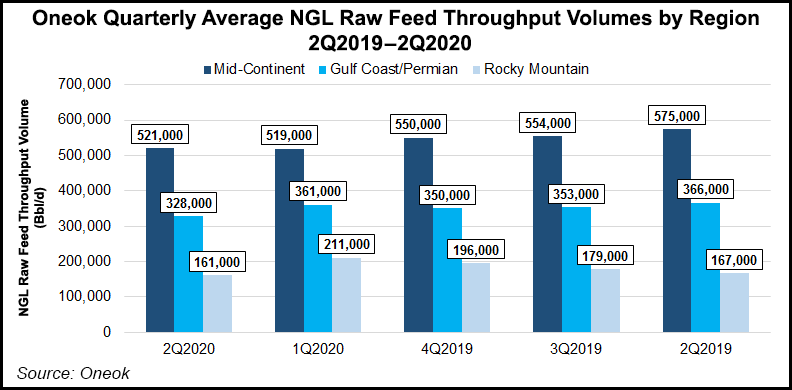

“As a matter of fact, many of our facilities during July have returned to pre-Covid levels,” Spencer said. “For example, our July average total NGL raw feed volumes are exceeding first quarter average NGL volumes, benefiting from higher propane plus volumes in the Permian Basin and increased ethane recovery in the Midcontinent.

“Williston Basin volumes have also strengthened significantly off the lows experienced in May.”

Spencer said earnings were impacted by “significant production curtailments” in the Williston, “where our earnings on a per unit of throughput are some of the highest due to the broad level of services we provide our customers.”

In the Midcontinent region, NGL raw feed throughput had surpassed 600,000 b/day in July, up 15% from the second quarter average. In the Rockies, NGL throughput had surpassed 200,000 b/d in July, a nearly 50% increase from the lows seen in May.

With the future of the Dakota Access Pipeline (DAPL) up in the air amid an ongoing legal battle over its water crossing permit, Williston producers are developing contingency plans to address their crude oil transport needs in case the 570,000 b/d pipeline is shut down permanently, Spencer said.

He said DAPL transports a substantial volume of crude from the Bakken Shale, but “there are alternatives through other pipelines and substantial rail capacity. It wasn’t long ago that nearly 800,000 b/d of crude were leaving the basin on rail.”

Spencer said an estimated 30-40% of DAPL crude volumes are from producers whose gas volumes are dedicated to Oneok’s gathering and processing business in the Williston. About half of those crude volumes have alternative means of transport currently available.

In other words, about 200 MMcf/d of the roughly 1.5 Bcf/d connected to Oneok’s Williston system “is associated with crude oil production that may not have an immediate takeaway option,” Spencer said.

“In our view, any impact from a DAPL shutdown would mostly impact 2021, providing some time for more solutions to develop.”

More quarterly earnings coverage by NGI can be found here.

Even under an extended shutdown of DAPL, Oneok estimates that its 2021 Williston gas processing volumes could approach the firm’s 1Q2020 average of more than 1.1 Bcf/d “due to curtailed volumes returning, the capture of flared gas and the completion of drilled but uncompleted wells.”

CFO Kevin Burdick said management believes that “if current market conditions sustain, the remaining curtailed production will come back online during the third quarter 2020.”

Oneok reported net income of $134.3 million (32 cents/share), versus a year-ago profit of $312 million (75 cents), with the decline driven largely by production curtailments in the Williston and Midcontinent.

The company said because of continued market uncertainty and the headwinds facing crude takeaway in the Williston, 2020 earnings are expected to be at the low end of the guidance range of $500-900 million provided in April.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1266 | ISSN © 2158-8023 |