Oil Rail Shipments to California Doubled in 1Q2014

Rail crude oil shipments to California were up sharply compared to the same period last year, according to statistics kept by the California Energy Commission (CEC).

Those statistics come at a time when the state’s leading refiners, Tesoro Corp. and Valero Energy Corp., are developing projects to increase the capacity for oil rail shipments into the state. Two proposals in Kern County alone would add 290,000 b/d capacity, substantially more than currently is coming into the state’s petroleum-rich central San Joaquin Valley.

They also come amidst increased efforts by federal regulators on both sides of the U.S.-Canada border to increase the rules for rail shipments and the design requirements for rail tank cars, something the oil/natural gas industry has been urging in recent years (see Shale Daily, Jan. 23).

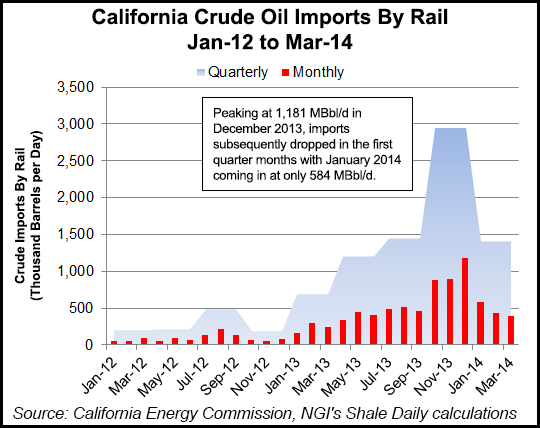

California brought in 1.41 million bbl in the first quarter, more than doubling the 1Q2013 total of 693,457 bbl delivered by rail into the nation’s third largest oil refining state. The principal sources were Canada and five western states (Colorado, North Dakota, New Mexico, Utah and Wyoming). Nearly half came from Canada (658,274 bbl).

North Dakota was the second largest source of the rail shipments, sending in excess of 270,000 bbl by rail to California in the three-month period. The state stepped up big with 122,885 bbl in March, nearly as much as Canada’s 132,872 bbl total for the month.

Although there was a strong increase in crude-by-rail imports when comparing the first quarter of 2014 with the same quarter of last year, implying that the trend was consistent would be misleading. In fact, imports fell 52% from 2,956 million b/d in 4Q2013 to 1,414 million b/d in 1Q2014. Upon examination of the breakout figures for the sources of these imports, NGI’s Shale Daily was able to conclude imports from Canada took the hardest hit by total barrels, falling from 709 million b/d in December to just 372 million b/d for the month of January. During the first quarter, imports from Colorado went from 28 million b/d in January to being almost absent at 0.642 million b/d in February.

North Dakota Energy consultant David Hackett, president of Irvine, CA-based Stillwater Associates, said the continuing increase in oil rail shipments reflects “continuing improvement” in crude-by-rail receiving facilities.

The source of California’s crude rail shipments is “from all over the midcontinent,” said Hackett, noting that the widespread sources include North Dakota’s Bakken crude.

Hackett has an opinion on the Pipeline and Hazardous Materials Safety Administration’s (PHMSA) warning earlier this year that the type of crude oil being transported from the Bakken region may be more flammable (see Shale Daily, Jan. 3).

“They don’t have a market for the lighter, more flammable components of crude oil that would be propane and butane,” according to Hackett.

“All of this crude oil is trapped in the center of America and there aren’t enough pipelines to get it out,” Hackett told local news media in Bakersfield earlier this year. “At the sorts of numbers that you hear about [for proposed new rail receipt capacity in the central valley], these would be significant facilities for the state and for the state’s refiners.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |