Regulatory | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

One-Dozen Shippers Hold 90% of PennEast Capacity

Twelve shippers have signed up for about 90% of the firm capacity that would be available on the proposed PennEast Pipeline, which would access eastern Marcellus Shale gas for the benefit of markets in Pennsylvania and New Jersey, according to the project’s formal application at FERC.

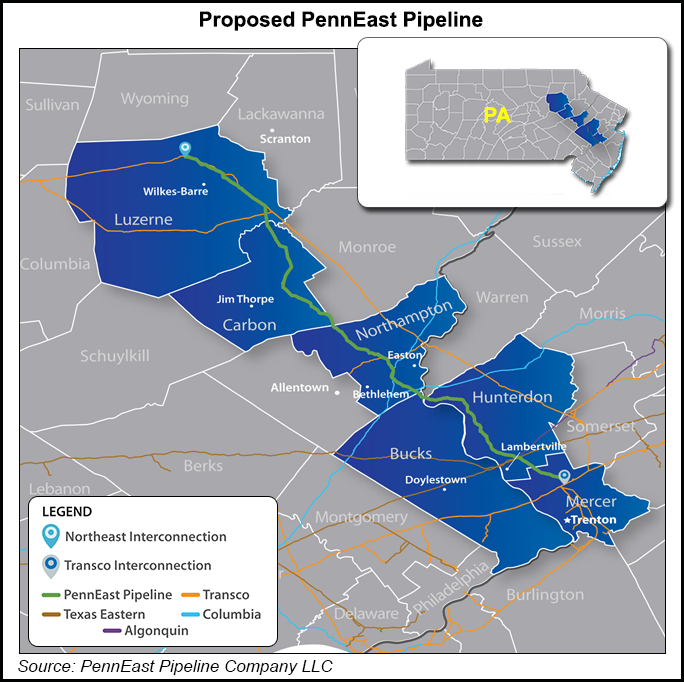

The 114-mile, 36-inch diameter greenfield pipeline would access receipt point interconnections in the eastern Marcellus region with Transcontinental Gas Pipe Line Co. LLC (Transco) and gathering systems operated by UGI Energy Services LLC, Williams Partners LP, and Energy Transfer Partners LP, all in Luzerne County, PA, according to the filing.

It would extend to delivery point interconnections in the “heart” of major northeastern natural gas-consuming markets, including interconnections with UGI Central Penn Gas Inc. in Carbon County, PA; UGI Utilities Inc. and Columbia Gas Transmission LLC in Northampton County, PA; and Elizabethtown Gas, NRG REMA LLC, Texas Eastern Transmission LP, and Algonquin Gas Transmission LLC in Hunterdon County, NJ. The terminus of the project would be at a delivery point with Transco in Mercer County, NJ. The project would also include three laterals of about two miles or less in length each.

About 990,000 Dth/d of the up to nearly 1.11 million Dth/d of capacity is spoken for, according to the company’s filing at the Federal Energy Regulatory Commission [CP15-558]. New Jersey Natural Gas Co. is the largest taker with 180,000 Dth/d. PSEG Power LLC and Texas Eastern Transmission each have 125,000 Dth/d. South Jersey Gas. Co. has 105,000 Dth/d, and Consolidated Edison Company of New York Inc., Elizabethtown Gas, and UGI Energy Services LLC each have 100,000 Dth/d.

Cabot Oil & Gas Corp. and Talen Energy Marketing LLC each have 50,000 Dth/d, and Enerplus Resources (USA) Corp. has 30,000 Dth/d. Warren Resources Inc. has 15,000 Dth/d, and NRG Rema holds 10,000 Dth/d.

PennEast is a joint venture owned by AGL Resources Inc. unit Red Oak Enterprise Holdings Inc. (20%); New Jersey Resources’ NJR Pipeline Co. (20%); South Jersey Industries’ SJI Midstream LLC (20%); UGI Energy Services LLC’s UGI PennEast LLC (20%); PSEG Power LLC (10%); and Spectra Energy Partners LP (10%). The partnership is managed by UGI Energy Services.

“The Project is designed to bring lower-cost natural gas produced in the Marcellus Shale region in eastern Pennsylvania to homes and businesses in New Jersey, Pennsylvania, New York and surrounding states,” the filing said. “The project was developed in response to market demands in New Jersey, Pennsylvania, and New York and interest from shippers that require transportation capacity to accommodate increased receipts of natural gas into the region. An additional supply of natural gas to the region will provide a benefit to consumers, utilities and electric generators by providing enhanced competition among suppliers and pipeline transportation providers.”

PennEast was announced in August 2014 and — backed by utility and marketing companies — was one of the first major pipeline projects in recent years to be a demand-pull endeavor rather than supply push (see Daily GPI, Aug. 12, 2014). In early September 2014 it had secured 965,000 Dth/d of capacity bids in a binding open season (see Daily GPI, Sept. 5, 2014), not far from where it stands today at 990,000 Dth/d of capacity sign-ups.

Since those early days there has been plenty of push back to the project from landowners and environmental interests. And there have been multiple route changes (see Shale Daily, Aug. 19; July 22). “The iterative and interactive process among PennEast, the Commission staff, and project stakeholders resulted in the evaluation of over 100 route alternatives and above-ground facility site locations, reduction of the project’s anticipated environmental impacts and improvements in the proposed mitigation measures for the project,” the project filing said.

Yet on Wednesday, the day of the PennEast filing, environmental and citizens groups opposed to the pipeline called on FERC and the New Jersey Department of Environmental Protection to block the project. “…that would cut through Mercer and Hunterdon counties, causing irreparable harm to over 4,000 acres of preserved open space and farmland, 31 of the state’s cleanest and most ecologically significant streams, and many landowners and communities.”

Michele Byers, executive director of the New Jersey Conservation Foundation, said, “The proposed PennEast pipeline would undermine and destroy decades of dedicated work to preserve land in this special region of New Jersey.”

Also on Wednesday, pipeline sponsors and their supporters held a conference call with reporters to tout the project.

“Pennsylvania’s natural gas revolution is giving our manufacturers new momentum with abundant, cost-competitive energy,” said Pennsylvania Manufacturers’ Association President David Taylor. “Since 2008, natural gas prices in Pennsylvania have decreased by approximately 40%. However, to fully realize the potential of shale gas, Pennsylvania needs robust infrastructure for transmission, especially more pipeline.”

A study commissioned by PennEast earlier this year found millions of dollars in natural gas and power cost savings to be had through the pipeline’s construction (see Daily GPI, March 24).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |